401(K) Contribution Limits for 2013

Post on: 16 Март, 2015 No Comment

How much you can put in your 401(k) in 2013

Please refer to our privacy policy for contact information.

The amount you can contribute to a 401(k) increases in 2013.

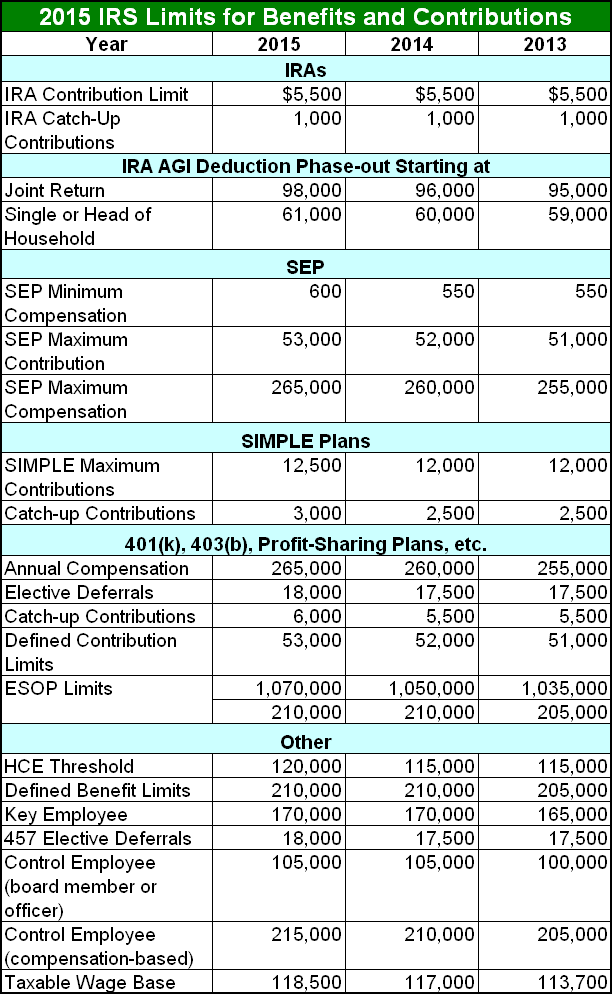

The contribution limit, or maximum amount you can contribute to tax-favored retirement plans each year, adjusts over time for inflation. In 2013, the contribution limit for 401(k)s is $17,500. This is up slightly from the 2012 contribution limit of $17,000. If you are age 50 or older, you may qualify for an additional contribution of $5,500, which remains unchanged from 2012. This is known as a catch-up contribution, and it’s the government’s way of encouraging people nearer to retirement to put a little extra savings aside. For those age 50 or older, the maximum amount you can contribute in 2013 is $23,000.

2013 Contribution Limits for Other Retirement Plans

The exact same limits apply to 403(b) and Section 457 plans, which are similar to 401(k) plans for those who work in nonprofits and in the public sector. The limits are also the same for a Roth 401(k), which is slightly different than a traditional 401(k). Contributions are made after-tax but the distributions at retirement are not subject to income tax.

It’s important to note that these are the limits set by the Internal Revenue Service. but the limits may be slightly lower in your employer’s plan. Catch-up contributions may not be offered by your employer’s plan at all. It’s a good idea to check on the specific limits allowed by your company’s 401 (k).

If you are self-employed and contribute to a self-employed retirement plan such as a SIMPLE IRA. SEP IRA or Individual or Solo 401(k). the contributions increase slightly in 2013 as well. The maximum contributions for SIMPLE IRAs is $12,000 in 2013, up from the 2012 limit of $11,500. Catch-up contributions for SIMPLE IRAs max out at $2,500.

An Individual 401(k) or Solo 401(k) works just like an employer-sponsored 401(k), but it’s for self-employed individuals. The maximum contributions for a Solo 401(k) in 2013 are the same as those for a traditional 401(k): $17,500, plus $5,500 in catch-up contributions if you are age 50 or older.

SEP IRAs are slightly different. You can contribute as much as 25% of your gross income, as long as you do not exceed the 2013 maximum of $51,000.

Why Make the Maximum Contribution in 2013?

How much should you save for retirement? If you can do it, maxing out your contributions each year is a great strategy for many reasons. First, the contributions are made pre-tax. Contributions to a 401(k) allow you to lower your taxable income, and more you can lower your taxable income. the less you pay when you file your income taxes. (This is why the IRS has contribution limits on these retirement plans, because they represent an amazing tax break.)

The other reason to max out your 401(k) contribution is, of course, that it will get you closer to a financially secure retirement. Especially during your peak earning years when you can afford to do so, you should set aside larger and larger portions of your income to build your nest egg.

If you can’t afford to max out your contribution, a good goal is to contribute 10% of your pre-tax income. But it that too seems lofty, you should aim to contribute up to the amount your employer will match—if your employer matches the contributions that you make. An employer match is kind of like a salary increase that’s deferred until retirement. Those employers who do it usually match between 3% to 6% of income. If you aren’t taking advantage of it, you could be missing out on a 6% raise and not even realize it.

For people who got a late start saving for retirement. contributing the maximum plus the catch-up contribution gives you a chance to catch-up while the tax breaks are still available. Consider banking raises, bonuses and any extra income you can afford.

If you have maxed out your 401(k) or self-employed IRA contribution and want to put aside even more, I’m impressed! Consider a Roth IRA or traditional IRA. Contribution limits for IRAs increased slightly in 2013, to $5,500. Individuals 50 or older can contribute up to $6,500 in 2013.

Disclaimer: The content on this site is provided for information and discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.