401K Plan Sponsors and the Mutual Fund Expense Ratio Wild Goose Chase

Post on: 24 Июнь, 2015 No Comment

H as the typical 401k plan sponsor been led astray by a long misreported twentieth century academic paper? Worse, will this “road mistaken” trap 401k plan sponsors into making decisions that actually increase their fiduciary liability? These are but a few concerns many in the industry have expressed as a result of the popular press’s ongoing assault on mutual fund expense ratios. Indeed, this overly-simplistic – and false – analysis may thwart the Department of Labor’s efforts to level the playing field among 401k investment products.

In promulgating Rule 408(b)(2) – the Fee Disclosure Rule – the DOL has made it very clear it wants all fees for all services out in plain sight. Ironically given the reports in the mass media, this disclosure is patterned after the long-standing regulations requiring mutual funds to disclose their expenses on a semi-annual basis. You’d think the focus would be on these hidden fees, not the fees we already know about.

But no, judging from a recent article published by Fortune magazine and appearing on CNN’s web-site. “Is Your 401k Ripping You Off? ” (Fortune. July12, 2012) leads with the recent trope disparaging the nation’s most popular retirement vehicle, using “high expense ratio” mutual fund fees as the cudgel de jour. The Investment Company Institute (ICI) immediately issued a rebuttal to the Fortune article that was on point and damaging. For example, the ICI’s response states, “within a given investment category, fund fees can vary because of differing investment focus or style (e.g. among equity funds, foreign equity fund fees tend to be higher than domestic equity fund fees) and differing services included in the fund fees.”

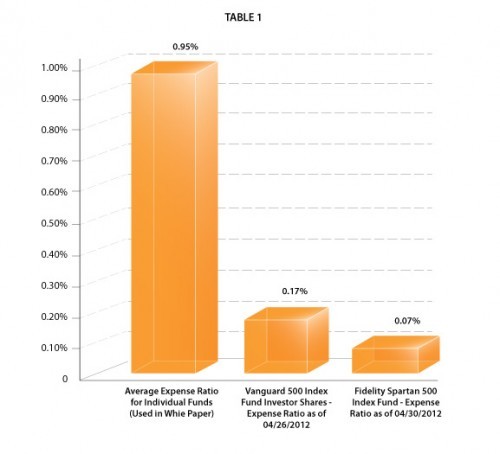

This fee variance exists even within the single category of the fund used as an example in the Fortune article. The story showed how an S&P 500 fund from Principal Financial (ticker: PLPIX) has an expense ratio of 1.04% and a 12b-1 ratio of 35 basis points. According to Morningstar, Principal offers an array of share classes for retirement plans with expense ratios ranging from 42 basis points to the cited 1.04%. In fact, the lowest expense ratio fund also has no 12b-1 fee. Granted, this is still more than twice as much as the 17 basis points the article (correctly) attributes to the Vanguard 500 fund (but even this fund is more than twice as much as the 6 basis points Vanguard offers its Admiral and Signal share classes for the same 500 index and these, in turn, are twice as high as the 3 basis point expense ratio for Fidelity’s Spartan 500 Index Advantage Institutional shares). Again, all fee data comes from Morningstar.

Such nitpicking aside, the bigger issue seems to be the industry’s misinterpretation of a 1997 paper by Mark M. Carhartt. The short-hand summary of this paper states “higher fee funds yield lower performance.” Indeed, “On persistence in mutual fund performance ,” (Journal of Finance. 52, 57-82) does show a strong correlation between high costs and lower performance. But Carhartt focused on two other factors in addition to a mutual fund’s expense ratio. He also looked at both mutual fund loads and turnover. Moreover, “investment costs” (Carhartt was correct not to mislabel them “expenses”) represented only his third conclusion regarding the factors that can maximize mutual fund investment performance.

In his first conclusion, Carhartt said it was most important to avoid funds with persistently poor performance. These funds rarely ever produce superior investment returns. This might be due to poor management, (including higher marketing and operational expenses), picking an investment style that is out of favor or focusing on an industry sector that is contracting.

In his second conclusion, Carhartt stated funds that did well in the previous year tended to do well in the subsequent year, directly contradicting the SEC favorite disclaimer “past performance does not guarantee future performance.” But – and much to the SEC’s delight, no doubt – he warned, this same correlation did not necessary hold for the years thereafter. Again, this strong positive correlation might have had something to do with the momentum of the particular stocks or industries the mutual fund had invested in.

It is only in his final conclusion that Carhartt turns to the subject of investment costs and the famous conclusion that appears to be the most remembered of the three. But we need to understand Carhartt’s conclusion within the context of the times when the research was first conducted. In the early-to-mid 1990’s, many load funds were still aggressively marketed and, when funds didn’t have loads, 12b-1 fees ruled the day. Carhartt included these, as well as the fund’s turnover ratio and expense ratio, as part of the investment cost.

More recent research (see “Does New Study Seal the Deal for Fiduciary Standard – or Just Warn Plan Sponsors? ” FiduciaryNews.com. January 19, 2011) shows if you remove loads and 12b-1 fees, actively managed funds perform just as well as the index. This fact may have been missed in the Fortune article. David Abbey, Senior Counsel of Pension Regulation at the ICI, told FiduciaryNews.com. “We believe some critics are underestimating American investors and savers. The truth is, ICI research shows that 401(k) participants have concentrated their assets in lower-cost mutual funds.” More specifically, a 2011 ICI report shows that not only are 401k investors invested in funds with lower expense ratios, but also in funds without loads and with lower turnover ratios – the three key factors contributing to investment cost in Carhartt’s study. Another ICI report shows nearly three-quarters of today’s 401k plans pay no 12b-1 fees.

This is not to say some 401k plans don’t have problems. Even the ICI’s numbers suggest nearly one in four 401k plans (i.e. those using funds with load fees or 12b-1 fees) could be paying fees they don’t need to. This, however, is not an issue with the 401k concept, but with plan sponsors who have not properly educated themselves as to their fiduciary duties. Some may also fault the DOL for failing to penalize these plan sponsors, but since the new Fee Disclosure Rule now places the responsibility for disclosure squarely on the shoulders of the plan sponsor, an argument can be made the DOL is moving in the right direction.

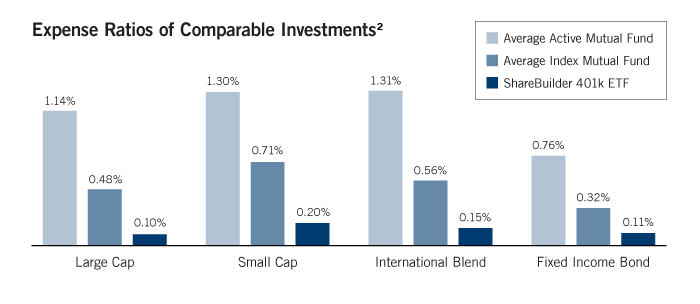

Which gets us back to the original issue: Are 401k plan sponsors being misled by an undue emphasis on mutual fund expense ratios (as opposed to loads and 12b-1 fees)? The DOL has been careful to warn plan sponsors not to merely go to the lowest cost provider. Unfortunately, the Fortune article quotes Moody’s as saying, “disclosures would ‘put downward pressure on fees and may prompt retirement plan sponsors to opt for lower-cost investment products, including greater use of index funds.’” This is precisely what the DOL has warned against, since, as evidenced in the first decade of the new millennium, (see “Does the ‘Lost Decade’ Signal the End of Passive Investing? ” FiduciaryNews.com. January 5, 2010), “low-cost” index funds did not offer the investment return value of the “high-cost” actively managed funds.

Perhaps it’s best if we avoid chasing the wild goose of mutual fund expense ratios and focus instead on more productive pursuits.

As the ICI’s Abbey says, “The new disclosure rules do not change how mutual fund expense ratios are calculated. Instead, they require that non-mutual fund products provide the types of disclosures that mutual funds have always provided. In this respect, the primary benefit of the new disclosure rules will be to improve the uniformity of disclosures across the service and investment provider communities thereby making it easier for plan sponsors and investors to make comparisons – something that the mutual fund industry strongly supports.”

Any talk of mutual fund expense ratios only diverts attention away from the true issue at hand – what are the true costs of those non-mutual fund products that make up nearly half of all 401k investments? Answering this question and exposing the worst ought to win some investigative reporter a Pulitzer.

Interested in learning more about this and other important topics confronting 401k fiduciaries? Explore Mr. Carosa’s new book 401(k) Fiduciary Solutions and discover how to solve those hidden traps that often pop up in 401k plans.

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D96&r=G /%