10 Best mutual funds where I am investing in 2014

Post on: 29 Май, 2015 No Comment

10 Best mutual funds where I am investing in 2014

Some of the readers have been asking in which mutual funds do I invest. Some of the regular readers sent a request to me to publish my mutual funds portfolio. While I am investing in best mutual funds, I keep testing to invest in emerging funds that has potential to grow money and to know how they are behaving which would help me to provide analysis on this blog. In this article, I would provide my mutual fund portfolio and indicate whether one can follow this portfolio or not?

Reasons why readers are interested to know my mutual funds portfolio

- Some of the readers have been sending emails and commenting on this blog as they would like to know my portfolio and follow me.

- Some readers indicate that they have read several such analyses and still fear of investing or not trusting people who are recommending such funds. To gain more confidence, they want me to publish this portfolio.

- Looks some readers doubt about my mutual fund portfolio, whether I am really making money or not

How do I invest in mutual funds?

Before I jump into MF portfolio, I would like to tell you that I invest only through SIP. Whenever I have surplus money in a month, I would first invest in a bank FD or liquid mutual funds before I buy any mutual fund units. Hence, in this list, you would not see any liquid funds which I have invested.

What type of investor I am?

I am a medium risk investor. Sometimes, I want to tend to be high risk investor. So I keep trying to invest even in high risk mutual funds to some extent of my portfolio.

10 Best mutual funds where I am investing in 2014

I believe in Top-10, hence some of my article titles resembles it. While I fine-tune my portfolio once in 3 months to check whether my decision is wrong, I have been sticking to this portfolio for some time. Also, I have made profit booking 2 years back due to personal exigencies and started investing again.

1) Large cap and diversified funds: ICICI Pru Focussed found, Birla SL Frontline equity, Franklin India Blue Chip Fund, Birla India Gen Next, UTI Opportunities are some of the top funds in this category. While large cap funds like ICICI Focussed or Birla SL Frontline provides stability to my portfolio, Birla India Gen Next and UTI Opportunities is where I felt would explore new growth opportunities and enhance my investment. These are good for medium risk investors.

2) Mid-cap/Smap-cap segment: I have invested only in HDFC Mid-cap opportunities fund. Since this segment is a high risk investment, one should be little cautious before investing. Due to stock market reaching peak, several mutual fund schemes under this segment show 40% returns in last 1 year, however these could easily vanish during the market crash.

3) Hybrid funds / Balanced Funds: I invested in HDFC balanced and HDFC Prudence mutual funds. These are good for medium risk investors as they invest 65% in equity and balance in debt related instruments.

4) Sector based funds: I invested only in Reliance Pharma MF and this sector is high risk. One has to carefully watch this segment and exit appropriately. We should not forget Infra sector and FMCG sector where they provided better returns and we could see a downturn in the last few years.

What I planned, but could not invest?

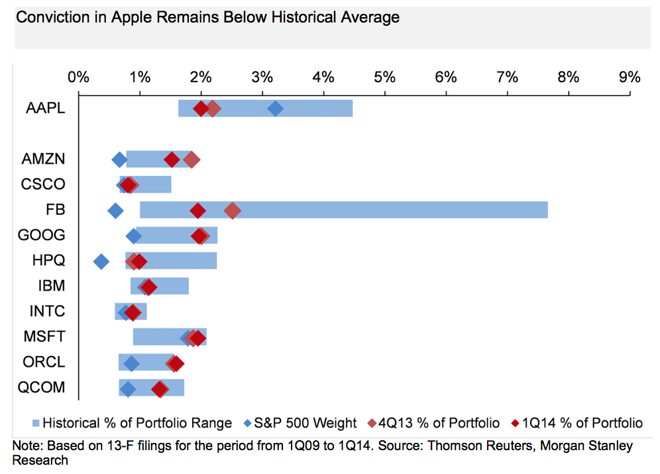

I wanted to invest in global / international mutual funds and waiting for the opportunity to begin with. The US market is dried up. I would like to explore opportunities in Europe and Asia funds now. Beyond this there are several best mutual funds across mutual fund categories, I would be investing them in next 3-6 months. Yes my list would go beyond 10, but, I am ready to track them on regular basis.

Should you blindly follow my 10 best mutual fund portfolio?

My straight answer is NO. Please read this points and then take the decision.

- It would depend on your risk appetite. If you are medium to high risk investor, you can follow this portfolio. However, you should know when to exit for funds such as Pharma funds.

- You should invest in these funds through SIP. Any lump sum investments in these funds can screw your mutual fund returns. In case you have any lump sum funds, invest them in liquid or ultra short term funds and use switch to invest through SIP

- If you want tax exemptions u/s 80C, you need to look for good ELSS mutual funds to invest. Since my 80C is already exhausted, I am not investing in such ELSS funds.

- If you are first time investor, you can invest in Rajiv Gandhi Equity Saving Scheme mutual funds (RGESS funds) where you would get special tax exemptions.

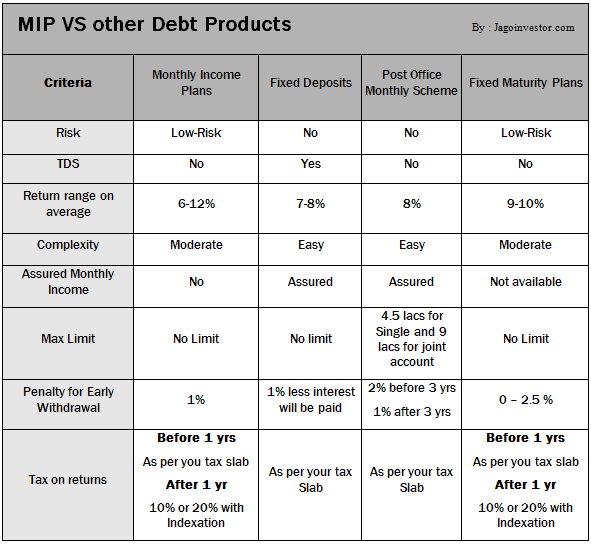

- If you are looking for regular income, you can try monthly income plan mutual funds. I am looking only for growing my money and not for regular income, hence I do not invest in them.

Conclusion : My mutual fund portfolio provides idea on how a medium to high risk investor can invest. It does not mean that there are no good funds outside this portfolio. You should invest in mutual funds based on your risk appetite, requirement and period of investment.

Readers, what do you say about my mutual fund portfolio?

If you enjoyed this article, share it with your friends and colleagues on Facebook and Twitter.

Suresh

10 Best mutual funds where I am investing in 2014