12B1 Fees are Included in the Expense Ratio

Post on: 28 Март, 2015 No Comment

As a career accountant I understand that a business must cover it’s distribution and marketing expenses as well as its operating costs in order to be profitable. But, for me, the 12b-1 fee, named for the SEC rule that authorized it, is a ruse. This non-transparent fee paid by fund investors (a recurring deduction from total fund assets) is used to first, pay a commission to the brokers selling mutual fund shares (and thereafter, as compensation for servicing these existing accounts). Plus, the 12b-1 fee finances the fund’s marketing and advertising expenses.

A 12b-1 fee means that current fund shareholders are paying expenses intended to boost sales. Fund companies initially promoted the idea of 12b-1 fees as a net operating expense decrease since more shareholders and more shares outstanding means (semi-) fixed operational expenses are spread across more shares and more shareholders. There is no proof that this is the end result.

Others, more cynical, speculate that the investment firm motivation for 12b-1 fees was to replace the direct and transparent front-end load — a more direct approach, but unpopular due to an immediate reduction in investment value. Now, funds with a 12b-1 fee offset their distribution and sales expenses — indefinitely — as long as you hold the investment.

Boosting sales means a bigger fund. But, is bigger better for the mutual fund investor?

- When a fund manager buys a large position in one stock, the market price can be driven up, which hurts investor return. And selling a large position can drive down a stock’s market price down. Large funds have to buy or sell their large positions -over time- in order to avoid volume impact. And, that fact also means a fund manager can’t dump a bad pick quickly!

- Larger fund size may mean a fund outgrows its investment strategy. With more investors and more cash to invest a fund manager may feel compelled to look beyond optimal investments. Actively managed funds may end up merely mirroring their benchmarks because fund managers run out of good places to put fund cash. Also, many funds restrict their holdings to less than 5% of a single company’s outstanding stock. If a fund invests in a small-cap stock, the impact of the relatively small investment will have a small impact on the fund’s overall performance. Conversely, there are simply a limited number of large-cap stocks those where a stock price spike (for a 5% ownership position) will in turn spike total fund returns. Note: There are diverse opinions about when a fund has become too large. But who can disagree that when a fund manager is unable to maintain the funds investment strategy plus generate returns consistent with it’s historical record, a fund has become too large?

- If there is a question as to whether or not larger fund size benefits investors, there is no question as to the benefit to fund managers—who are paid a defined percentage of fund assets.

In 2010 mutual fund investors paid about $9.5B in 12b-1 fees often 0.25% of net fund assets, but sometimes as much as 1%, the maximum allowed an expense that directly reduces fund returns.

- If you use a discount-brokerage “fund supermarkets” without any transaction fees the mutual fund pays the “fund supermarket” a percentage, and in turn offsets that payment by charging shareholders a 12b-1 fee.

- If you use a full-service brokerage firm, the fund uses the 12b-1 fee to make payments to the brokerage firm and its advisors—which may be in addition to a front-end sales charge the amount deducted from the total available to purchase fund shares. The sales charge load is the commission paid to compensate the selling broker.

- In cases where a back-end load or deferred sales charge is levied, some funds use a “contingent deferred sales load” calculation. The load percentage to be assessed declines (generally) to zero over a schedule of years’ held. However, a fund or class of stock within a fund with a contingent deferred sales load usually also has a 12b-1 fee.

- In some 401(k) plans where a brokerage firm is not involved 12b-1 fees are used to cover the plans’ administrative costs.

Once again the SEC is considering legislation that would change how 12b-1 fees are used and disclosed by fund companies, including potentially limiting these fees on certain mutual fund share classes and requiring greater transparency with respect to how fund companies spend the money generated by these fees. Unlike actively managed mutual funds, few index funds or exchange-traded-funds have adopted 12b-1 fees, but many through their BOD resolutions have reserved the right to do so in the future.

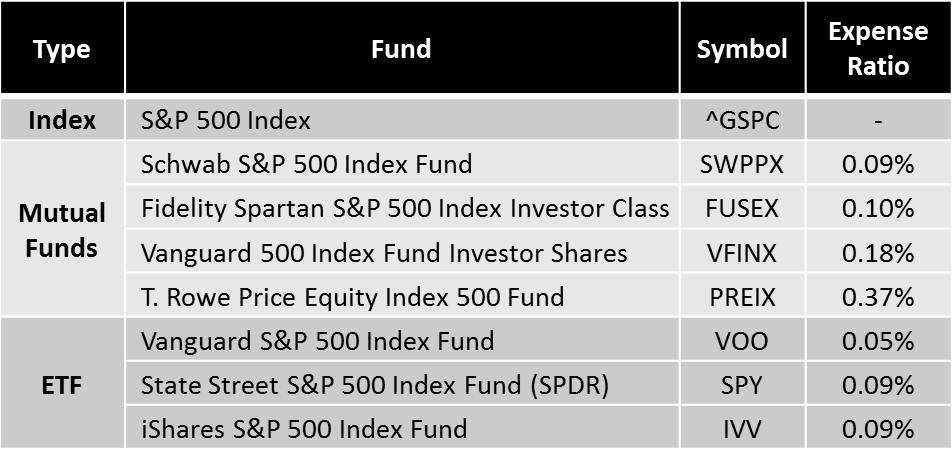

As a savvy investor you know that expense ratios matter. And 12b-1 fees are included in the expense ratio. A fund with high costs must perform better than a low-cost fund to generate the same revenue for you. Even a small difference in fees can translate into a large difference in returns over time.