Winklevoss Bitcoin ETF Why it Matters Bitcoin Daily

Post on: 24 Сентябрь, 2015 No Comment

Winklevoss twins’ brand-new Bitcoin exchange-traded fund SEC file Image Source: sec.gov

Despite tremendous support for bitcoin to become an investment, stock markets around the world are still apprehensive about putting it on their list. This is why two of bitcoin’s biggest supporters, the Winklevoss twins, plans to list their Bitcoin exchange-traded fund (ETF) on the NASDAQ exchange.

This is the second time that the Winklevoss brothers have tried to boost Bitcoin’s legitimacy as an investment. Earlier this year, they launched Winkdex, a Bitcoin index that averages the weighted prices from seven exchanges.

According to Wedbush Securities analyst Gil Luria, the Winklevoss Bitcoin Trust could be approved by the end of the year. If it pushes through, should investors consider it as a safer alternative to purchasing bitcoins from other exchanges?

Better Security

One advantage of the Bitcoin ETF is security. Let’s consider the collapse of Mt. Gox and Flexcoin. Hackers broke through their security protocol and emptied their vaults. Since bitcoin exchanges operate independently, investors in both exchanges were fed to the wolves. The value of Bitcoin at these exchanges became zero while it continued to trade in other exchanges at normal rate.

If the Bitcoin ETF will be listed on NASDAQ, investors won’t have to worry about buying bitcoin from shady exchanges. They could just buy shares of the ETF at any brokerage. Hackers cannot steal anything from NASDAQ since it is not a bank, the Bitcoin ETF is just priced on the underlying value of the Winklevoss’ own Bitcoin assets.

Making Bitcoin the Next Gold

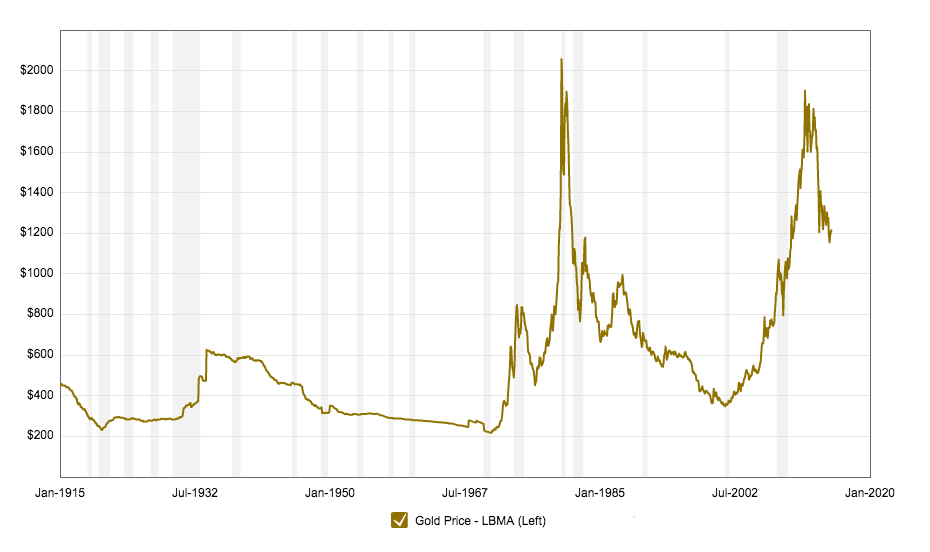

In an interview with The New York Times, Cameron Winklevoss said that their goal is to make their Bitcoin ETF “as similar to the gold ETF as possible.” He was referring to the SPDR Gold Trust ETF and anyone who is familiar with investments and stock market will understand how bitcoin could work just by analyzing the SPDR Gold Trust.

SPDR Gold Trust ETF is backed by 25.9 million ounces of gold. Investors are issued ETF shares similar to how a gold standard nation issues gold-backed paper currency. Investors cannot redeem their shares for physical gold from the trust, only “authorized participants” can withdraw or deposit gold. In essence, investors have to trust that the Gold Trust has enough physical gold to back its shares at all times.

The Winklevoss ETF wants to apply this model to their trust fund, by locking away physical Bitcoins and issuing Bitcoin-backed shares to investors.

Points Bitcoin toward the Right Direction

The Winklevoss Bitcoin Trust could eliminate the need for dubious exchanges like Mt. Gox, ease concerns about digital currencies and cryptocurrency crimes, and may lead to the stabilization of Bitcoin prices which, in the long run, will make bitcoin a viable investment.

The Winklevoss Bitcoin Trust is currently working its way toward regulatory approval. If SEC approves it, its shares will be issued at a price arrived at through a volume-weighted average of the Bitcoin price on the leading exchanges around the world. While it is undergoing this process, bitcoin supporters can breathe a little easier because bitcoin is one step away from becoming a legit investment.