5 Year CD Rates 60 Month Certicates of Deposit

Post on: 16 Март, 2015 No Comment

BestCashCow strives to maintain the most accurate rates. If you find a rate that is not accurate, please let us know by commenting below so that we can update it. Thank you for your help.

Comments

Sally, November 19, 2014

Add your comment

Your Name: Your Comments: Type the characters you see in the picture below.

Five Year CDs — Branch Banks

Five year CDs are the big kahuna of the CD world. While banks may offer six year, seven year, or even 10 year CDs, the five year is the most longest of the most common terms. Because they are the longest term, they also generally offer the highest rate of any CD term and the temptation for those looking for yield, is to open one, deposit money, and forget about it for five years. This could be a mistake. In low rate, or rising rate environments, a five year CD may not be a good investment.

Like every other CD term, five year CDs from FDIC insured banks are protected up to FDIC limits (generally $250,000 per account holder per bank). If your deposit is over the FDIC limit then you may not receive the uninsured money in case of a bank failure.

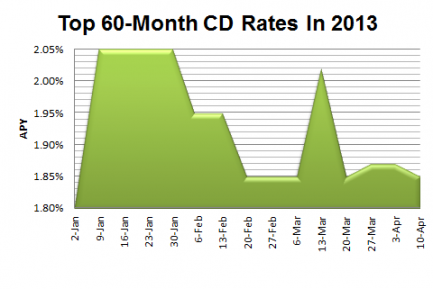

The principle threat to a a five year CD is inflation. If the CD is opened in a low rate environment, and rates and inflation subsequently rise, then inflation will erode the value of the certificate of deposit over its five years. For example, if a depositor opened a five year CD in year 1 with a yield of 2.05% APY and inflation at 1.5%, then the real return is .55 percentage points. But if inflation rises the next year to 2.5% and stays there for the next four years, then the CD in real terms is losing money every year: 2.05% — 2.5% = -.45%.

While it is impossible for anyone to predict too far into the future, savers should be cognizant of the economic environment before locking up money for a five year time-period. Our rate analysis page provides some insight into where we think rates will go.

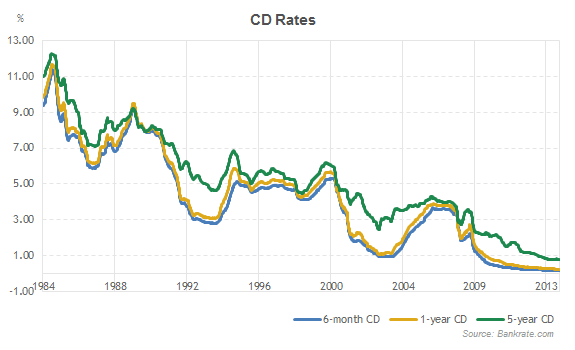

On the other hand, if rates are falling and will continue to do so for some time due to an economic recession then it makes sense to lock in a higher rate with a five year CD. Savers who opened five year CDs in 2008 immediately after the financial crisis were able to lock in rates in the 6% range, a great move considering two years later a five year CD paid below 3%.

Five CDs currently pay about 70 percentage points more in interest than a one year CD. In general, CDs of this duration are best opened as part of a laddered CD portfolio or if the depositor thinks that rates will either stagnate or drop over the next couple of years.

Opening a Five Year CD

Opening a five year CD in a branch is relatively easy and similar to every other CD term. Most banks require the customer be a resident of the United States and most branch-based banks ask that the account be opened in the bank. Funding can be performed by transferring money that is already located at that bank or by check or ACH transfer from another bank. The CD can be opened that day and the rate locked.

With longer term CDs, savers should make sure they put a record of the CD in a safe place and that if they move, they forward their new address to the bank. In cases where the bank cannot find the CD holder, the bank may hand the funds over to a state authority as a lost deposit, and it will require onerous paperwork to reclaim the money.

Advantages and Disadvantages