12 Things You Need To Know About Financial Statements

Post on: 5 Сентябрь, 2015 No Comment

Knowing how to work with the numbers in a company’s financial statements is an essential skill for stock investors. The meaningful interpretation and analysis of balance sheets. income statements and cash flow statements to discern a company’s investment qualities is the basis for smart investment choices. However, the diversity of financial reporting requires that we first become familiar with certain general financial statement characteristics before focusing on individual corporate financials. In this article, we’ll show you what the financial statements have to offer and how to use them to your advantage.

1. Financial Statements Are Scorecards

There are millions of individual investors worldwide, and while a large percentage of these investors have chosen mutual funds as the vehicle of choice for their investing activities, a very large percentage of individual investors are also investing directly in stocks. Prudent investing practices dictate that we seek out quality companies with strong balance sheets, solid earnings and positive cash flows .

Whether you’re a do-it-yourself or rely on guidance from an investment professional, learning certain fundamental financial statement analysis skills can be very useful — it’s certainly not just for the experts. Over 30 years ago, businessman Robert Follet wrote a book entitled How To Keep Score In Business (1987). His principal point was that in business you keep score with dollars, and the scorecard is a financial statement. He recognized that a lot of people don’t understand keeping score in business. They get mixed up about profits. assets. cash flow and return on investment .

The same thing could be said today about a large portion of the investing public, especially when it comes to identifying investment values in financial statements. But don’t let this intimidate you; it can be done. As Michael C. Thomsett says in Mastering Fundamental Analysis (1998):

That there is no secret is the biggest secret of Wall Street — and of any specialized industry. Very little in the financial world is so complex that you cannot grasp it. The fundamentals — as their name implies — are basic and relatively uncomplicated. The only factor complicating financial information is jargon, overly complex statistical analysis and complex formulas that don’t convey information any better than straight talk. (For more information, see Introduction To Fundamental Analysis and What Are Fundamentals? )

What follows is a brief discussion of 12 common financial statement characteristics to keep in mind before you start your analytical journey.

2. What Financial Statements to Use

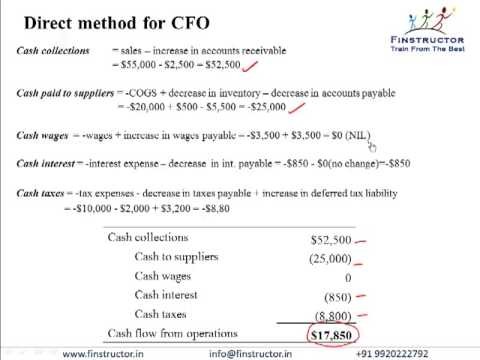

For investment analysis purposes, the financial statements that are used are the balance sheet, the income statement and the cash flow statement. The statements of shareholders’ equity and retained earnings. which are seldom presented, contain nice-to-know, but not critical, information, and are not used by financial analysts. A word of caution: there are those in the general investing public who tend to focus on just the income statement and the balance sheet, thereby relegating cash flow considerations to somewhat of a secondary status. That’s a mistake; for now, simply make a permanent mental note that the cash flow statement contains critically important analytical data. (To learn more, check out Reading The Balance Sheet , Understanding The Income Statement and The Essentials Of Cash Flow .)

3. Knowing What’s Behind the Numbers

The numbers in a company’s financials reflect real world events. These numbers and the financial ratios/indicators that are derived from them for investment analysis are easier to understand if you can visualize the underlying realities of this essentially quantitative information. For example, before you start crunching numbers, have an understanding of what the company does, its products and/or services, and the industry in which it operates.

4. The Diversity of Financial Reporting

5. The Challenge of Understanding Financial Jargon

6. Accounting Is an Art, Not a Science

7. Two Key Accounting Conventions

8. Non-Financial Statement Information