Would CPI linked bonds offer you a better hedge against inflation

Post on: 3 Июль, 2015 No Comment

Impact

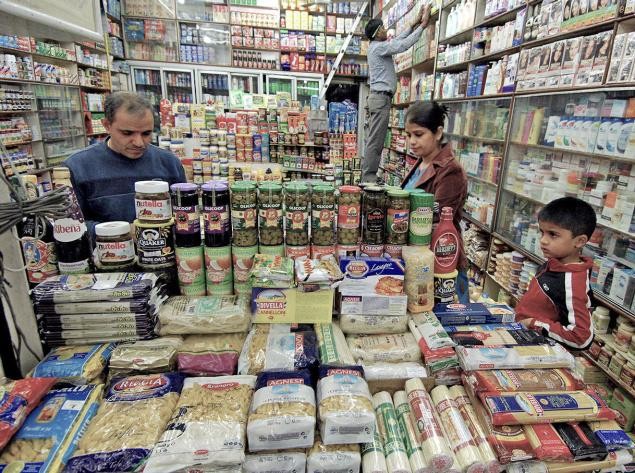

Food articles constitute a major part of the personal budget of many. Vegetable prices are hot potatoes these days while prices of other household items have also been on rise. Growing expenses make it difficult for the common man to save money. Fixed deposits have been generating negative real returns due to high inflation. Equity markets have been range-bound and have failed to reward retail investors. Under such conditions, people find solace in gold as it is considered to be the hedge against inflation. But India’s huge appetite for gold weakened its fiscal position considerably as the current account balance sharply slipped in negative causing huge deficits due to higher gold imports. Now that government has imposed curbs on gold imports, retail investors appear to be in a fix.

New alternative.

To shield investors from pestering inflation, RBI has planned to issue CPI-linked bonds this month. This is in line with broader strategy of RBI to focus on retail inflation and discourage investors from investing in gold. The bond will have a maturity of 10 years and would be linked to the movement of consumer price index. The issue is likely to come in two series; the first would be open for all while the second would be reserved only for retail investors. The bond issuance will form a part of overall borrowing target of the government.

Why CPI index bonds?

There has been a huge gap between inflation measured by two different indices. Wholesale Price Index (WPI) chiefly captures inflation at the wholesale level, while Consumer Price Index (CPI) reflects inflation at retail level. WPI rose 7.0% in October on Y-o-Y basis, while CPI jumped 10.09%. The food price inflation was 12.56% in October. This suggests that, retail inflation, which affects the household budgets to a great extent, needs to be addressed more urgently. The need to provide protection against inflationary pressure was recognised earlier but inflation indexed bonds issued in the first tranche were linked to the movement of WPI. The bond issue had attracted very ordinary response since WPI linked bonds hardly provide any protection against rising prices of consumer goods and services.

Should you consider investing in CPI bonds?

PersonalFN is of the view that, CPI linked bonds make much more sense than the WPI linked bonds to retail investors who are left with not many option at present. However, it is noteworthy that further details pertaining to the issue are not disclosed yet. As of now, interest earned on inflation indexed bonds doesn’t get any favourable tax treatment. Moreover, only principal component is adjusted for the rise (or fall) in inflation. PersonalFN is also of the view that, issuance of CPI linked bonds may not help curb gold demand to a great extent as India has huge consumption demand for gold. besides having investment demand.

Nonetheless, PersonalFN believes, CPI linked products would offer a better hedge to investors worried about rising cost of living. PersonalFN recommends investors to consider investing in CPI linked investment instruments when they are launched after carefully assessing options. CPI linked bonds may have a weightage of about 10%-20% in your debt portfolio.