5 Misconceptions About ETFs In Retirement Accounts

Post on: 1 Апрель, 2015 No Comment

Exchanged traded funds (ETFs) are the stock market darling. There are now thousands on the market and just like apps in the Apple (Nasdaq: AAPL) app store, more are constantly added. Not only do professional money managers use ETFs, retail investors use them too. Their simplicity and low fees make them perfect for retirement accounts.

If you’re considering ETFs for your retirement accounts. however, you should know how they work — at least in a basic sense. Not all of what you read is true. Here are a few common misconceptions.

Fees Are Always Lower for ETFs

Your 401(k), IRA and other retirement accounts likely have mutual funds as the only option but that’s changing. 401(k) managers are slowly adding ETFs as options alongside mutual funds. Often ETFs charge less in fees than mutual funds but not always.

Sure, ETFs such as the Vanguard Total Stock Market ETF (NYSE: VTI) has an expense ratio of only 0.05%. But, the Teucrium Sugar ETF (NYSE: CANE) has an expense ratio of 2.93%.

Of the more than 1,400 on the market, only about 50 have fees over 1%. Investors should never assume that ETFs are always cheaper than mutual funds .

If you have the option of ETFs in your retirement accounts, look closely at the fees. The funds might be cheaper than mutual funds but not always.

Exchange Traded Funds That Follow an Index Follow It Exactly

In recent years, there has been a push to load retirement funds with low-cost index funds — either in the form of ETFs or mutual funds. Rather than trying to beat the market, performing with the market produces better gains over time.

If you are tempted to use an ETF that follows an index, understand that it won’t follow the index exactly.

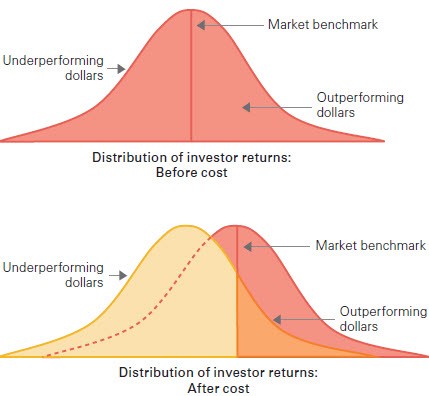

Let’s look at the most popular ETF as an example. The SPDR S&P 500 (NYSE: SPY) is designed to mirror the S&P 500 index. Although it is close, it’s not exact. That’s, in part, because of the fees and expenses. Once expenses are subtracted, the fund may slightly underperform. Higher-cost ETFs may diverge from the index they’re designed to mirror more drastically.

Look at the ETFs yearly performance alongside the index’s performance. They should be nearly identical. You can do this for the major indices.

All ETFs Are Passively Managed

You might have heard that ETFs are perfect for your retirement portfolio because they’re passively managed and that keeps fees lower.

Mutual funds have gained a lot of bad press because of the high fees that come with a manager actively changing the holdings of the fund. Not only do the investors in the fund have to pay the manager, they also have to pay taxes and trading costs associated with the activities of the fund.

Passively managed funds have lower expenses because they do not have to employ a team to constantly research and trade in the fund. That lack of activity does not produce high fees.

Because passively managed ETFs have these lower fees, they’re best for retirement funds since fees can severely erode the gains in a long term retirement fund. Be careful. There are actively and passively managed mutual funds and ETFs.

Index ETFs All Work the Same

Some index ETFs such as the SPDR S&P 500, follow their index by investing in all of the stocks available to them. Others, such as the Vanguard Total Stock Market ETF (NYSE: VTI) invest in a representative sample of the stocks listed in select indices.

The VTI attempts to mirror the total stock market making sampling essential, but what’s more important is to read about each ETF before committing money. Different strategies will produce varying results.

Fees and expenses could cost you more than $100,000 over the life of your retirement portfolio. This makes even one tenth of 1% very important. Look at how each index ETF works and compare its performance to the index it follows.

Owning ETFs Means You Are Diversified

Safety is just as important as growth in a retirement portfolio. One of the easiest ways to find safety is by diversifying. You should have a variety of investments in different sectors of the economy.

If you own an ETF that mirrors one of the major indices like the Dow Jones industrial average or the S&P 500, you are well diversified.

If you own a sector ETF such as the Financial Select Sector SPDR (NYSE: XLF) that is only comprised of financial stocks, you’re only diversified in the sector. Most portfolio managers do not consider that to be well diversified.

ETFs range from covering the entire stock market to only investing in small sectors. Since short-term trading in your retirement account is generally not advisable, make your core holdings ETFs that follow the larger market indices.

Don’t attempt to pick the sector that will outperform the rest of the market. That strategy isn’t likely to produce higher-than-average gains.

The Bottom Line

ETFs are slowly becoming investment options inside 401(k)s. Many IRAs allow for ETF investing already. The funds are perfect for retirement accounts, but don’t assume that ETFs are always the better choice. There is no always in investing.