10 Questions the DOL Wants 401k Plan Sponsors to Ask Their Investment Consultant

Post on: 8 Май, 2015 No Comment

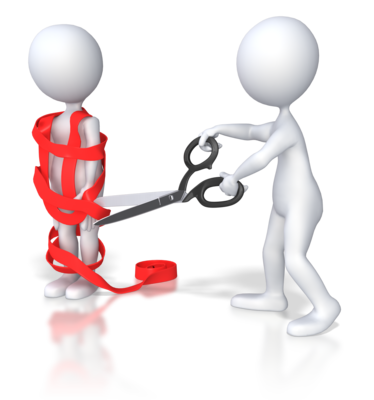

A re too many 401k investment consultants shrouding their true face? The Department of Labor (DOL) offers many tools to 401k Plan Sponsors. Their Fact Sheet “Selecting And Monitoring Pension Consultants Tips For Plan Fiduciaries ” appears to be very useful for the typical plan fiduciary. Unfortunately it appears to have a little problem. According to its opening paragraph, the material is based on a May 2005 report published by the Securities and Exchange Commission (SEC). This SEC report uncovered a major concern every 401k plan sponsor must address when it concluded: “the business alliances among pension consultants and money managers can give rise to serious potential conflicts of interest under the Advisers Act that need to be monitored and disclosed to plan fiduciaries.”

As a result of this SEC revelation, the DOL put together a list of 10 questions to help the plan fiduciary determine if a conflict-of-interest may exist. We’ll review these questions here and add any additional update that might have changed the nature and importance in the six-and-a-half years since the DOL first published them.

Are you registered with the SEC or a state securities regulator as an investment adviser? If so, have you provided me with all the disclosures required under those laws (including Part II of Form ADV)?

This is now a moving target, this has changed dramatically in the last year alone. While you can go to the SEC site to find disclosures about Registered Investment Advisers (RIAs), those permitted to register with the SEC have been reduced. Currently, investment advisers with 50 million in assets can register with the SEC, but next year that asset threshold increases to 100 million. All those beneath that target will have to register at the state level. On the up side, today, you can look up both Part I and Part 2 of ADV on the SEC site.

Do you or a related company have relationships with money managers that you recommend, consider for recommendation, or otherwise mention to the plan? If so, describe those relationships.

This is the key question and it gets more problematic starting next year with mandated fee disclosures. A plan sponsor will have to know, understand and potentially share this fee data with participants. Some bundled providers do not willingly share this information without being asked.

Do you or a related company receive any payments from money managers you recommend, consider for recommendation, or otherwise mention to the plan for our consideration? If so, what is the extent of these payments in relation to your other income (revenue)?

This question defines conflict-of-interests. While it’s not clear what impact the DOL’s new fiduciary rule (expecting in the first quarter of 2012) will have on the current exemption of certain conflicts-of-interest, we do know the new Advice Rule seeks to eliminate this specific conflict of interest. Let’s repeat this since it’s potentially confusing: Right now, plan consultants are allowed to engage in certain conflicts-of-interest while participant advisers cannot.

Do you have any policies or procedures to address conflicts of interest or to prevent these payments or relationships from being a factor when you provide advice to your clients?

This is a disclosure question. 401k plan sponsors will need to first answer this question themselves: is it appropriate to allow a conflict-of-interest just because a vendor admits to having one?

If you allow plans to pay your consulting fees using the plan’s brokerage commissions, do you monitor the amount of commissions paid and alert plans when consulting fees have been paid in full? If not, how can a plan make sure it does not over-pay its consulting fees?

This question has faded to near-irrelevancy as soft-dollar commissions have been rigorously regulated (if not eliminated) over the past several years. In addition, these hidden fees will be exposed with the new fee disclosure mandate.

If you allow plans to pay your consulting fees using the plan’s brokerage commissions, what steps do you take to ensure that the plan receives best execution for its securities trades?

Again, this question comes from an era with 401k plans where managed like traditional profit sharing and pension plans and in an era when soft dollars were considered an acceptable business practice. Today, most 401k plans use mutual funds, obviating the need to ask this question.

Do you have any arrangements with broker-dealers under which you or a related company will benefit if money managers place trades for their clients with such broker-dealers?

Although SEC regulations make it more difficult for mutual funds to engage in soft dollar practices, some funds may still employ this archaic method. It therefore makes sense to ask this question. By the way, this is a standard question the SEC poses to an investment adviser during an SEC audit. The SEC expects the adviser to always say brokers are chose for best execution (see the above question).

If you are hired, will you acknowledge in writing that you have a fiduciary obligation as an investment adviser to the plan while providing the consulting services we are seeking?

Don’t ask, demand. While the DOL still permits a fiduciary to engage in certain prohibited transactions, if it ever changes its tune, the 401k plan sponsor will want to have the investment adviser follow suit.

Do you consider yourself a fiduciary under ERISA with respect to the recommendations you provide the plan?

Again, the answer should be “yes.” Otherwise, move on to the next candidate. Why is this question so critical? As stated above, a fiduciary has a higher standard – a duty to the client – that currently requires, at a bare minimum, at least disclosure of any conflicts of interest.

What percentage of your plan clients utilize money managers, investment funds, brokerage services or other service providers from whom you receive fees?

In the end, the consultant can answer all the right answers above, but if most of their revenues derive from non-fiduciary products, that might tell the 401k plan sponsor much more than any other answer.

As with any other resource on the internet, it’s important to identify who wrote it and when they published it. Sometimes stale information can be just as useless as no information at all.