8 Solid reasons why young families MUST use “Mutual Funds” to plan their financial goals

Post on: 5 Апрель, 2015 No Comment

by Abhinav Gulechha on June 17, 2013

This is in continuation of my previous post where I had tried to explain how a “mutual fund” works.

I myself am a mutual funds investor and a great believer in power of collective investing. I believe that “mutual funds” are a boon for small families who have certain long term goals to plan for, but don’t have the risk appetite, deep pockets or necessary expertise to invest directly.

So today, I want to list out some of my top reasons why as a young family, it makes some real sense for you to explore “mutual funds” as a vehicle to plan your short/medium/ long term financial goals.

Ability to invest in small amounts regularly to build a big corpus over long term:

Most small investors have small savings (from their income) that they want to invest on a regular basis, mostly in Rs. 1000 – Rs. 5000 range. They cannot commit say Rs. 10K in one go.

Mutual funds allow such investors to decide a suitable monthly amount and then do a recurring investment of that amount without resulting in any unnecessary liquidity constraint. In case midway the investor feels that s/he wants to increase/ decrease the amount, it can done without any hassles.

This way, mutual funds is a boon for the govt. also to bring the “Great Indian Middle Class” to stock market investing and reap the gains of investing in equity without compromising the monthly budget and liquidity aspects.

Ability to invest systematically to allow averaging of cost (no need to time the market):

The stock markets are by nature volatile, and people have lived to tell the losses they have suffered while investing in highs of 1992 and 2002. However, the past data of sensex also suggests that longer the time frame you regularly invest, the risk of money comes down dramatically.

There are 2 reasons for that – 1) equities perform better in longer periods 2) when you invest regularly, you are buying at different levels and thus averaging out the overall purchase cost – which results in higher gains when you sell

When you invest in mutual fund through a SIP (Systematic Investment Plan) and that too for longer periods (min. 10 years), you can be more certain of reaping handsome inflation beating returns.

Also, even if you have lumpsum (like bonus received from employer), mutual funds offers the convenience of STP (Systematic Transfer Plan). whereby you invest the lumpsum in a low risk debt fund, and then move money through SIP mode to your chosen equity fund.

Also, if you don’t want to withdraw all of your accumulated money all in one go as you don’t need it, mutual funds allow for Systematic Withdrawal Plan (SWP) – this allows you to set a fixed amount that gets redeemed each month and acts like a monthly income.

All it requires is a bit of patience, systematic investing capacity and not getting worked up by good and bad news that comes on TV….

Let professionals manage your money for a very small fee:

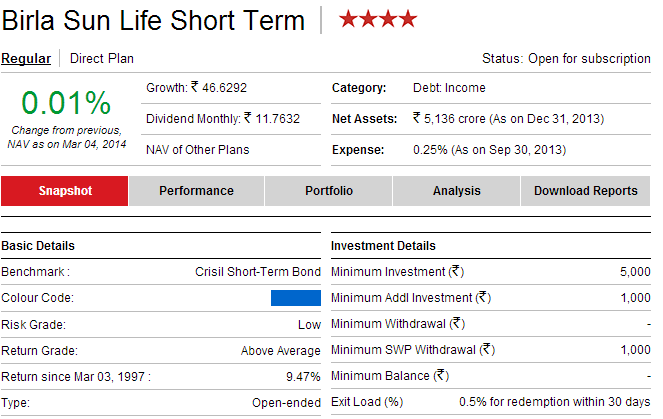

The beauty of mutual fund investing is that you accept the fact that you are not a market expert and you hand over your money to a professional and pay a very very small fee for that purpose – this is known as “fund management fee” and it ranges around 1-2% (varies from fund to fund)

Since this fee is this nominal, it does not dig a big cut in your returns. On the contrary, what you get is that since a professional manages your money day in and day out, the chances of losing money in mistimed bets on your part, is really minimized.

Ability to diversify and build a balanced portfolio:

As I touched upon in one of my earlier posts. it is not only necessary to invest consistently; you also need to smartly diversify your investment across asset classes to reduce the risk of your portfolio. Main asset classes are equity, debt, gold. and real estate.

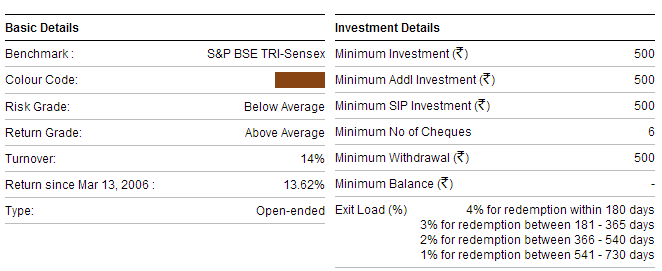

Fortunately, mutual fund products are available presently for all asset classes except real estate. Hence, if you have a monthly savings goal of Rs. 5,000 your child’s education a decade away, you can very conveniently start parallel SIPs in 1 large cap equity fund, 1 gold fund and 1 long term debt fund, in the ratio of your risk profile. (for e.g. you are not comfortable with equity, you can have a less allocation in that to start with) – so you see, the freedom is completely in your hands!

Over the long term, by this way, you would have created a very balanced and less-risk portfolio to meet your long term goal.

Helps in putting your investment plan on auto-pilot:

This is a very understated benefit of MF investing. When you invest in a stock or a debenture or purchase gold, you have to actually spend a lot of time and paperwork for doing that “single transaction” – or employ a broker to do that for you, who will charge his brokerage for doing this activity. Also, the same transaction if to be done again, requires another round of time and effort – you probably have to set a reminder so that you don’t forget….

Now, as young professionals who juggle between demands of work and personal life, this is not always possible. Here’s where mutual funds come to rescue – you decide how much to invest each month, deciding on which are the good funds, do a one-time paperwork and activate ECS from your bank account at the start of the month, and then sit back and relax …

Automatically, at start of each month, a fixed amount will get deducted from your bank account, and you will get a set no. of units alloted to you – after every transaction, the fund house will e-mail you an upto-date fund statement (or you can yourself generate the same )….so, you have to just set the ball rolling and rest is done by itself!

And this is not it, there are such wonderful online platforms available like Fundsindia.com. which allow you to do the whole bit fully online – now, that’s what you call convenience (I am myself a Fundsindia customer and read my earlier post on review on their services here )

Almost no commission: You pay to advisor only if he gives you good service:

Almost every product has its share of built in commission that forms part of the cost structure of the product – when you buy say a ULIP. the “premium allocation charge” levied to you is just another name for the “commission” that insurance company will charge from you and pay to the agent who sold you the policy. This actually eats into the return that you are entitled to get from your product.

In mutual funds also, prior to 2009, an entry load of 2.25% was levied on every purchase. That meant that if you invest Rs. 100 in a mutual fund, Rs. 2.25 will be compulsarily be deducted and paid out to agent who sold you the mutual fund, and only Rs. 97.75 will be invested in your name in the fund. In a customer friendly move in 2009, SEBI removed this entry load on mutual funds – which meant that the entire Rs. 100 will be invested for you, without any deduction for commission. However, in return for expert advice and service provided by the agent, investor will pay separate fees directly to the agent – that is something that is completely between investor and agent – if you don’t feel he is giving you service, you don’t pay.

However, it may be noted that in 2012 though, the system of “entry load” was brought back in a very limited way (as distributors had stopped selling mutual funds because they got nothing). Still, especially with launch of direct-to-investor plans , mutual funds remain today the lowest cost avenue for investing, and a big reason why you should invest in them…

Full control in your hands Easily switch to other fund in case of under performance (biggest advantage over ULIP):

Amongst the various reasons offered by financial planners and media on why ULIP’s are inferior to mutual funds, I believe an often missed out reason is that in case of underperformance of the fund, since ULIP is an insurance product, getting out is too cumbersome and comes at a significant cost. As per the IRDA regulations on ULIP, there is a mandatory lock-in of 5 years. Also, there are surrender charges.

However, in mutual funds, in all except equity linked savings schemes (ELSS), it’s like a breeze. One fine day, you think that the fund has been underperforming for quite a file. You can quickly place a switch request to another scheme of the same fund or a different fund house altogether. On a maximum, you might have to incur a small exit load as per the terms and conditions of the scheme.

This means full freedom, flexibility and control in your hands – all the more a reason for mutual fund cos. to be on your toes to manage your money better.

Transparency in disclosures, strict regulation by SEBI:

Unlike products like chit funds, for which there is no proper regulation, mutual funds are regulated by Securities Exchange Board of India (SEBI). SEBI is a very strong regulator and exercises a very strong oversight mechanism to see that investors’ interests are protected .

This includes detailed norms for fund houses on capital, solvency, bringing new fund offers to market, as well as managing investors money on a day to day basis. There are very tight disclosure norms for e.g. sending periodic unit statement to investors, publishing the portfolio on website, including sufficient details in Scheme Information Document (which is like a prospectus of a scheme in case of a new fund offer) etc.

A closing comment:

I hope I have tried to at least create in you some interest to move from low return avenues like FDs and NSCs or very high-risk ones like direct investing, chit funds etc. to mutual fund investing so that you can plan your financial future in a better way. However, the road is not all that easy. Before you can invest a single paisa in mutual fund, there is a strict know your customer (KYC) compliance formality that you will have to complete. Regulatory body has made it so complex that people shy away – But I don’t want you to be like those. Stick and complete the KYC (read my earlier post on this topic here ), open an online account in some good portal like Funds india and invest for long term systematically – as a small investor, you will definitely benefit from this approach, that’s my hope and belief!

Subscribe to our Monthly Newsletter & FREE E-book