A Beginner s Guide to Understanding ETFs US News

Post on: 24 Май, 2015 No Comment

If exchange-traded funds sound like exotic investments, here’s what you need to know.

The causes of the current economic malaise that continues to grip most of the world seem too many to count. A financial crisis in Europe, unemployment in the United States, a global housing market that can’t seem to recover, and corporations run amuck are just a few of the culprits. But the true root of the financial crisis can be traced back to one thing: subprime mortgages.

These non-traditional instruments allowed consumers to borrow sums they couldn’t afford. When the rates of the mortgages adjusted higher, many homeowners were unable to keep up with their payments and had to forfeit their homes. Banks that were left holding these mortgages took steep losses, and the financial crisis was on.

The term subprime mortgage became a dirty word to American consumers. It also became known as an exotic instrument, unlike traditional instruments like stocks and bonds. For most people, exotic instruments are synonymous with financial trouble.

But these exotic instruments have gotten a bad rap. Just because a financial security isn’t traditional doesn’t mean it isn’t a solid investment capable of producing consistent returns. One such instrument is an exchange-traded fund.

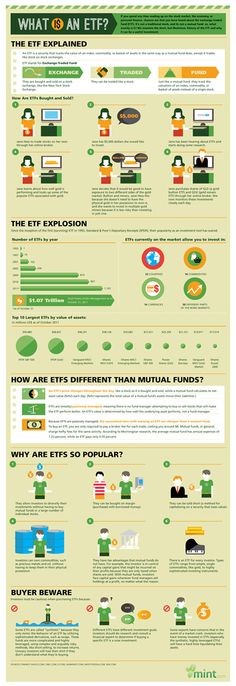

Known as ETFs, these funds are comprised of stocks, bonds, and commodities. Like stocks, ETFs trade daily on stock exchanges and their price fluctuates daily. They are also becoming an increasingly popular way to invest.

How ETFs work. ETFs are created by large money managers like the Vanguard Group, which bundle the underlying instruments of the funds. After a series of regulatory steps, an ETF can be offered for sale to the public and can be purchased through a broker.

There are ETFs available to suit any taste. Many track an index. This means that their value is tied to a major stock index, like the S&P 500. If the value of the S&P goes up, the value of the ETF goes up as well.

Some ETFs track indexes that include commodities, currencies, and bonds. Others invest in precious medals like gold. There are also leveraged ETFs, which, due to their composition, are much riskier than funds that track indexes.

Mutual funds and ETFs are similar in many ways. The main difference is that ETFs are traded actively throughout the day, meaning that the price of a fund will change from the opening bell to the close of trading. The value of a mutual fund is redeemed at the end of each day’s trading session, so its value only changes once per day.

Advantages of ETFs. Like mutual funds, ETFs allow investors to spread risk over a series of investments, as opposed to one or two stocks or bonds. This lessens exposure to loss and provides peace of mind for investors who are weary of dramatic swings in the market.

However, ETFs typically charge lower management fees than mutual funds. They also vary in how they are run. Mutual fund managers are the primary custodians of their funds. They make daily buy and sell decisions that are executed by stock, bond, or commodity traders. Because of the varied composition of ETFs, many more people are involved in the day-to-day maintenance of these funds. Each day, money managers work with a vast array of traders in a number of different markets.

ETFs also provide tax advantages. They are known to be tax-efficient, meaning that capital gains taxed on money made with an ETF do not have to be paid until the fund is redeemed. For investors concerned with long-term growth, this makes annual tax reporting a much easier process.

One final advantage of ETFs is their connection to indexes. Despite recent market swings, indexes like the Dow Jones Industrial Average and the S&P 500 have gone up consistently over time. Someday, when economic growth returns, these indexes will rise again.

With any investment, risk looms. This is not to say that ETFs are a sure thing; no investment is. Being too closely tied to one sector or index means that a crisis would immediately impact your bottom line. Asset allocation spreads the risk, but doesn’t eliminate it.