5 Things You Should Know about Mutual Funds

Post on: 3 Апрель, 2015 No Comment

One of the ways that investors particularly beginning investors add diversity to the portfolios is with the help of mutual funds. Mutual funds can provide you a way to get the benefit of a variety of investments without the need for individual stock picking.

However, before you get too excited about mutual funds, its important to have a handle on what you should know about these investments. Here are 5 things you should know about mutual funds:

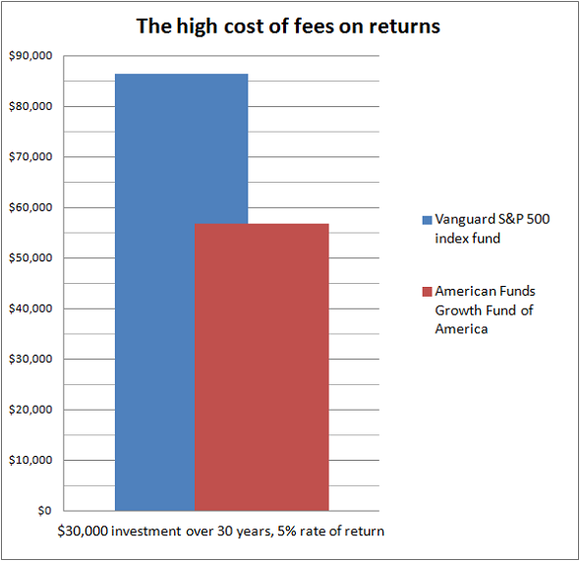

1. You Can Get Better Performance Out of Low-Cost Funds

It seems natural to think that an actively managed fund, with an expert at the helm, would perform better. As a result, the fact that you are paying more for an actively managed fund makes sense. Unfortunately, this often isnt the case. While there are some managed funds that outperform the market, and other funds, most actively managed funds dont. And, by the time you take out the fees, your real returns can be sparser than you though. You might actually be better off with carefully chosen index funds .

2. Your Mutual Fund Doesnt Trade Instantly

When you buy or sell shares in your mutual fund, the transaction doesnt take place immediately. Instead, mutual fund transactions (actively managed and index) are taken care of at the end of the day. If you want the advantage of a fund, but with the ability to trade like a stock on an exchange, you might consider ETFs.

3. You Need to Rebalance

While its tempting to think that all you have to do is set it and forget it, that isnt the case with a mutual fund. Whats held in the fund can change over time (especially in an actively managed fund), and that means the composition changes. You might not have as much diversity as you thought as a result. Look over your mutual fund holdings, and rebalance your investments if you need to. Its important that you not let drift within your mutual funds throw off your asset allocation.

4. There Could Be Fees You Dont Know About

If you decide to go with an actively managed fund, you probably expect to pay something up front, in the form of a front load. When you buy, you might have to pay up to 5% of the amount you invest. You probably also expect to an expense ratio. However, hidden in that expense ratio might also be a 12b-1 fee, which is an operational charge. And, you might not realize that you could pay a back load. This is a fee that you pay when you sell the fund. So, if you arent careful, you can get hit on both ends with the mutual fund. While these fees have to be disclosed, they can sometimes be hard to spot.

5. Past Performance May Mean Nothing

We all like to see how something has performed in the past, since it can provide valuable clues about the possible future. However, its important to remember that with mutual funds or any investment past performance is no guarantee of future results. Just because a fund has performed well in the past doesnt mean it will perform well in the future. Make sure you keep that in mind, and realize that you could lose money.