5 Steps to Simplifying Your 401(k)

Post on: 9 Май, 2015 No Comment

Posted on Aug 18, 2012

Heres another interesting post from our friends at InvestingAnswers :

Simplify your retirement by consolidating old 401(k) plans into one manageable account.

If youre anything like me, youve probably worked at a few different jobs over the years and picked up a few 401(k) plans along the way. Each time I started a new job, I was always too busy to do anything with the funds locked away in my previous 401(k) plans.

What I didnt realize was that by letting my retirement accounts sit with my old employers, I was subject to record keeping and management fees that took a significant bite out of my investment returns.

This is a fairly common story today, with the average baby boomer holding 11 jobs between the ages of 18 and 44. After that many job changes, there comes a point when your retirement account may be scattered across a vast work history, making it difficult to keep track of the funds and control management fees.

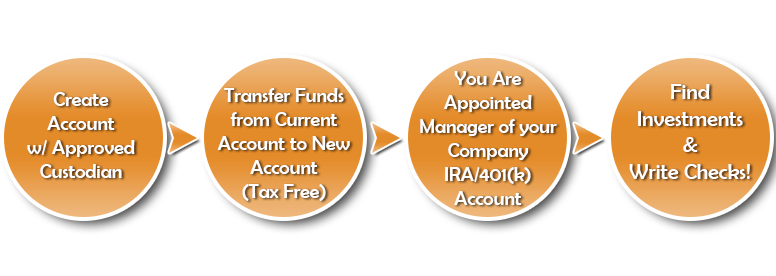

Performing a rollover transferring the funds from your previous 401(k) plans into a your current401(k) plan or individual retirement account (IRA) allows you to continue to receive tax-free deductions for retirement (versus the tax hit and 10% penalty fee youd face if you cashed out the investments), minimize fees and offer better control over how the funds are allocated.

Rollover into an IRA or 401(k)?

You can rollover your previous 401(k) plans in one of two ways: either into your 401(k) plan with your current employer or into a traditional IRA that you set up on your own.

Want More?

Both are tax-deferred retirement accounts with contributions made from pre-tax dollars; the difference is that with an IRA you are generally given a larger variety of investments to choose from.

Most IRAs allow you to invest in individual stocks, exchange-traded funds (ETFs ),mutual funds or bonds. whereas with a 401(k), youre pretty much stuck with the investment choices offered in your company plan typically only mutual funds, ETFs or moneymarket accounts.

If youre more interested in having your retirement funds all in one place, however, you may prefer to rollover into your current 401(k) plan. Once youve decided how you want to invest your 401(k), here are the steps to take to complete the rollover.

401(k) Rollover Step 1: Know Your Options

Usually after you leave a company, your old 401(k) sponsor will send you a letter giving you three options:

- Leave the plan with the sponsor

- Cash out the plan (the funds will be taxed as normal income and youll be hit with the 10% early withdrawal penalty)

- Roll over the old plan funds into a new retirement plan (such as a 401(k) or IRA)

If you decide to roll over your funds, be sure to call your current 401(k) plan sponsor to find out all the conditions and possible fees involved.

401(k) Rollover Step 2: Complete Old Plan Sponsors Rollover Forms

While you are in contact with your old 401(k) plan sponsor, let them know of your intentions to roll over your funds and have them send you any required paperwork that you need to complete to initiate the rollover. While youre talking with them, make sure and ask them what the account number is on the plan, as youll need it for the next step.

Many sponsors allow you to conveniently fill out the rollover forms online. In some cases, your old sponsor will simply need a rollover request from your current sponsor to complete the transfer.

401(k) Rollover Step 3: Talk to Your Current Plan Sponsor

Check with your current plan sponsor to find out what information they need to deposit rollover funds (from the old plan) into your current 401(k) plan. Generally, you will need the old plans sponsor name i.e. ING , T. Rowe Price , Fidelity. etc. along with the old plans account number, and the amount that will be transferred (whether thats in specific dollars or 100% of funds).

Youll then likely complete a physical or online form (one that looks similar to a bank deposit slip) as a way to tell the current sponsor that your rollover funds will be going into your account with them.

401(k) Rollover Step 4: Accurately Complete the Forms

It seems like a given, but accuracy is paramount when filling out rollover forms, so dont just guess what to fill in. While these forms sometimes require a lot of information, filling them out correctly and completely will ensure the transaction moves along much faster.

Call your current or old sponsor if you have any questions on completing the forms; representatives from either company should be familiar with the entire process of fund rollovers and are generally happy to help.

401(k) Rollover Step 5: Submit the Forms

Once you are finished, submit the forms by mail or fax to the correct companies. But dont relax just yet you need to remain vigilant. If one of the forms is filled out incorrectly, you cant count on your old plan sponsor to contact you to try to make it right.

If the funds havent been deposited into your new 401(k) plan or mailed to you in two weeks, check back with your old plan sponsor to see what is wrong. Keep your account numbers, names, and other information (from both plans involved) handy, as this will help speed along the inquiry process should you run into rollover delays.

The Investing Answer: The process of rolling over your 401(k) plan may seem tedious at first, but its one of the smartest long-term moves youll ever make. Consolidating your 401(k) accounts into one simple plan will not only save you hours of time when you review your 401(k) plan performance, it will eliminate hundreds of dollars worth of unnecessary management fees, helping you get back on track towards a more successful, simplified retirement plan.