4 Popular Mutual Fund Benchmarks Financial Web

Post on: 16 Март, 2015 No Comment

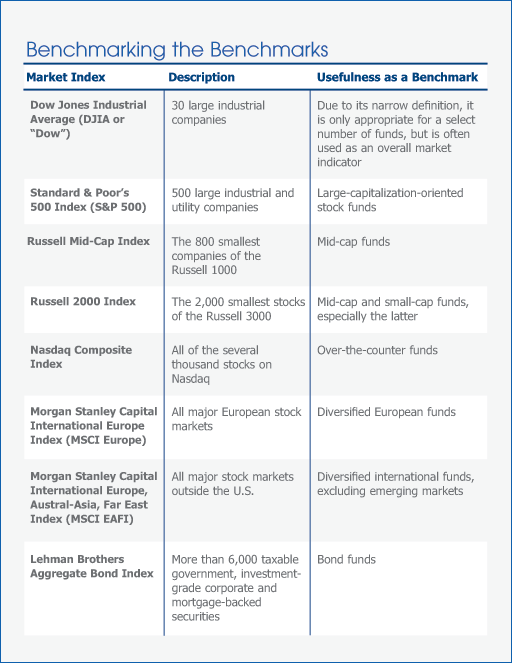

Looking at a mutual fund benchmark can provide you with information that lets you know whether your mutual fund is performing up to expectations. Every type of mutual fund should have a benchmark that you can use for comparison purposes. Here are some of the most popular mutual fund benchmarks in the market today.

Standard & Poor’s is one of the leading financial analysis companies in the world today. They created a financial index that is known as the S&P 500. The S&P 500 is one of the most widely known financial indices in the industry and is used in a variety of different contexts. The S&P 500 is made up of 500 of the largest companies in the stock market. These companies have market capitalizations that are considered to be very large. Because of this, the S&P 500 makes a great benchmark for any mutual fund that invests in large-cap stocks. If your mutual fund is not performing as well as the S&P 500, then you know that you should potentially consider investing in a different mutual fund.

Another one of the most popular mutual fund benchmarks is the Russell 2000. The Russell 2000 is a compilation of the bottom 2000 companies in the Russell 3000 index. The companies that make up the Russell 2000 are considered to be small-cap companies. Most of them have market capitalizations of less than $500 million. The largest company in the Russell 2000 has a market capitalization of approximately $1.4 billion. This financial index is commonly used to compare against mutual funds that specialize in small-cap stocks. Investing in small-cap stocks is popular because it provides investors with huge growth potential. This makes the Russell 2000 an index that many people pay attention to regularly.

The Lehman Brothers Aggregate Index is another benchmark that many investors like to use. This financial index is comprised of government bonds, mortgage-backed securities, corporate bonds and asset-backed securities. This means that if you are an investor in a bond fund, you might want to compare the performance of your fund to this index. It will give you an idea of how your mutual fund is performing when compared to an aggregate of many different types of bonds in the market today.

The MSCI EAFE index is another commonly used financial index that many people utilize for a mutual fund benchmark. This financial index is comprised of many of the most popular international stocks in the world. If you are an investor in any of the international stock mutual funds out there, this is going to be one of the best mutual fund benchmarks that you could potentially use. Sometimes it can be difficult to find very many choices when it comes to comparing the performance of international stock investments. However, this index traditionally does a good job of that.