WisdomTree Japan Hedged Equity ETF The Perfect Investment To Play A Weakening Yen WisdomTree

Post on: 16 Март, 2015 No Comment

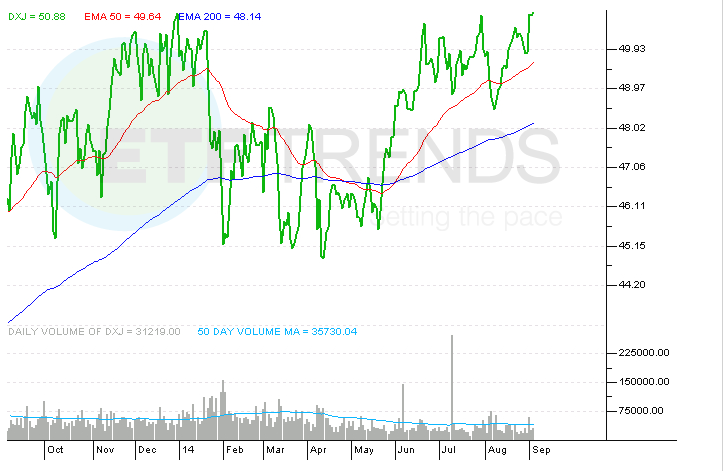

Elections bring a mandate for change that can manifest itself in different ways. New Prime Minister Abe won on a platform promising to devalue the yen and create Western-style inflation by copying the quantitative easing playbook of the U.S. Federal Reserve. This article will focus on my bullishness toward Wisdom Tree Japan Hedged Equity ETF (NYSEARCA:DXJ ) and its prospects for further capital gains.

According to the fund company’s description, DXJ seeks investment results that closely correspond to the price and yield performance, before fees and expenses, of the Wisdom Tree Japan Hedged Equity Index. The Fund employs an investment approach designed to track the performance of the Wisdom Tree Japan Hedged Equity Index. The Index and the Fund are designed to provide exposure to equity securities in Japan, while at the same time hedging exposure to fluctuations between the value of the U.S. dollar and the Japanese yen. The Index and the Fund seek to track the performance of equity securities in Japan that is attributable solely to stock prices without the effect of currency fluctuations.

As we can see from the above description, the key aspect of this fund is the hedged exposure to the fluctuation of the yen. The yen was trading at 78 per $US pre-election up to a current quote of 93 per dollar for a stunning 19% move. The DXJ has managed to move from $32 to $41 for a stellar advance of 28% in the same time frame. For the year, Japan’s Nikkei gained 23% in 2012, its best gain since 2005. but the popular EWJ is up just 6.3%, thanks to a declining yen (FXY -11.3%). The DXJ — hedged against currency fluctuations — is up 16.5% YTD. The stellar returns of the DXJ highlight the importance of the currency hedge. The question that remains is: Where do we proceed from here?

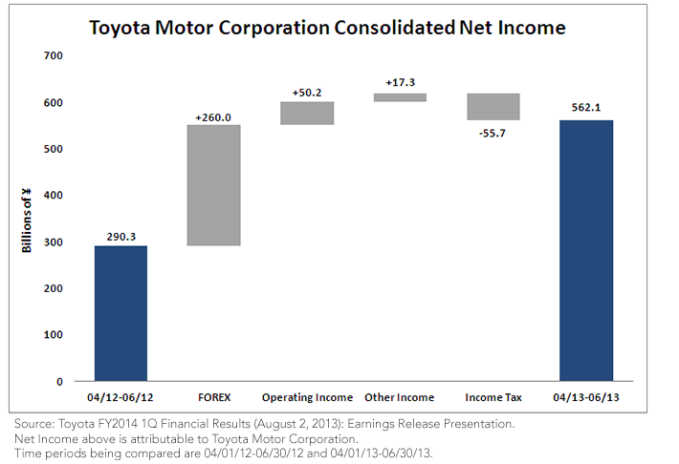

It is my view that we are in the very early stages of the game and further gains are to follow. The table below details the top 10 holdings of the fund. They are all world class companies that derive a significant percentage of their profits overseas and would be direct beneficiaries of a further weakening yen. The car manufacturers alone would see their costs drop significantly, allowing them to offer better incentives on their vehicles while maintaining a good margin. The weaker yen should allow the fund components to trump earning expectations, which should fuel further stock gains.

1. Mitsubishi UFJ Financial Group