4 Quick Facts about Dividend Investing

Post on: 27 Апрель, 2015 No Comment

#1 You can either get a -2% yield holding Mutual Funds (i.e. fees) or hold dividend stocks that pay you

+3% a year

If you start investing through mutual funds, you will most likely start your investing journey at -2%. This is because you will have to pay roughly 2% in fees to a portfolio manager that will be trading for you.

On the other side, if you buy a 3% dividend yield stock, you start your investing journey at +3%. Receiving dividends in your investment portfolio will help you:

- Compensating for your trading fees.

- Growing your investment portflio.

However, holding 1 or 2 stocks only in your portfolio is not the best idea either. This will put you at high risk; what if one of your stock goes down? This is why investing in either a Dividend ETFs or a Dividend Mutual fund may be a good idea to start with. The dividend payout received within the dividend fund will most likely cover the management fees.

#2 Dividend yield + dividend growth = escalating yield + capital appreciation

This is the reasonning behind dividend investing in one line! In order to be successful, you should look at solid dividend payers. Here are the list of the best dividend paying stocks:

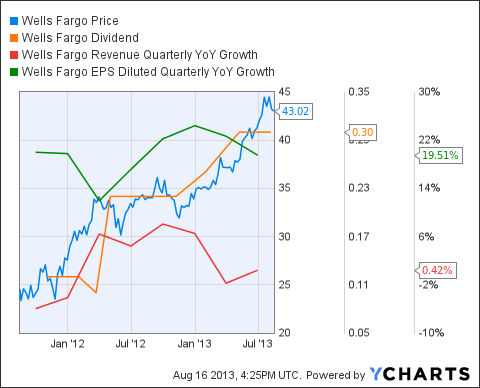

Companies increasing constantly their dividend will help you creating a solid passive income in the future. If you keep your dividend stocks over several years, you will not only benefit from high dividend payouts but also a high capital appreciation. Over time, solid dividend payers are rewarded by the market as their stock value grows.

There are some stocks keeping a dividend yield around 3% but constantly increasing their dividend payout. The dividend yield remain at 3% because more investors want to earn the dividend and buy shares. Therefore, the stock value goes up and keep the 3% dividend yield range.

#3 Dividend paying stocks have lower volatility than non-dividends

When you look at the overal yield, dividend paying stock will be affected by economic cycle. The reason being is that you always have a decent number of investors holding the stock for its dividend. Therefore, regardless if the stock value goes up or down, investor hold the stock as long as they beleive that the dividend will be maintain.

Also, the dividend payout will smoother any stock value plunge. For example, if you hold a stock that pays a 4% dividend yield and the stock value goes down by 10%, your overall return will be -6% as compared to another stock that is not paying dividend and drop in value by 10%.

#4 Dividends have contributed a significant proportion of the index returns

If you have read Dividend Investing Vs Stock Market Yield you know already that dividend payouts count for 58% of the overall stock market return. Therefore, it is a huge mistake to ignore dividend stocks in your portfolio.

As you can see, dividend investing has many advantaged as compared to regular investing. Dividend stocks investing is definitely a great strategy to build a solid investment portfolio.

This entry was posted on Thursday, April 7th, 2011 at 5:00 am and is filed under Dividend Investing. You can follow any responses to this entry through the RSS 2.0 feed. You can leave a response. or trackback from your own site.