World Gold Council ETFs Good For Investors – And For Gold

Post on: 10 Июль, 2015 No Comment

(Kitco News ) - Gold-backed exchange-traded funds have been good for investors — and for gold , said the World Gold Council in a report Wednesday.

Over the past decade, gold-backed exchange-traded funds have transformed the gold investment market, the report said. Yet, their rise has not been universally popular. They may have put pressure on gold vendors margins, and some investors believe that they have led to an increase in volatility of the gold market.

As we see it, ETFs may not be an answer to every gold investors needs, but the gold market has benefited more broadly since their launch. Overall, we believe that ETFs have reduced total cost of ownership, increased efficiencies, provided liquidity and access, and brought new interest – and demand – into gold as a strategic investment.

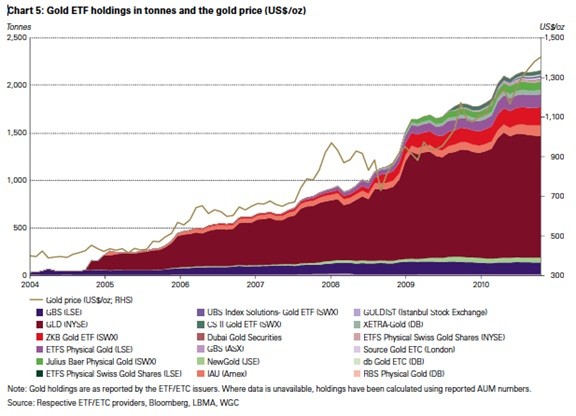

The ETFs trade like a stock but track the price of the commodity, with metal put into storage to back the ETF shares. Currently, ETFs around the world hold some 1,700 metric tons of gold, the WGC said. After the popularity of gold ETFs launched roughly a decade ago – with input from the World Gold Council – similar ETFs have been launched for silver and the platinum group metals.

Prior to the ETFs, investors gained exposure to the gold market mainly through gold futures contracts or mining stocks, a precious-metals mutual fund or by holding physical gold in the form of bars and coins.

The ETFs helped lower the cost of owning gold and increased the efficiency of holding bullion in a portfolio several ways, including lower management fees, the WGC said. The report said ETF fees are typically around 40 basis points, compared to 160 to 250 basis points for actively managed mutual funds with a precious metals strategy.

Gold-backed ETFs helped to democratize physical gold investment, the WGC said. ETFs offered investors of all sizes wholesale prices for the first time, while offering shares at fractional units of an ounce of gold, resulting in a much cheaper cost per purchase than bullion. In contrast, investors who chose physical bars and coins may pay additional premiums over the gold price depending on the size of their investment.

ETF investors do not have to incur storage and vaulting costs, which are included in the management fees. Also, the ETFs are liquid, allowing investors to easily convert their holdings into cash, the WGC said.

The WGC said ETFs have increased overall growth in gold investment.

While demand for ETFs attracted some demand from other gold investment products, we do not believe that there has been a simple one-for-one substitution effect from retail physical gold markets into ETFs, the report said. Instead we see evidence pointing to ETFs having a net positive effect and expanding investment demand. The overall gain from increased average gold prices, investing interest in gold, and the cost reductions from ETFs was in the interest of all gold investors and participants. ETFs appealed to some existing gold investors while attracting investors who previously had not held gold.

In fact, the WGC added, retail investor purchases of physical bars and coins have been greater than ETF demand for the metal since the financial crisis. Since 2004, annual bar and coin demand has been, on average, at least three times as large as ETF demand, the report said.

The WGC described the interest in the ETFs after their introduction as remarkable, with the largest such product – SPDR Gold Shares (GLD) – hitting more $1 billion in assets under management within its first three trading days nearly a decade ago.

Despite the sizable outflows experienced in 2013, assets in gold ETFs currently rival the market capitalization of major global companies or the gold holdings of major central banks, the WGC said. As of August 2014, the 1,700 tons gold held collectively by the 60 gold-backed ETFs we track had a value of $71billion. To put this in perspective, if these ETFs were a company, they would be in the top 10% of companies worldwide ranked by market capitalization.

When measured against the constituents of the S&P 500, gold ETFs listed in the U.S. fall within the top 20% of U.S. companies by size. In addition, these 60 funds hold more gold than central banks combined with the exception of the U.S. Germany, Italy and France.

Related Stories:

The report suggested that competition from ETFs may have contributed to a reduction in bullion coin premiums.

Overall there has been an average net reduction of 64 (basis points) across six major 1-oz bullion gold coins in the last decade, the report said. This relates to a 9.3% reduction in premiums since ETFs became an option for investors. While it is difficult to directly attribute the cause of these compressions to gold-backed ETFs, it makes intuitive sense that given a cheap and liquid investment alternative, dealers would need to reduce their premiums to stay competitive.

The WGC report maintained that the ETFs likely have not resulted in higher market volatility. The report said that daily ETF volumes, while significant, are small when compared to the trading activity in futures and OTC (over-the-counter) markets.