5 Mutual Fund Investing Lessons from the Bill Gross Saga

Post on: 16 Март, 2015 No Comment

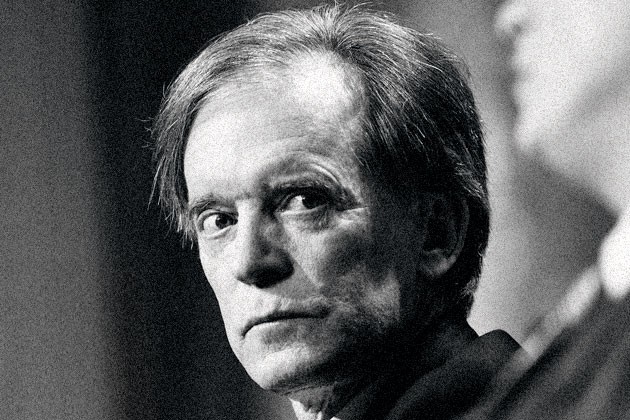

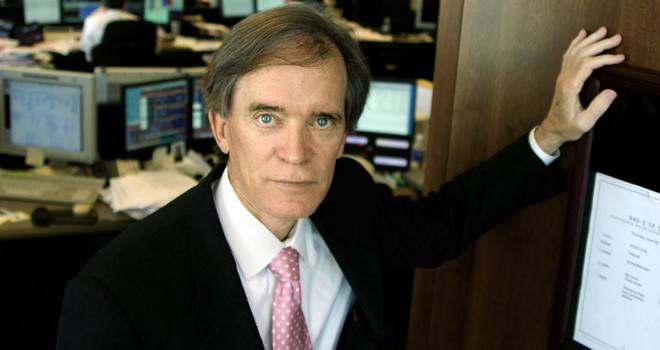

The soap opera at PIMco that began with the departure of Co-CEO Mohamed El-Erian in January came to a head with the recent departure of PIMco flounder Bill Gross. More than just being the founder of PIMco Gross managed the firm’s flagship mutual fund PIMco Total Return (PTTRX). His high profile exit once again brings one of the pitfalls of investing in actively managed mutual funds to the forefront. Here are 5 mutual fund investing lessons from the Bill Gross saga.

Know who is in charge of your fund

Bill Gross was the very public face of PIMco and was known as the “Bond King.” To his credit he built PIMco Total Return into the world’s largest bond fund and the fund did very well for investors over the years. The question investors, financial advisors, and institutions are now asking themselves is what is the future of the fund without Gross?

While PIMco promoted two very able managers to take over at Total Return, the redemptions that have plagued the fund over the past several years as a result of its downturn in performance have continued and seem to be accelerating in the short-term. Much of this I’m sure stems from the uncertainty over the direction of the fund under these new managers.

Succession planning is vital

While most fund manager changes don’t take place in this fashion if you invest in a mutual fund run by a superstar manager what happens if he or she leaves? For example does Fidelity have a plan to replace Will Danoff when he decides to leave Fidelity Contra (FCNTX)?

One of the long-time co-managers of Oakmark Equity-Income (OAKBX) retired a couple of years ago. This was planned and announced ahead of time. Shortly after that the fund brought on four younger co-managers to help the remaining long-tenured manager manage the fund and more importantly to provide succession and continuity for the fund’s shareholders.

The investment process matters

What makes an actively managed mutual fund unique is its investment process. If the fund were to merely mimic its underlying index why not just invest in a low cost, passively managed index fund? There have been a number of articles in the financial press in recent years discussing “closet index” funds. These are actively managed funds that for all intents and purposes look much like their underlying benchmark. This is fairly prevalent in the large cap arena with many funds mimicking the S&P 500. Why invest in an actively managed fund that is really nothing more than an overpriced index fund ?

An institutionalized investment process is key when a manager leaves a fund. I can think of three small cap funds I’ve used over the years that transitioned to new managers seamlessly via the use of a solid investment process. While it is expected that the new managers may make some changes over time, I’ve also seen well-known funds replace a superstar manager and essentially have the new manager start over. The results are too often not what shareholders have come to expect. To a point this is what has happened to Fidelity’s one-time flagship fund Magellan since the legendary Peter Lynch left a number of years ago. Subsequent managers have never been able to come close to replicating the fund’s former lofty position.

Even the best managers have down periods

Bill Gross has made a lot of money for shareholders in PIMco Total Return and other funds he managed over time. However Total Return has lagged its peers over the past several years which has led to a lot of money flowing out of the fund and the firm in recent years. It is not uncommon for a top manager to go through a few down years over the course of a solid long-term run. The trick is to be able to determine if this is a temporary thing, or if this manager’s best days are in the past. For example if the fund has grown to be too large the manager may have more money to manage than he or she can effectively invest.

Is an index fund a better alternative?

To be clear I am not in the camp that indexing is the only way to go when investing. There are a number of very good active managers out there, the trick is to be able to identify them and to understand what makes their strategy and investment process successful.

However before ever investing in an actively managed mutual fund, ask yourself what will I be gaining over investing in an index mutual fund or ETF?

It was sad for me to see Gross’ tenure at PIMco end as it did. It is not always easy to go out on top. Michael Jordan should have quit after sinking the winning shot to secure the Chicago Bulls’ last championship. Perhaps the role model here is the late Al McGuire whose last game as the men’s basketball coach at Marquette ended with the Warriors winning the 1977 NCAA championship.

Please check out our Book Store for books on financial planning, retirement, and related topics as well as any Amazon shopping needs you may have (or just click on the link below). The Chicago Financial Planner is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com. If you click on my Amazon.com links and buy anything, even something other than the product advertised, I earn a small fee, yet you don’t pay any extra.