5 Millionaire Traders on the Biggest Mistakes You Can Make in the Stock Market

Post on: 16 Март, 2015 No Comment

The stock market made me a millionaire by age 21 and now for the past few years I’ve been teaching others the rules of the game. I’ve made over $4 million (see my profit chart ) but more importantly, in the past few months, two of my students passed the $1 million in trading profits, a very proud achievement for both me and them.

And yet no matter how many video lessons, blog posts, webinars, watch-lists and trade alerts I give, far too many of my students keep making the same mistake that prevents them from taking their accounts to the next level.

The biggest mistake I see newbie traders making is not cutting losses quickly, instead their egos take control, they refuse to admit when they’re wrong and small losses become emotionally and financially devastating.

That’s why my number one stock market trading rule is to cut losses quickly, which means sometimes I miss out on a big move after being proven right after I’ve already exited the position, but this is to prevent myself from ever putting my account and confidence in a position that risks disaster.

I also asked a few of my multi-millionaire trading friends what the biggest mistake they see and the top rule they use to be successful.

My friend Gregg aka LX21 has made nearly $11 million (see profit chart ) and he says:

Trading without a proven strategy is the biggest mistake I see. The stock market is a very competitive place and there are many sophisticated participants who are ready to take your money. Traders and investors need to put the odds in their favor if they want to stand a chance of success. The first thing any investor or trader should do before putting their money on the line is to find a strategy that has a positive expectancy.

As for his number one rule:

Be patient! Patience is one of the key ingredients to reaping large profits. It can be very difficult to sit idle when I am surrounded by all the action of the market, yet sometimes the best course of action is to do nothing at all. I make far more money when I wait for the best set-ups, wait for the best entries, and wait for the best exits.

Paul aka Super_Trades I have known for over a decade and he has discovered more big winners than anyone else I’ve ever met. (See his profit chart )

He says:

The biggest mistake I see investors/traders making is taking position sizes that are too large for their portfolio and not using stop losses when trades go against them. Many new people want to make the money but they do not want to put in the work and discipline to be successful. Those that do are obvious and they catch on quick and compound their wealth.

As for his number one rule he says:

The number one stock market rule I have used to make millions is having a trade plan. This involves researching a stock and having a plan on how to take profits when it works or what to do if it does not work. I have now verified nearly $3 million in profits over the last couple of years and my subscribers have verified almost $1 million this year by learning the trade plan/research strategy I now teach.

My buddy Nate has just crossed the $2 million profit mark (see his profit chart ) but has wisdom beyond his years. He says:

The biggest mistake I see traders make is dollar signs in their eyes and thinking that a few hundred bucks profit isn’t a good trade and they need more, more, more. And in the end they turn a winning trade into a losing one. You need to start somewhere and you’re not going to hit a home run every time. Second mistake is disconnecting from the reason of the trade, ie: day trade turning into a swing trade and why this now losing trade is worth holding despite being wrong.

As for his number one trading rule, he says:

Trading is like baseball — consistency is the name of the game, base hits win games. You may be a home run leader but more often than not if you swing for a home run you’re likely to strike out. Never underestimate the power of taking profits along the way, always adapt and evolve; the moment you think you know best the market will humble you time and time again. I like to add to winners and use the house’s money (unrealized gains) as risk for bigger profits. This concept seems so simple to do — adding to winners, but contrary to what we are accustomed to doing — adding to losers. Try it, you may be surprised!

My second millionaire student Tim Grittani aka KroyRunner has now made $2.22 million in four years (see profit chart ) and says:

I see far too many traders/investors refuse to cut losses. They delude themselves into believing the stock will come back their way for fundamental reasons, or simply are too proud to admit they were wrong and take a loss. No matter what the reason, the end result is usually one bad trade taking them out of the game. You could be short a near worthless company (like some were with CYNK) and still blow up your account if you refuse to cut a loss quickly. The market is always right, you have to be humble and respect the market, or the market WILL humble you!

He sounds like a veteran already, right? As for his top trading rules he says:

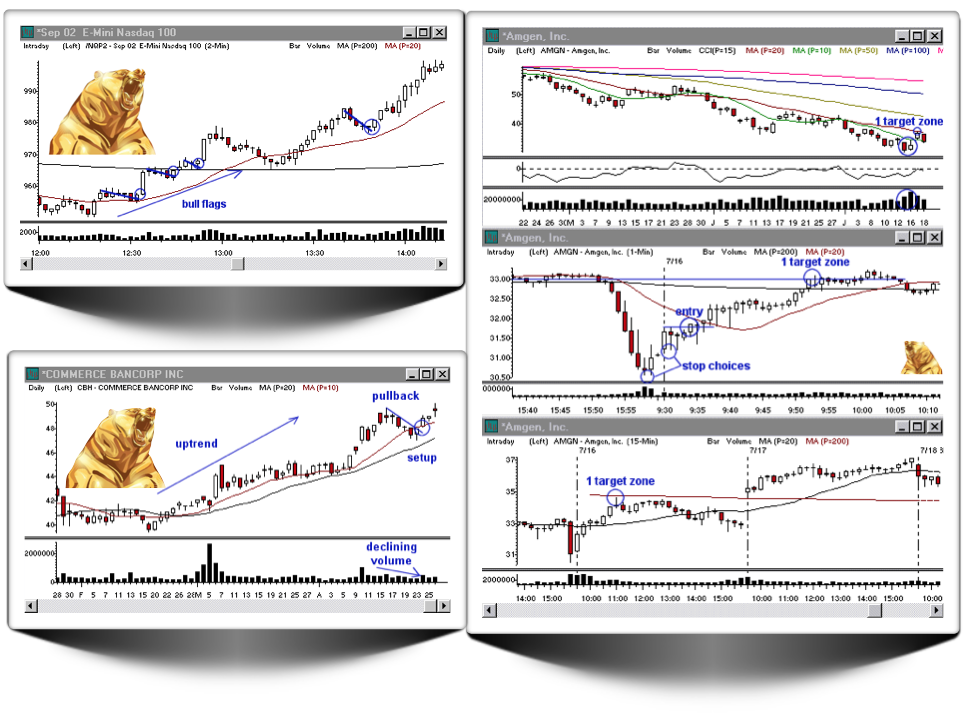

I think the biggest reason for my success is I trade off of technical analysis alone. Whether it’s the latest OTC stock scam, or a blue chip stock, I am trading the chart patterns I am most comfortable with and nothing more! I don’t let the latest earnings numbers or seemingly positive (or negative) PR cloud my judgment; I completely ignore those factors and just stick to playing the price action. By keeping my approach simple and literally making the exact same trades over and over again, I am able to learn from my mistakes and better myself as a trader every day.