4 Key Points About Liquid Alternatives

Post on: 30 Март, 2015 No Comment

2. Not All Liquid Alternatives Are Created Equally

One of the more frequent criticisms of liquid alternatives is that the best strategies are not offered as a mutual fund, and the best managers are still only found through traditional alternative investments. There might be some truth to this, as the compensation structure for managers within a traditional partnership structure is potentially more lucrative than in a 40 Act structure, but that is quickly changing.

To learn more about this democratization, be sure to read A Brief History of Mutual Funds .

The world’s best and biggest asset management firms are quickly establishing mutual funds to provide all investors with access to their best ideas. In addition, even if a handful of the best managers aren’t moving into liquid alternatives, many great ones are. The primary concern for investors should be finding the right manager and fund. In this respect, the process should be no different than finding a good growth manager in the traditional mutual fund universe. Evaluating the track record of the fund is a good start, but investors also need to consider the strength of the investment process, the experience of the portfolio manager and the fund company, as well as fees and expenses. Fortunately, all of this information is readily available.

Investors also need to understand that some strategies will work better than others when liquidity and transparency are increased. Complex strategies that involve illiquid securities or long holding periods to achieve results are not well suited for a liquid alternative offering, nor are strategies that use a lot of leverage, as leverage use is restricted under the rules of the 40 Act. Many strategies found in long/short equity or market neutral categories do not depend on esoteric formulas, leverage, or trading in illiquid securities to deliver returns, and are therefore well suited for a mutual fund offering.

Be sure to learn more about the history of the Investment Company Act of 1940 .

3. Track Record Matters

Many advisors and investors who have yet to embrace liquid alternatives are concerned about the relatively short track records of these funds, as most offerings have a track record of less than 5 years. The rise in popularity of liquid alternatives has taken place within the context of one of the strongest bull markets of all time, which (as we all know) followed the greatest financial crisis in recent memory.

Given the short public record of many of these funds, it is therefore hard to analyze how they might perform in changing market conditions. However, investors can look at the track records of the managers in charge of these strategies to see how their predecessor funds, or other similar offerings, were managed and how they performed prior to and during the crisis of 2008-2009. While these funds may not have been around as a 40 act structure, if they previously existed as a partnership and can provide audited financials, investors may be able to make more informed decisions.

4. Understanding Your Own Risk Tolerance Is Still the Most Important Factor

As is the case with any investment, the conversation needs to start with the goals of the investor, and how a portfolio can be structured to meet those goals. Liquid alternatives are an exciting new option for many investors to consider, but they are just a tool to help achieve a desired result. There is nothing magical about them, and their risks must be carefully considered.

Daily valuation, transparent pricing, and enhanced liquidity make liquid alternatives potentially more attractive than traditional alternatives owned through more restrictive partnership structures. There is always an emotional component to investing, as people are highly sensitive to loss aversion. When properly used, the right liquid alternatives can be used to help reduce overall portfolio risk while maintaining exposure to the markets, and should therefore be considered as part of any diversified portfolio.

About RiverPark Structural Alpha Fund

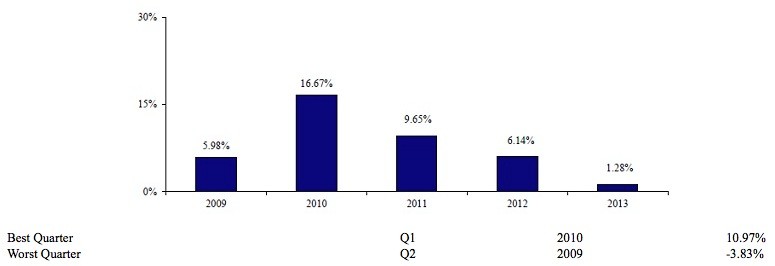

Justin Frankel co-manages the RiverPark Structural Alpha Fund with Jeremy Berman. Prior to joining RiverPark, Justin and Jeremy managed the same strategy as a hedge fund since 2008, and that predecessor fund was converted into a mutual fund in June of 2013.

The RiverPark family of funds consists of seven funds across a variety of equity and fixed income offerings, with a combined $3.6 billion in assets under management. The RiverPark Structural Alpha Fund is a Market Neutral strategy. and is one of three liquid alternative strategies offered by the firm.