5 Ways to Fight Inflation With ETFs

Post on: 1 Апрель, 2015 No Comment

June 15th at 1:00pm by Tom Lydon

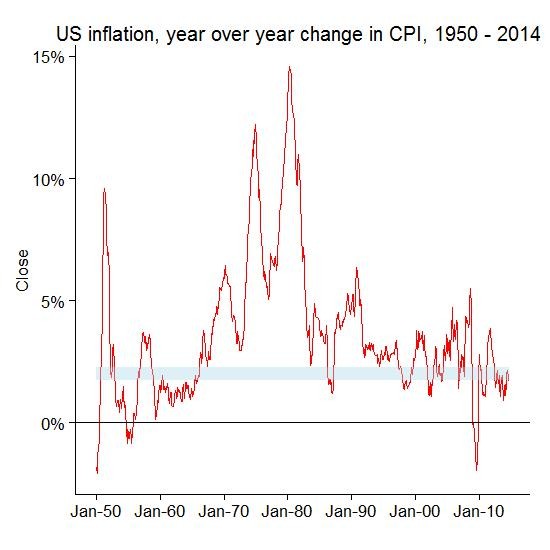

Inflation seems to be on the mind of all American citizens as the economy takes its first steps toward a recovery. With exchange traded funds (ETFs), there are a number of ways you can hedge the inflationary climate.

After enormous government spending and constant money printing, most Americans fear that inflation is looming.

1. Oil and Commodities. As the dollar weakens, owning oil related stocks and ETFs/exchange traded notes (ETNs) will be one of the most direct ways to hedge against this. Also, if we do see inflation, chances are that we will be experiencing some economic growth here in the United States. United States Oil (USO ). up 19.1% year-to-date.

2. Non-U.S. Currencies. If the U.S. dollar does lose value relative to other currencies. it will be beneficial to have a portion of your investments in those foreign currencies. This can be accomplished by owning the actual currency itself in a brokerage account, or investing in an ETF that tracks a foreign currency. There are an increasing number of these currencies available to investors, including CurrencyShares Euro Trust (FXE ) and WisdomTree Dreyfus Chinese Yuan (CYB ). up 0.4% and up 2.3% year-to-date, respectively.

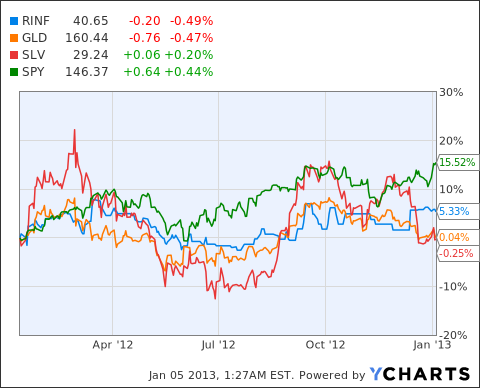

3. TIPs/ Bonds. TIPS, or U.S. Treasury Inflation-Protected Securities. are aptly named, as they are designed specifically to pay you a steady yield adjusted to the U.S. Consumer Price Index. iShares Barclays TIPS Bond (TIP ). up 2.5% year-to-date.

4. Futures. There are a number of ETFs that trade futures available today its a much simpler route to take for the average investor. PowerShares DB Agriculture (DBA ) is just one such ETF that holds futures in corn, wheat, sugar and soybeans. Its up 4.4% year-to-date. You can find more ETFs that hold futures here .

5. Non-U.S. Stocks. Remember this works both ways: If inflation does not turn out to be a problem here in the United States and the U.S. dollar actually strengthens versus other currencies, your foreign stock investments will suffer. There are dozens of international ETFs that hold non-U.S. stocks visit the providers page to find out the holdings and decide whether theyre right for you.

For full disclosure, Tom Lydons clients own shares of TIP.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.