5 Ways to help clients navigate liquid alternatives

Post on: 3 Апрель, 2015 No Comment

Share This Story

In mutual funds and exchange-traded funds (ETFs), one of the biggest stories of 2014 will be the growth of liquid alternatives. Large asset managers are putting big budgets behind new fund launches and programs to expand advisor and investor education. Leading hedge fund managers are evaluating the merits of expanding by launching registered funds.

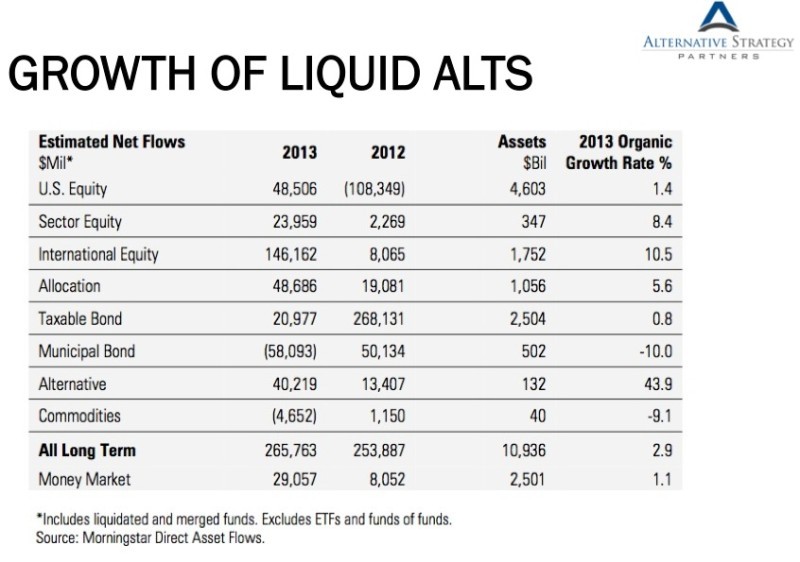

For all of 2013, Morningstar reported that alternative mutual funds captured $40.2 billion in net inflows and grew to $132 billion in total assets, representing a 43.9% organic growth rate (from inflows). In January of 2014, the torrid growth pace continued with $4.4 billion in inflows. Twice as much money has flowed into alternative mutual funds over the past year as into all U.S. taxable bond funds combined!

Morningstar now tracks about 1,400 alternative mutual funds and ETFs in 13 categories, and hundreds more will be launched in 2014. In January, the giant institutional money manager Invesco launched six new alternative mutual funds. Combining mutual funds and its PowerShares ETFs, Invesco now sponsors 32 liquid alternative funds.

This year, clients will be asking you more questions about liquid alternatives, and looking to you for guidance in: 1) increasing knowledge about how alternatives work; 2) deciding how to integrate alternatives into portfolios; and 3) choosing specific liquid alternative funds.

How will you help them navigate the liquid alternative maze? Here are five ideas.

Idea #1: Take charge of client education.

Your clients need educational information to understand alternatives, and you are its best source. Heres proof: In February, Invesco released findings from a survey it sponsored with Market Strategies International of high net worth (HNW) and affluent investors who work with a financial advisor. The survey found:

- 77 percent of affluent and HNW investors are not familiar with the term alternative investment.

- Of the remaining 23 percent, just 4 in 10 currently use alternatives. Among these, alternatives account for just 16 percent of total investment assets.

- Only 10 percent of investors said they have a high-level understanding of the alternative category.

- Among alternative users, 65 percent of HNW and 52 percent of affluent investors named their advisor as the primary driver of the decision to add alternatives.

None of these findings are surprising. They just reinforce the fact that clients expect advisors to lead them through the alternatives maze. The huge and growing promotion some might say hype surrounding alternatives makes a trusted advisors role even more important.

Idea #2: Focus first on the big five categories.

Of the 13 alternative categories tracked by Morningstar, five are mainstream. The table below shows these five ranked by assets and net inflows for 2013 and January of 2014. (Both mutual funds and ETFs are included.)