7 Common Investing Mistakes And How to Avoid Them

Post on: 5 Апрель, 2015 No Comment

People often think that there is some sort of magic formula when it comes to investing. If that were true we’d all be millionaires! Some genius entrepreneur somewhere would publish the formula and make billions (not millions) from selling it.

Sorry to be the bearer of bad news, but there is no magic formula and it’s pointless to waste time trying to find one. When it comes to investing, it’s much better to stick to the basics – and equally important – to avoid making investing mistakes. You can often come out ahead simply by avoiding the following mistakes:

Investing late, or not heavily enough

The time value of money is one of the most well documented investment phenomena of all time. Simply put, the more time that your money has to grow, the larger your portfolio will get. That makes now the perfect time to begin investing! If the years have flown by and you have not invested, you have to partially make up for lost time by investing more money than you would have earlier in life.

You’ll never be able to completely overcome the loss of the advantage of many years of investment income accumulation, but saving and investing a larger percentage of your income is the next best step.

Here are some tips for balancing your portfolio during different stages of your life:

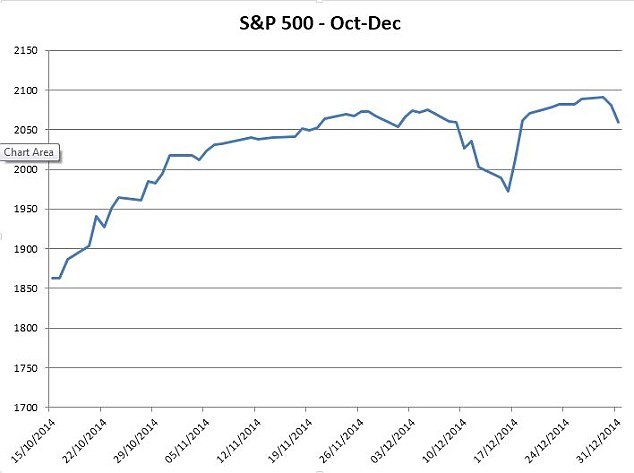

Trying to time the market

Here’s where we get back to that suspected magic formula problem. As logical as it seems, it’s impossible to properly time the market. You can even lose a lot of money trying to do this, so it’s best to come up with another method.

That better method is usually dollar cost averaging . Rather than trying to figure out when the best times to buy into the market are, you allocate a steady percentage of your income to put into new investments. By investing gradually, you’re spreading out the price of the investments you are buying over a very long period of time. That will minimize the need to buy into the market at the best possible time – which you can never do anyway.

Not rolling over 401(k) plans

There is an epidemic in America when it comes to rolling over 401(k) plans upon changing jobs. Employees often see the distribution of a 401(k) plan from a previous employer as a financial windfall to be liquidated for other purposes. When you do this, not only do you raise your tax liability and incur early withdrawal penalties, but you also disrupt your retirement planning maybe even having to start back at square one.

Since changing jobs is only becoming more frequent, make it a point to roll over your plan upon leaving an employer. Either roll it over into your own IRA, or into your new employer’s 401(k) plan.

Using retirement accounts as savings accounts

It’s unfortunate but true that a lot of people use retirement accounts as savings accounts. Often this happens because they don’t have savings accounts – or even emergency funds. When there is an emergency, or they need to make a major purchase, they turn to the only real asset they have – their 401(k).

There are two big problems with reaching into the retirement cookie jar: the first is early withdrawal penalties which equal 10% of the amount you withdraw, on top of paying taxes on the amount you withdraw. The second problem is reducing the size of your nest egg.

To avoid having this happen to you, become a regular saver outside of your retirement plan. At a minimum, you should have an emergency fund equal to at least 30 days of living expenses, and/or a savings account that you regularly fund to pay for contingencies.

Paying high investment fees

Out of either tradition or lack of knowledge, many investors pay excessive investment fees. They may be loyal to a traditional full-service broker, or frequently invest in mutual funds with high load fees. But a 1 2% difference in investment fees can make a large difference in the value of your investment portfolio after 10 or 20 years.

A better approach is to keep your money invested through discount brokerage accounts, and lean toward no-load and low load funds.

Poor investment allocations

When you invest, building a balanced investment portfolio is one of the most important practices. You have to build a portfolio that is appropriate both for your age and your risk tolerance. Some people invest too heavily in fixed income assets that don’t keep up with inflation. Others invest too much money into equities and get clobbered during market declines.

The key is to have a solid mix of both investment types. Even if you see yourself as an aggressive investor, you should still have some money invested in safe assets. That way when the stock market does decline, you will have the capital available to scoop up bargains. And if you are a conservative investor, you’re going to have to have at least some money invested in equities so inflation doesn’t eat up all of your interest rate gains.

Buying too heavily at market tops and selling at market bottoms

A lot of investors get burned by following the “herd”. When the stock market is in record territory they buy heavily, feeling more secure simply because the herd is buying in. And many investors – including those who buy heavily at or near market tops – sell off their investments after steep market declines.

This puts you in a position of overloading your portfolio when prices are high, and selling off after your investments have plummeted. This means that you are buying high, and selling low – which is the exact opposite of what you need to be doing.

Once again, dollar cost averaging is the best way to avoid buying too heavily at market tops. And on the sell side, it’s always best to take profits in a healthy market. The last thing you ever want is to sell after a big market drop. If you do, you’ll simply lock in your losses. Meanwhile, if you did take profits at the top of the market, you’ll have cash to buy those bargains at the bottom when everyone else is selling.