4 Reasons Why a Roth IRA May be Better Than Your 401(k)

Post on: 16 Март, 2015 No Comment

Wise Bread Picks

Retirement planning is wrought with rules of thumb, asset allocation recommendations, compound return assumptions, pension and/or Social Security income calculations, inflationary expectations, and more. Getting to that perfect number is an effort in futility unless you can see into the future with perfect clarity. So, aside from planning conservatively and starting early, a key consideration within your control now is the determination on where you direct your retirement dollars early in your career for the best net benefit in retirement. (See also: The End of the 4% Rule? )

The conventional wisdom on retirement savings has traditionally been that you should always invest in your 401(k) plan at least up to the limit of the company match. After all, who would argue against a free 100% return or whatever the match amounts to? But what about when you surpass that amount, which might only be the first 4-5% of income investments, if at all?

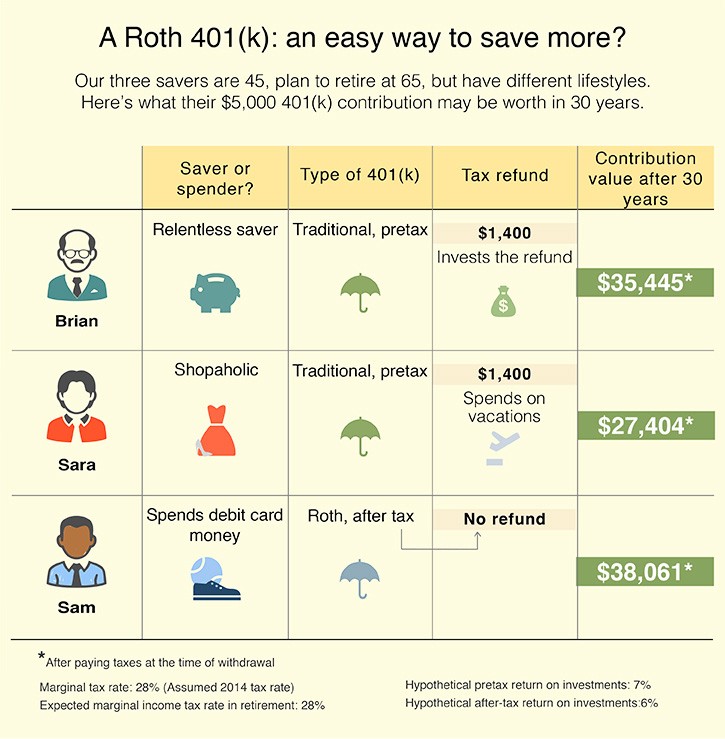

If your company matches funds up to say, 5% of your salary, but you could reasonably afford to invest another 10% of your income for retirement, would your money be better off topping off the same 401K(k) account or would you be better of investing the same funds in a Roth IRA account (noting the Roth IRA limit of $5,000 per person annually)? (See also: How to Make the Most of Your 401K)

Here are 4 reasons why those additional funds may well be better off in the Roth IRA.

Fees Matter!

With investors focused so much on stock market returns and volatility, the unsung hero of long-term investing is low fees. Even in the most aggressive conventional asset class, equities might reasonably be expected to return 9% per year including dividends. When you consider that inflation could reasonably average 3% or more over the ensuring decades, that’s a net 6% return in real dollars. Now, factor in a difference of 1% in a high fee versus low fee mutual fund and the difference in compound returns really adds up!

It’s now becoming common knowledge that company-sponsored 401(k) plans often offer sub-par mutual funds that are both high-fee and generally don’t even match their benchmarks. Contrast that with the ability to select a low-fee ETF or mutual fund in a self-directed IRA account and right off the bat, you’re looking at improved returns over a prolonged period of time. Personally, I have funds in my company plan with expense ratios in excess of 1% while Vanguard offers many mutual funds closer to 0.10%. Over the 30 years I have until retirement, that 1% difference can add up to six figures or more!

More Options

Aside from being presented with higher fee options, 401(k) plans often offer only a single choice in a given asset class. Your plan might have all actively managed mutual funds based on say, Large Cap US, Small Cap US, European Growth and a Bond Fund. What about if you want to diversify further into Emerging Markets, commodities or even various high yield investments which can flourish in a tax advantaged plan since income accrues untaxed? You are strictly limited in your 401(k) plan while you have thousands of investment options in a Roth IRA ranging from mutual funds to ETFs to stocks to bonds (see the risks/benefits of ETFs over other investments). You can even own gold in an IRA, not that I’m an advocate.

A friend of mine sells mutual funds for his firm to corporate clients for their 401(k) plans. He said what he hears over and over is basically a conservative mantra: We’re not looking to be superstars here. We need to avoid being sued. We aren’t going to offer our employees exotic or volatile funds. Companies aren’t in the business of providing you a lot of options. They’re trying to just keep up with the competition and offer a decent total benefits package which often includes a modest match and some funds to choose from. But probably not the range of funds you’d invest in if you had the choice like you do in a Roth IRA you set up yourself.

Tax Rates Are Likely to Rise

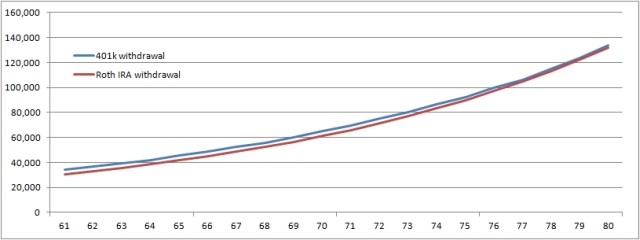

The tradeoff with a 401(k) versus a Roth IRA is that with the 401(k), while the amount you invest is deducted from your taxable income in the current year, you have to pay taxes on the withdrawn amount in the future. Conversely, with a Roth IRA, you invest now with after-tax funds, but regardless of tax rates in the future, those earnings can be withdrawn tax-free. So, it often comes down to an assumption about tax rates.

The conventional wisdom had always held that you’re probably in a higher tax rate today than you will be in retirement because you won’t be working the same full-time job and might only be collecting Social Security and some retirement income. However, this whole notion of tax rates needs to be reconsidered.

See, it is a mathematical certainty that the US can’t continue to meet its debt obligations without increasing taxes, especially on the upper-middle class and higher. Unless your income is very low on the spectrum (in which case, the ability to invest excess funds to this degree may be limited), there’s a decent chance that in the coming years, tax rates will begin to increase. After all, we’re in the midst of a temporary, controversial, negotiated Bush-era tax rate regime right now. But the political will and fiscal ability to make the current tax rates permanent just isn’t there.

Additionally, while my income may decrease in retirement, so will my deductions. I will no longer have a mortgage interest deduction and I won’t be getting state tax deductions for 529 Plan Investments. Therefore, if you assume that your effective tax rate in retirement may be higher, or even just roughly equivalent to your present tax rate, then the conventional wisdom no longer pushes the equation in favor of 401K(k) investing and the other considerations above should take precedent.

Flexibility for Emergencies

Not that you want drawdown of your principal as a retirement planning philosophy, but in the event of extreme need, one can withdraw the principal portion of IRA contributions without penalty, whereas in a 401(k), there’s a 10% penalty incurred plus the taxes of course, since they were deferred initially. There are some provisions of hardship associated with 401(k) plans, but the restrictions are rather onerous whereas the Roth IRA is flexible. This shouldn’t be an up-front expectation that you’ll be withdrawing funds prior to retirement, but it might be comforting to know that there’s added flexibility in that portion of your retirement assets, as opposed to having everything in the 401(K) which would be subject to penalties and taxes.

The reality is, nobody knows what’s going to happen 20 or 30 years from now. But the priorities of diversification, minimizing expenses, and optimizing your tax liabilities may well push you more in the direction of Roth IRA contributions over 401(k) contributions once you exceed a company match.

Note that 403(b) and other equivalent plans have similar attributes to the 401(k) and can be used interchangeably throughout.

Where do you invest extra retirement funds?