4 Things Every Investor Should Know (KOG MSFT WYNN)

Post on: 5 Июль, 2015 No Comment

There are a lot of nuances to investing, especially with new products popping up every year. Stocks, bonds, mutual funds, options, and ETFs are just a few of the options available to investors, but there are nuances that still escape many.

In the spirit of The Motley Fool’s mission to educate investors, I’ve outlined four things I have learned about investing in recent years that every investor should know.

Shorting pays — sometimes

Did you know that you can actually get paid to short stocks? When you short a stock, you borrow it from your broker (who is really borrowing it from another customer) and sell it on the market, leaving cash in your account. Hypothetically, this cash will earn you interest. So, if you bought and then sold a stock at the same price (for a $0 gain/loss) you would actually be left with less money than if you shorted and then bought back the same stock at the same price.

This is one of the advantages of shorting that few investors are aware of. The payout may not be high today, given the record-low interest rates, but shorting can potentially earn you some interest.

Here’s the rub, though: This advantage to shorting is available to the big players, but it may not be to you and me. Most brokerage houses won’t pay small retail investors on the cash from shorting, and with interest rates as low as they are, even the big guys don’t get much back. For two examples, I know that Scottrade does not pay interest (or charge to borrow stock), but if you have more than $100,000, Interactive Brokers will pay interest on short balances if rates allow it. Clearly that asset level isn’t in the cards for everyone, so check with your broker if this is something you want specific information about.

Leveraged ETFs head toward zero — eventually

ETFs have become a popular investing instrument for retail investors, but leveraged ETFs come with dangers for investors who don’t know how they work .

A leveraged ETF doesn’t follow the long-term performance of an underlying index; it is built to follow the daily performance of an underlying index. This means that when you do the math, the leveraged ETF will eventually deteriorate in value as long as the underlying index moves up and down over time.

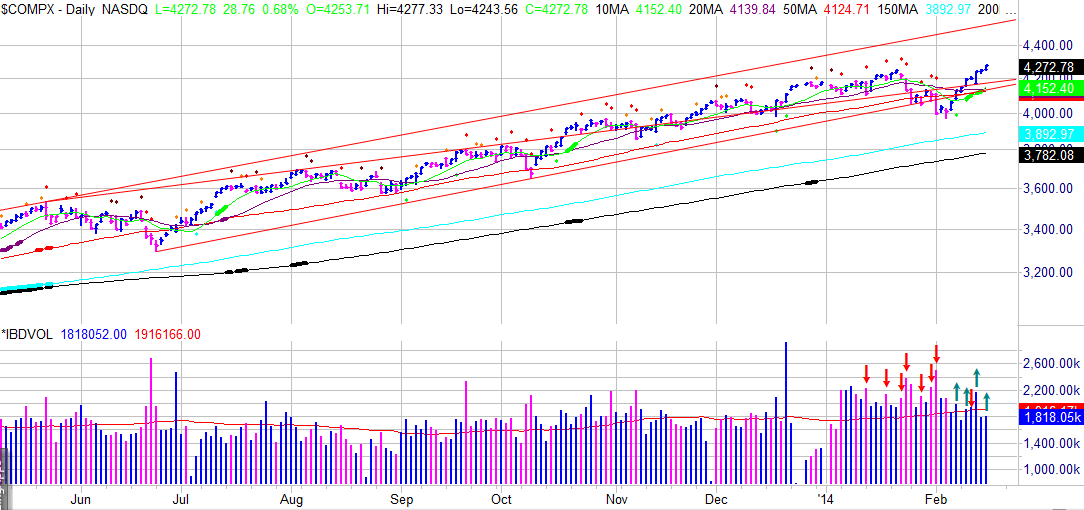

Don’t believe me? Take a look at the graph below of two reference indexes and two leveraged ETFs that provide leveraged returns of the referenced index. The first pair is the S&P 500 and ProShares Ultra S&P 500 ( NYSE: SSO ). which seeks a return that is 2x the return of an index or other benchmark (target) for a single day , according to the fund’s overview. The second pair is the Nasdaq 100 index and ProShares Ultra QQQ ( NYSE: QLD ). which seeks the same result.

Notice that the Nasdaq 100 rose over the last five years, while the S&P 500 fell, but both leveraged ETFs underperformed their indexes. This shows that whether an index is going up or down, the leveraged ETF will underperform over the long term due to the math behind following daily returns, which I explain in more detail here. Given enough time, as long as an index doesn’t head straight up or down forever, leveraged ETFs will head toward zero.

Special dividends are just that: special

At The Motley Fool, we love our dividend stocks. But some investors may not be aware that not all dividends are created equal. Regular dividends are given on a regular basis by a company and are generally expected to stay consistent by investors; these are the dividends we usually talk about. Special dividends, on the other hand, are one-time events that affect options and stock prices in ways you may not expect.

A special dividend comes with three very important dates for investors: the payment date, the date of record, and the ex-dividend date. For example, Microsoft ( Nasdaq: MSFT ) paid a $3-per-share special dividend on Dec. 2, 2004, but the date of record was actually Nov. 17. So the ex-dividend date, or the first day of trading that the stock trades without the dividend, was Nov. 15. Investors needed to own shares on Nov. 12 (a Friday) to get paid the dividend.

It is also interesting to note that Microsoft’s stock didn’t fall $3 when it traded ex-dividend, either.