3 Reasons Why You Should Invest In REITs

Post on: 5 Июнь, 2015 No Comment

A Real Estate Investment Trust (REIT) is a trust specifically set-up to invest in real estate. REITs invest their capital in existing real estate projects like shopping malls, industry buildings or commercial buildings and they also buy into or finance upcoming real estate projects.

These real estate assets are then leased out or put to rent, thereby generating income for the REIT. REITs were first setup in the 1960s to reduce the incidence of taxation on real estate investments.

Since then, they have become immensely popular with investors all over the world and right now, there are 22 REITs in Singapore. Most REITs are publicly traded on global stock markets like other stocks and mutual funds while a few are unlisted and privately held.

Taking into consideration the widespread popularity enjoyed by the REITs as an asset class, governments across the world have come up with some very REIT-friendly tax laws and legislation. As a result, most REITs today have to pay no income-tax. Instead, they must pass on at least 90% of their income to their investors in the form of cash dividends. This is the reason why if you know how to invest in REITs appropriately, it can be a fantastic form of passive income for you!

Additionally, REITs are structured to mimic equity mutual funds and holding companies, giving small and mid-sized investors a chance to participate in large real-estate projects in a safe and methodical manner.

Today, we shall discuss 3 compelling reasons that make REITs a must-have for every serious long term investor.

1. Great way to diversify your portfolio

While it is first important to invest only within your circle of competence, investing in REITs can also be a fantastic way to diversify your portfolio. This is because REITs solely invest in real estate and make money from leases and other forms of rental income. Such income has a very low co-relation with economic cycles as compared to other industries. Thus, investing in REITs is a fantastic way to diversify your investment portfolio and build a source of regular dividend income.

2. A combination of fixed income and capital appreciation

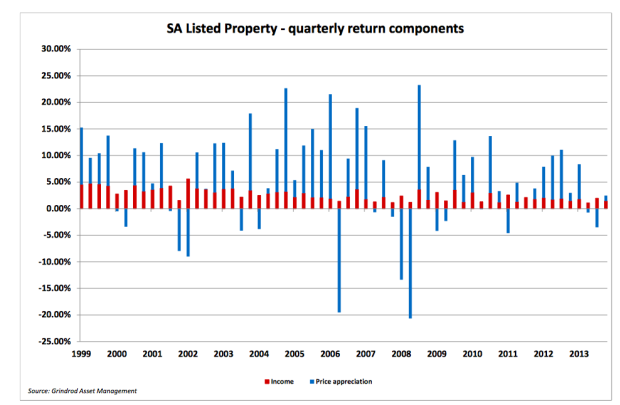

While there are companies which offer high dividend yield (ie. slow growers, stalwarts), there are also some companies where their share prices grow quickly (ie. fast growers). REITs, however, provide a middle path; the income earned from rent and leasing out of real estate assets is passed on to investors through dividends and any increase in the value of a REIT’s real estate investment portfolio leads to an appreciation in the market value of the REIT.

For example, several Millionaire Investor Program graduates bought Suntec REIT at $0.50 during the sub-prime crisis. The current share price of it as the time of writing right now is $1.51. That is more than 200% of increase in capital appreciation, and not even including their dividends!

3. A very convenient way of investing in real estate

Real estate has historically been one of the most popular asset classes in existence. Unfortunately, many large scale real estate projects like shopping malls like Plaza Singapura, CentrePoint, or even Suntec City and other big-ticket commercial projects are beyond the reach of the average investor.

Additionally, real estate assets are extremely illiquid and cannot be bought or sold instantly. Real estate investments also come with a number of additional hassles like property taxes, property maintenance, rent recovery etc. These problems spook small and mid-sized investors and they tend to stay away from real estate assets.

REITs offer a real estate investment option that is largely free of the above-mentioned problems. REITs are generally listed on stock exchanges and are traded like stocks.

Therefore, small investors can invest in REITs according to their individual financial status and risk profile; this gives small investors the option of participating in large real estate projects without investing a large amount of money. Also, since REITs are openly traded on stock exchanges, investors can buy and sell REITs whenever they want, thereby solving the problem of liquidity associated with real estate investments.

To add to this, all REITs have a professional management team which takes care of all the paperwork and other requirements (taxes, maintenance, collecting rent, dealing with defaults and litigation etc.) that are usually linked to real estate investments. Thus, REIT investors get all the benefits of investing in real estate without ever having to deal with any of the problems. This makes REITs the best and most convenient way of investing in real estate.

The above-mentioned reasons explain why REITs should be a part of your investment portfolio. At the same time, it is prudent to do your homework properly and carefully select fast growing and well managed REITs that will add value to your investment portfolio.