94 Formula for nest egg withdrawal still works

Post on: 1 Июль, 2015 No Comment

’94 formula for nest egg withdrawal still works

Lynn O’Shaughnessy

August 6, 2006

Have you seen the commercial in which a guy carts around his nest egg about the size of a Mini Cooper everywhere he goes? Presumably he does this so nothing bad happens to his money. The commercial is silly, but our strong desire to protect our life savings is all too real.

In fact, one of the questions uppermost in the minds of many retirees and those eyeing that milestone is how they can prevent some destructive force from rolling over their nest eggs and leaving nothing behind but tread marks.

The answer isnt as complicated as you might think. In fact, youll find it in what many would consider an unlikely place. The best advice, you see, didnt originate at a Wall Street brokerage house. You didnt hear it from a frequent guest on CNBC or an esteemed economics professor from the Wharton School.

Rather, the words of wisdom are coming from an unassuming certified financial planner, who works out of his home office in El Cajon.

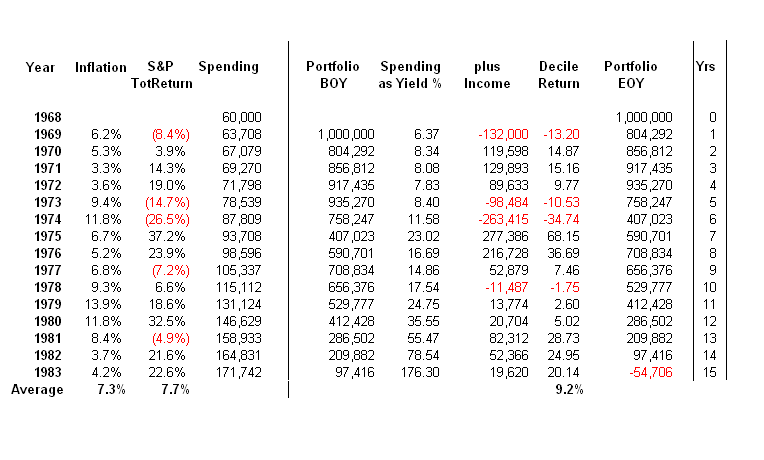

Back in 1994, William P. Bengen published an ambitious study in the Journal of Financial Planning that pinpointed how much you or I should be able to withdraw each year from our retirement accounts without busting the bank. If historic investment returns can be believed, anyone following his prescription for a financially healthy retirement shouldnt run out of money for at least three decades.

Bengens study, which shredded the conventional wisdom on this subject, elevated the fee-only planners standing in the financial community from Whos he? to something akin to Paul Bunyon.

Specifically, Bengen figured out the maximum percentage of your money that you can withdraw safely. He also made recommendations on what mix of investments your portfolio should contain to ensure a nest eggs longevity. In the intervening years, Bengens sagacious advice has been adopted by financial planners across the country, as well as Wall Streets big boys.

Not long ago, Bengen decided to revisit his calculations to see if they still stood up. He discovered that they had.

He included his findings, with updated figures, in his new book, Conserving Client Portfolios During Retirement. In the book, youll discover his magic number: 4.15. Thats the percentage of your portfolio that you should be able to withdraw when you first retire.

After this initial calculation, however, you can discard that percentage forever. Instead, each year you take the amount of the previous years withdrawal and increase it by the inflation rate.

For instance, if you calculated your first yearly withdrawal at $40,000, and inflation during the next 12 months was 3 percent, you could safely pull out up to $41,200 during the second year. For the third year, youd take $41,200 and adjust that by inflation, and so on.

Youre probably thinking that 4.15 percent seems awfully skimpy. With the recent heat spell, you might not even be able to pay for the A/C on that kind of restricted financial diet. Bengen, however, isnt a masochist.

He arrived at this figure after looking back at the most notorious bear markets of the 20th century, including those that struck during the Great Depression and World War II. If investors had followed Bengens withdrawal guidelines, their retirement portfolios would have also survived the dot-com bust.

If youre someone who breaks into hives just thinking about owning stocks, that 4.15 percent figure is going to be too generous. Bengen based his withdrawal advice on a basic retirement portfolio thats divided between intermediate government bonds (37 percent) and large-cap stocks (63 percent).

Bengen does offer a way to squeeze out a little higher withdrawal rate. He recommends that you split your equity holding between large-and small-cap stocks. (Preferably in stock mutual funds.)

He personally favors a portfolio that contains 40 percent intermediate government bonds, 42.5 percent large-cap stocks and 17.5 percent small-cap stocks. If you choose that route, your withdrawal rate can creep up to 4.4 percent.

Heres yet another way to boost your safe withdrawal rate.

Older retirees who dont think they share Methuselahs longevity genes can trash the 30-year noose. A widow in her 70s with a bad heart, for instance, probably wont need her money for three decades.

Someone with a 20-year time horizon should be able pull 5.25 percent out the first year, as long as he or she keeps 30 percent of the portfolio in equities. Slash five more years off that time horizon and your beginning withdrawal rate can creep up to 6.3 percent, once again assuming that 30 percent of the portfolio is devoted to stocks.

If youd like a copy of Bengens book, its only available through the Financial Planning Association in Denver (800-647-6340). The book has a ridiculous price tag of $65, but books that are geared toward financial advisers as this one is are always outrageously priced. The book wont garner Bengen any literary awards, but after you slog through it, it could save your nest egg from getting smashed.

Lynn OShaughnessy is the author of The Retirement Bible and The Investing Bible. She can be reached at LynnOShaughnessy@cox.net .

Next Story