Yield Curve

Post on: 7 Июль, 2015 No Comment

Yield Curve

The Treasury Yield Curve is the global benchmark for U.S. interest rates. Many U.S. dollar denominated capital markets securities and assets are quoted or priced off this curve.

The curve is typically depicted as a graph with yields along the Y-axis and Maturities along the X-axis. The specific Treasury securities used to construct the Yield Curve are the most recently auctioned 3, 6 and 12 month Bills, 2, 3, 5, 7 and 10 year Notes, and the 30 year Bond.

U.S. Treasury Yield Curve (August 26, 2011)

Benchmark Status

These nine Treasury securities on the Yield Curve are the most actively traded among the approximately 200 Treasuries securities outstanding. They are also called the “benchmarks, actives, current issues or on-the-runs.” These benchmarks account for over 80% of the hundreds of billions traded every day in the U.S. Treasury market.

Because of the enormous amount of trading activity, the prices and yields of these benchmark Treasuries are watched and followed by hundreds of thousands of market participants. They are widely distributed in real-time by market data vendors such as Bloomberg, Thomson Reuters, TradeWeb and Gmarkets, by brokers and dealers on their websites, and by a number of financial news and websites.

Yield versus Maturity

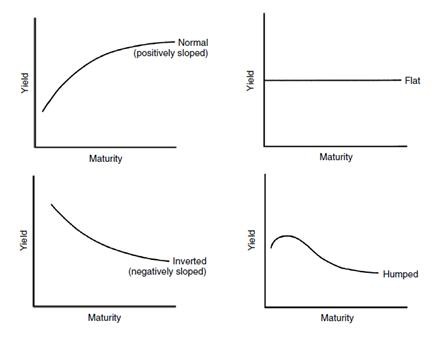

Notice that Yields tend to be higher for Treasuries with longer maturities. This is called the Normal Yield Curve. The main reason why Yields for longer maturities are higher is because they have higher interest rate risk. That is for the same change in interest rate, the price of the longer maturity security on the Yield Curve will change more (see article on Price and Yield Calculations ). Investors will demand higher yields for assuming additional risk; which explains the increasing yields across maturities for a Normal Yield Curve.

Treasury Yields

The U.S. Treasury Yield curve is used by many fixed income professionals as the reference rate for other interest rate sensitive securities. Since Treasuries are backed by the full faith and credit of the United States, they are considered to have the highest credit worthiness, and therefore the lowest risk. Many market participants and economists consider Treasuries to be “risk free” and often times use Treasuries as the “risk free rate” in their analysis and models.

Treasuries typically have the lowest yields because investors are willing to pay a premium for credit quality and liquidity. Consequently, investors demand higher yields from all other fixed income securities to compensate them for the additional credit default risk.

Spread to Treasuries

Treasuries are used as the baseline reference rate among other fixed income securities.

As an example, Corporate bonds typically trade at a higher yield than comparable Treasuries. Corporations are perceived by investors to be less credit worthy than the government of the United States, and therefore must offer higher yields to attract investors.

Even among corporate bonds, there is a pecking order to credit worthiness. Ratings agencies (Moody’s, S&P and Fitch) assign ratings based on their analysis of the company, financials and the specific terms and conditions of the underlying debt security. Lower rated companies and bonds trade at higher yields. And conversely, higher rated companies trade at lower yields, but still higher than comparable Treasuries.

Corporate bonds are frequently quoted as a Spread to Treasuries. That is, they are not quoted as a price, but rather as a yield spread (in basis points) to a comparable Treasury. For example, a 10 year, AA rated, corporate bond may trade 75 basis points over the 10 year Treasury. Using the Yield Curve from above, we see that the current 10 Year Treasury Note is trading at a Yield of 2.19 percent. So the corporate bond is being negotiated by the two counter-parties at a price that is 75 basis points or 0.75% above the 10Y Treasury Yield, or 2.94% (2.19% + 0.75%).

Frequently, market participants will negotiate only the spread. And once it is agreed, they will both look up the Treasury yield at the point of the trade (which is readily available on their market data screens) to calculate the final agreed Yield and Price.

More on Spreads

Many capital markets securities trade as spreads to Treasuries. Among them are money market instruments, mortgage-backed securities (MBS), federal agency bonds, Eurodollar bonds, interest rate swaps, structured products and many others.

Another reason why spreads have evolved to be so popular is that there is always a price and yield on these benchmark Treasuries because they are so actively traded and widely observed. As the capital markets evolved, it was just easier to use Treasuries as the benchmark reference rate.

As an analogy, the spot gold price is well known and actively traded. So your local jeweler prices his inventory based on a spread or relationship to spot gold. Rather than price each individual item in inventory every time the gold price changes, they just put on the tag (using their own secret coding system) its relative value to the observable gold price. For example, 25 on the tag may mean that he should charge 2.5 times the price of spot gold. So as gold goes up or down, he doesn’t have to adjust prices for his entire inventory; he just looks at the tag to see how much he should charge based on the current price of gold.

Using spreads to the Treasury Yield Curve has been widely adopted by market participants across the capital markets. This has been particularly useful for less liquid instruments that trade much less frequently than Treasuries.

Steepening Yield Curve

As discussed before, most of the time, the Yield Curve is upward sloping; that is shorter maturities have lower yields than longer ones. When short-term yields get much lower than long term yields, the Yield Curve is said to be steepening.

This phenomenon frequently happens during times of crisis, where there is a flight to safety. During turbulent markets, many investors begin selling other assets and investing them into the safe U.S. Treasury markets, especially in Treasury Bills – a proxy for cash. As demand increases for T-Bills, prices go up, which drive yields down. In fact, during August of 2011 debt ceiling crisis, the 3 month Bill was trading at a “zero” Yield as seen in the Yield Curve graph above. This flight to safety drives short-term interest rates typically lower than the longer maturity Treasuries, thus steepening the Yield Curve.

Flattening Yield Curve

When the markets expect interest rates to go down, many investors want to lock-in the higher rates for a longer term. This demand for the longer maturity Treasuries drives up prices and lowers yields on the longer end of the Yield Curve. Also, during these times, investors will sell their shorter term investments to invest longer; thus driving down prices and increasing yields on the shorter-end of the Yield Curve. This demand to sell the short-end of the curve and to buy the long-end of curve tends to flatten the Yield Curve from the Normal curve.

Inverted Yield Curve

Occasionally, especially during times when investors think long-term rates will drop precipitously, they will shift the demand and supply curve for Treasuries from the short to long end so dramatically that the Yield Curve is inverted. That is, short-term yields are higher than long-term yields. Long-term investors are willing to earn much less yield and lock-in the higher rates because they expect rates to drop. Many market participants see an Inverted Yield Curve as a leading indicator of a recession because the markets are anticipating a worsening investment climate.

Parallel Shift in the Yield Curve

Oftentimes interest rates across the Yield Curve go up and down in tandem. For example, if interest rate for the 3 month T-Bill moves up by 25 basis points, the other eight Treasury benchmark issues will also move up by 25 basis points. This is called a Parallel Shift in the Yield Curve. It is as if the entire curve just shifted up or down. Studies have shown that Parallel Shifts explain about 80-90% of the Yield Curve movements on a day-to-day basis.

Occasionally, the Yield Curve doesn’t shift in parallel. For example short-term yields may increase while long-term yields drop. This is called a non-Parallel Shift in the Yield Curve. These shifts are typically triggered by an economic or news event.

The U.S. Treasury Yield Curve is an important tool used by many market participants to evaluate the general levels of interest rates. It is also widely used as benchmarks to price other interest rate sensitive securities.