7 Mutual Fund Performance Measures Ratings What They Mean

Post on: 16 Март, 2015 No Comment

For years, investors, fund managers, and stock analysts have sought reliable indicators to project the future return and risk of owning an individual stock, bond, or a portfolio of securities. The underlying assumptions are as follows:

1. All investments have inherent risk which is assumed upon ownership.

2. Returns and risk can be objectively quantified by mathematical analysis of historical results.

3. The correlation of potential return and underlying risk constantly varies, providing opportunities to acquire investments with maximum potential return and minimal risk.

These assumptions exemplify modern portfolio management and are the basis for the widely used capital asset pricing model (CAPM) developed in the 1960s, which led to a Nobel Memorial Prize in Economics for its creators. Enabled by technology, Wall Street wonks amass and analyze massive amounts of historical data searching for hidden, often arcane relationships to identify undiscovered opportunities for gain without risk. The results of their analysis are often publicly available for use by private investors.

Measures of Common Stock & Mutual Fund Portfolios

Common stocks, mutual funds. and managed portfolios have been assigned certain measures by which analysts judge their performance.

Alpha is the measure of a portfolios return versus a specific benchmark, adjusted for risk. The most common benchmark in use and the one you can assume is used unless otherwise noted is the S&P 500. An investment with an alpha greater than zero has provided more return for the given amount of risk assumed. A negative alpha less than zero indicates a security which has underperformed the benchmark; it has earned too little for the risk assumed. Investors typically want investments with high alphas.

Beta is the measure of an investments volatility to another market index, such as the S&P 500. Volatility indicates how likely a security is to experience wide swings in value. If beta is 1.0, the investment moves in sync with the S&P or experiences a measure of volatility similar to the S&P. If beta is positive, the investment moves more than the index; if negative, the investment is less volatile than the index. For example, a beta of 2.0 projects a movement two times that of the market. Assuming a market price change of 15%, the investment could move 30% up or down. Conservative investors typically prefer investments with low betas to reduce volatility in their portfolios.

3. R-Squared Value

The R-squared value is a measurement of how reliable the beta number is. It varies between zero and 1.0, with zero being no reliability and 1.0 being perfect reliability.

The two charts illustrate the variability of return for two funds compared to the volatility of the S&P 500 in the same period. Each y-value represents a funds returns plotted against the S&P 500 returns (x-values) in the same period. The beta, or the line created by plotting these values, is the same in each case. This suggests that the correlation between each fund and the S&P 500 is identical. However, closer examination indicates that the beta in the second chart is far more reliable than the beta in the first chart as the dispersion of the individual returns (x) is much tighter. Therefore, the R-squared value is higher for the fund in second chart.

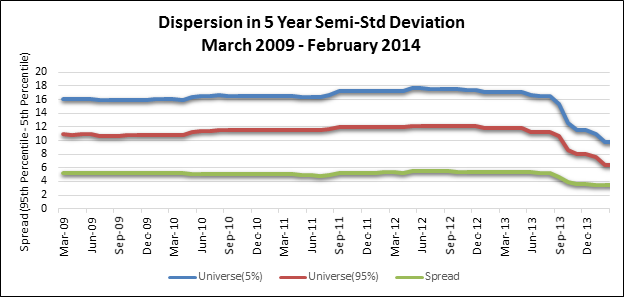

4. Standard Deviation

While beta typically measures an investments movement against an index such as the S&P 500, standard deviation measures the volatility of an investment in a different way. Instead of comparing the investments return to a benchmark, standard deviation compares an investments individual returns (for example, the closing price each day) over a specific period relative to its average return over the same period. The more individual returns deviate from the investments average return, the higher the standard deviation.

An investment with a standard deviation of 16.5 is more volatile than an investment with a standard deviation of 12.0. According to Morningstar Ratings, the standard deviation for the S&P 500 has been 18.8 for the last five years.

The underlying premise is that an investor should receive a higher return if he assumes more volatility in his portfolio. Theoretically, the higher the ratio, the stronger the portfolios return has been relative to the risk taken. A ratio of 1.0 indicates that the return was what should be expected for the risk taken, a ratio greater than 1.0 is an indication that the rate was better than expected, and less than 1.0 is an indication that the return did not justify the risk taken. Refinements of return to volatility ratios include the Sortino ratio, the Treynor ratio, and the Modigliani risk adjustment performance measure (RAP).

6. Capture Ratios

Capture ratios, or the percent of broad market moves over a specified term reflected in a portfolio, are intended to be a simpler way to reflect a portfolio managers performance. For example, if the S&P 500 has moved upward 20% while the portfolio being managed has increased 25%, the portfolio has captured more gains than the market move and would have a ratio of 1.25 (25%/20%), an upside capture ratio. If the market falls by 20% and the portfolio drops 25%, the downside capture ratio would also be 1.25, indicating that the portfolio has underperformed the market for the period. Generally, investors would prefer a fund with an upside capture ratio in rising markets greater than 1.0 and a downside capture ratio less than 1.0.

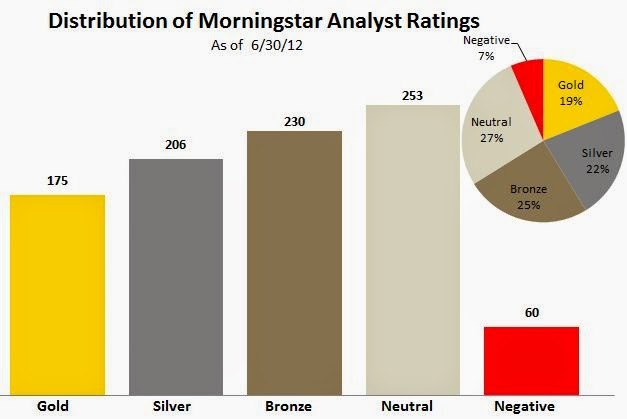

7. Independent Ratings