Will the US Dollar Lose Reserve Currency Status Forecasts Trends Investment Strategies

Post on: 14 Июль, 2015 No Comment

- Most Americans Are Dollar Indifferent/Oblivious

- How the Dollar Became the Reserve Currency

- Long-term Swings in the US Dollars Value

- Global Calls for Reserve Currency Replacement

- Editorial: The Dump-the-Dollar Conspiracy

- Conclusions No Change Likely Anytime Soon

Introduction

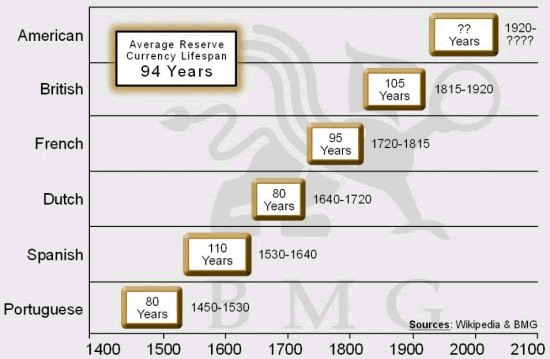

The US dollar became the global reserve currency in 1944 near the end of World War II and continues as such. There have been numerous reserve currencies over the centuries, but none more widely accepted than the US dollar since 1944. While the US dollar has fluctuated widely in value over the 65 years since its designation as the reserve currency, its credibility has come under the most intense scrutiny ever in the last few years.

The US dollar peaked in value in 2000-2001 and has been in a significant decline ever since. There was a relatively brief period in 2008 when the dollar rebounded quite sharply due to the worldwide financial crisis and economic meltdown, when there was a global rush to the safety of US Treasury securities. But since then, the dollar has resumed its long-term downtrend.

With President Obamas most unprecedented spending plans in history, with trillion-dollar budget deficits as far as the eye can see, and the potential to more than double the US national debt in the next 5-10 years, there is now widespread speculation that the dollar is headed for new all-time lows and a possible collapse.

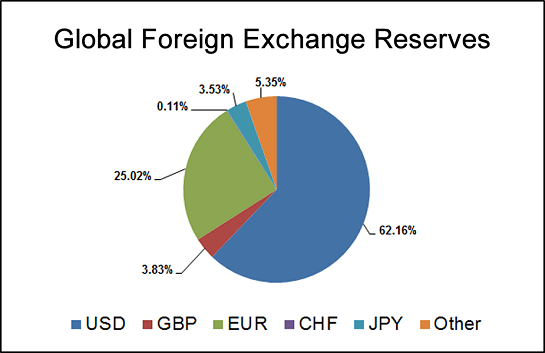

As a result, we are seeing and hearing calls around the world to end the dollars status as the worlds reserve currency and replace it with something else. The question is, replace it with what? The US dollar is by far the largest currency in the world; many commodities around the world are priced in dollars; and most international transactions are settled in dollars.

This week, we will look at the debate regarding what to do about the US dollar as the worlds reserve currency. I will start by explaining how the US dollar became the global reserve currency. Next, we will look at some of the difficulties the global community will face if the dollar is to be replaced as the reserve currency. And finally, we will explore what may happen if the US doubles the national debt over the next 5-10 years. It should make for an interesting letter.

Most Americans Are Dollar Indifferent/Oblivious

The financial media keeps us constantly aware of whats happening with the US dollar, as it should. But lets face it, most Americans pay little attention to the financial media, much less the value of the US dollar. And why should they? The dollar goes up in value and goes down in value, most often with few obvious effects on the lives of everyday Americans.

In extreme cases, a sharply falling dollar can result in significantly higher inflation and higher prices for the goods and services we consume. The late 1970s, when we had what some called hyperinflation, is one such example. But Americans have come to accept that inflation rises every year, and few correlate rising consumer prices to fluctuations in the US dollar.

Likewise, a falling dollar can make US exports more competitively priced in foreign countries, and this can be a positive factor for the economy and job creation here at home. Yet a falling dollar can also make foreign imports more expensive to US consumers. But the point is, when it comes to a rising or falling dollar, most Americans are indifferent if not oblivious.

Most Americans, as far as I can tell, are likewise indifferent or oblivious as to the significance of the US dollar being the worlds reserve currency. I would similarly suggest that most Americans dont even know what it means to be the worlds reserve currency. Yet that may be about to change in a big way, what with increasing calls for the replacement of the US dollar as the worlds reserve currency.

Sophisticated investors need to understand the importance of these issues as the future of the US dollar can significantly affect the value of our investments, as well as the prices we pay for the goods and services we all consume. In that regard, lets start with a brief discussion of how the US dollar came to be the worlds reserve currency and what that means.

Gary D. Halbert, ProFutures, Inc. and Halbert Wealth Management, Inc.

are not affiliated with nor do they endorse, sponsor or recommend the following product or service.

How the Dollar Became the Reserve Currency

In July 1944, with World War II still raging and the international economic and financial systems in near shambles, delegates from all 44 Allied nations gathered in Bretton Woods, New Hampshire for the United Nations Monetary and Financial Conference. The goal was to set up a system of rules, procedures and institutions to regulate the international monetary system. After three weeks of deliberating, the delegates agreed upon and signed the Bretton Woods Agreements.

The planners at Bretton Woods established the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (IBRD), which today is part of the World Bank Group. These organizations became operational in 1945 after a sufficient number of countries had ratified the Bretton Woods Agreements.

One of the chief features of the Bretton Woods system was an obligation for each country to adopt monetary policies that maintained the exchange rate of its currency within a fixed value (plus or minus 1%). The US dollar was established as the worlds reserve currency, which is typically defined as theforeign currency held by central banks and other major financial institutions as a means to pay off international debt obligations, and/or to influence their domestic currency exchange rates.

At the same time, the US agreed separately to link the dollar to gold at the price of $35 per ounce, with the added promise that Allied nations could convert their dollar holdings to gold if they so preferred. This was collectively known as the new gold standard.

Ultimately, the other Allied nations agreed to peg their currencies to the US dollar, and agreed to buy and sell dollars to keep market exchange rates within plus or minus 1% of parity. Thus, the US dollar took over the role that gold had played in the previous international financial system. As the worlds reserve currency, most international transactions came to be denominated in US dollars. The US dollar was the currency with the most purchasing power, partly because it was the only currency that was backed by gold. This led to the phrase that the US dollar is as good as gold.

The gold standard for the US dollar, as the global reserve currency, continued until August 15, 1971 when President Richard Nixon unilaterally closed the so-called gold window and ended the option of converting US dollars into gold. Despite that, the US dollar has continued to be the global reserve currency to this day. But that may be changing or maybe not.

Long-term Swings in US Dollar Value

The decoupling of the US dollar from gold in 1971 meant that the greenback became a fiat currency that was supported by nothing more than the full faith and credit of the US government, and thus subject to the whims of the market. The US Dollar Index (as measured in relation to six major foreign currencies) actually fell for several years after Nixon closed the gold window.

Then from 1980 to 1985, the US dollar skyrocketed on the upside, nearly doubling in value by 1985. But then in late 1985, the dollar began a virtual collapse which saw its value cut almost in half by late 1987. From late 1987 to 1995, the dollar moved in a broad sideways trading range.

From 1996 to 2001, the dollar staged another strong rally which moved the Index up to 120 as you can see in the chart below. From 2001 to the present, the Dollar Index fell sharply, reaching a new low in early 2008. Yet as the recession and the credit crisis unfolded in earnest in 2008, the dollar saw a fairly significant bounce, which was driven almost entirely by the global rush to safety in US Treasuries.

As you can clearly see, the credit crisis rally in the dollar ended early this year, and the long-term downtrend has resumed. The question now is whether or not the US dollar is headed for new all-time lows. With Obamas plans to run trillion-dollar annual budget deficits as far as the eye can see, and double the national debt in the next 5-10 years, it would seem almost certain that the dollar is headed for new lows.

This is precisely why we are hearing calls from around the world to replace the US dollar as the global reserve currency. But again, the question is with what?

Global Calls for Reserve Currency Replacement

As the US dollar has resumed its long-term downtrend this year, a growing international chorus is suggesting that the dollar be replaced as the worlds reserve currency, a move that could theoretically end the greenbacks six decades of global dominance.

China was the first major power to call in March for the dollar to be replaced as the worlds reserve currency. China holds more US debt than any other country — about $800 billion — and the further the dollar drops, the less the value of the US debt owed to China. Never mind that China has been roundly criticized for its handling of its own currency, the yuan, which I might add is pegged to the US dollar.

Reportedly, there were informal talks on the dollar continuing as the reserve currency at the G-20 summit in London in early April. Since then other nations such as Russia, France and Brazil have suggested that the US dollar should be supplemented by other major currencies as a shared reserve currency.

The US was again criticized at the latest G-20 summit in Pittsburgh at the end of September, to the point that Treasury Secretary Geithner felt obligated to say the following at the opening of the conference: A strong dollar is very important to the United States. Given the massive spending by the Obama administration, and plans to double the national debt in 5-10 years, it is no wonder that no one believed Geithners remarks.

Regardless of whether the dollar would be replaced or supplemented, it would be a very complicated matter. The technical and political hurdles are enormous. For one thing, central banks around the world hold far more US dollars and dollar-denominated securities than they do assets denominated in any other individual foreign currency. Such reserves are frequently used to stabilize the value of the central banks domestic currencies.

Most finance ministers around the world, including Chinas, know this and their comments in regard to replacing or supplementing the dollar as the worlds reserve currency are just so much lip-service, which is really aimed at threatening the Obama administration over its out-of-control spending.

China says, for example, that it would prefer to hold its apprx. $2 trillion in reserves in something other than US dollars, but the fact is that Beijing has few alternatives. With more US dollars continuing to pour into China from trade and investment, Beijing has no realistic option other than storing them in US debt.

Some Argue SDRs are the Solution

So-called Special Drawing Rights (SDRs) are a synthetic currency created by the International Monetary Fund (IMF) in 1969 in an effort to stabilize the international foreign exchange system. The IMF defines SDRs as follows: The SDR is an international reserve asset, created by the IMF in 1969 to supplement its member countries official reserves. Its value is based on a basket of four key international currencies.

Basically, SDRs are a combination of four currencies — US dollar, the Euro, the Yen and the British Pound. The US dollar alone makes up almost half of the value of a SDR. The amounts of each currency making up SDRs are determined by the IMF Executive Board in accordance with the relative importance of the currency in international trade and finance every five years.

SDRs were originally created to replace gold and silver in large international transactions. Since the quantity of gold and silver worldwide is finite, and the economies of all participating IMF members as an aggregate are growing, a purported need arose to increase the supply of international reserves. Thus, SDRs (also called paper gold) are credits that nations with balance of trade surpluses can draw upon from nations with balance of trade deficits.

In short, SDRs are little more than an accounting transaction within a ledger of accounts, which eliminates the logistical and security problems of shipping gold back and forth across borders to settle national accounts.

When SDRs were created, the IMF also suggested that member nations could convert their US dollar holdings into SDRs to diversify away from the dollar without driving the value of the dollar down. However, since US dollars account for almost half the value of SDRs, this diversification argument never made very much sense.

Despite the IMFs initial desires, SDRs never became the currency of choice for any countries. Even today, SDRs are primarily used only to settle accounts between the IMF and its members treasury departments/foreign exchange ministries. Frankly, this is a good thing, in my opinion.

Still, there are continued calls for the SDR to replace the US dollar as the worlds reserve currency. There are even a few voices out there that seem to believe we should adopt the SDR as a single global currency. In either case, the logic is flawed because of the limited size of the SDR market. Plus, if SDRs were instated as the global currency, every country with its own currency would lose a significant measure of national sovereignty.

Other arguments against making SDRs the worlds reserve currency include the fact that the US dollar, the Euro and the Pound which make up the large majority of SDRs have all lost value since late 2007 when the recession began. Why replace a falling dollar by an index which so heavily includes the dollar? Also, SDRs do not contain the Chinese Yuan, Indian Rupee, Australian Dollar or Canadian Dollar, all of which are important benchmark or secondary global reserve currencies.

These are just some of the reasons that the SDR is not likely to become the global reserve currency.

EDITORIAL REPRINT

What follows is one of the more interesting analyses on the US dollar that I have read in some time about the so-called Dump the Dollar conspiracy. The piece is written by Dean Baker, a senior correspondent for Foreign Policy magazine (www.foreignpolicy.com ), a leading non-partisan foreign policy think-tank in Washington.

QUOTE:

Debunking the Dumping-the-Dollar Conspiracy

For at least the last decade, a persistent, recurring conspiracy theory has held that major oil exporters will stop pricing oil in dollars, which will then lead to a collapse in the U.S. economy as the dollar becomes worthless. According to some accounts, Iraqs decision to price its oil in euros rather than dollars precipitated the U.S. overthrow of Saddam Hussein, and Irans threats to move away from the dollar is the real reason the U.S. government is raising the alarm over the countrys nuclear program.

The latest item in this tradition was an article by Robert Fisk, a longtime Middle East correspondent, in the London-based Independent . The article warns of a grand conspiracy between the Arab oil states, China, Japan, Russia, and France to stop pricing oil in dollars by 2018. When this happens, Fisk says, the dollar will suffer a severe blow to its international standing and the United States might struggle to pay for its oil. The article apparently caused a shudder in the currency markets yesterday [October 6], as panicked investors unloaded dollars in reaction to the terrifying prospect of this alleged international oil conspiracy.

But they really shouldnt be concerned. Fisks theory would make a good plot for a Hollywood movie, but it doesnt make much sense as economics. It is true that oil is priced in dollars and that most oil is traded in dollars, but these facts make relatively little difference for the status of the dollar as an international currency or the economic well-being of the United States.

With the United States ascendancy as the pre-eminent economic power after World War II, the dollar became the worlds reserve currency: Most countries held dollars in reserve in the event that they suddenly needed an asset other than their own currency to pay for imports, or to support their own currency. Much international trade, including trade not involving the United States, was carried through in dollars. In addition, most internationally traded commodities became priced in dollars on exchanges. However, the dollar was never universally used to carry through trade (even trade in oil), and the pricing of commodities in dollars is primarily just a convention.

Any market — a stock market, a wheat market, or the oil market — requires a unit of measure. The importance of the U.S. economy made the dollar the obvious choice for most markets. But there would be no real difference if the euro, the yen, or even bushels of wheat were selected as the unit of account for the oil market. Its simply an accounting issue.

Suppose that prices in the oil market were quoted in yen or bushels of wheat. Currently, oil is priced at about $70 a barrel. A dollar today is worth about 90 yen. A bushel of wheat sells for about $3.50. If oil were priced in yen, then the current price of a barrel of oil in yen would [be] 6,300 yen. If oil were priced in wheat, then the price of a barrel of oil would be 20 bushels. If oil were priced in either yen or wheat it would have no direct consequence for the dollar. If the dollar were still the preferred asset among oil sellers, then they would ask for the dollar equivalents of the yen or wheat price of oil. The calculation would take a billionth of a second on modern computers, and business would proceed exactly as it does today.

It does matter slightly that the trade typically takes place in dollars. This means that those wishing to buy oil must acquire dollars to buy the oil, which increases the demand for dollars in world financial markets. However, the impact of the oil trade is likely to be a very small factor affecting the value of the dollar. Even today, not all oil is sold for dollars. Oil producers are free to construct whatever terms they wish for selling their oil, and many often agree to payment in other currencies. There is absolutely nothing to prevent Saudi Arabia, Venezuela, or any other oil producer — whether a member of OPEC or not — from signing contracts selling their oil for whatever currency is convenient for them to acquire.

Even if all oil were sold for dollars, it would be a very small factor in the international demand for dollars, as can be seen with a bit of simple arithmetic. World oil production is a bit under 90 million barrels a day. If two-thirds of this oil is sold across national borders, then it implies a daily oil trade of 60 million barrels. If all of this oil is sold in dollars, then it means that oil consumers would have to collectively hold $4.2 billion to cover their daily oil tab.

By comparison, China alone holds more than $1 trillion in currency reserves, more than 200 times the transaction demand for oil. In other words, if China reduced its holdings of dollars by just 0.5 percent, it would have more impact on the demand for dollars than if all oil exporters suddenly stopped accepting dollars for their oil.

This raises a more serious issue affecting the demand for dollars, which is the dollars status as an international reserve currency. Currently the dollar is by far the preferred currency, but others, notably the euro, are gaining ground. A switch away from the dollar will lower its value, but this is hardly anything to fear: In actuality, it was and is an official policy goal of both the George W. Bush and Barack Obama administrations [to have a weaker dollar].

Both administrations are on record complaining about Chinas manipulation of its currency. China does this by buying up vast amounts of dollars to hold as foreign reserves, suppressing the value of the yuan against the dollar. This, in turn, makes Chinese goods cheaper in the United States and bolsters Chinas exports.

If China stopped buying up huge amounts of dollars, as the United States wishes, then the dollar would fall in value against the yuan, thereby making Chinese imports more expensive. The result would be that the United States would buy fewer imports from China, improving its trade balance. Not too many people would be frightened by this prospect.

To summarize, the dollars needed to finance the international oil trade are trivial compared with other sources of demand for dollars. The currency chosen for foreign reserve holdings can have an impact on demand for dollars, but this has nothing to do with the currency chosen to conduct the oil trade. If Saudi Arabia wanted to hold euros rather than dollars, it could almost instantly offload as many dollars as it desired. Plus, the White House wants the dollar to decline anyway because it would improve the United States trade balance.

Thus, the conspiracy theory Fisk resurrected might have spooked the markets, but the reality is that there is nothing to fear. The dollars value will likely fall over time (as it has been doing against the euro for the last nine years). But there is nothing in the cards to suggest a collapse, even if Saudi Arabia starts selling its oil for euros or yuan.

END QUOTE

Gary D. Halbert, ProFutures, Inc. and Halbert Wealth Management, Inc.

are not affiliated with nor do they endorse, sponsor or recommend the following product or service.

Conclusions

The US dollar is not likely to lose it reserve currency status anytime soon, unless it were to collapse for some unexpected reason. As illustrated in the chart above, the dollar has been losing value for almost a decade, yet no major countries have switched to some other currency to settle international transactions. As discussed earlier, there is no other currency that is large enough to replace the dollar as the world currency.

Longer-term, however, the prospects dont look very bright. With President Obamas plans to run trillion-dollar annual budget deficits for at least the next five years (and possibly longer) and double the national debt in 5-10 years, the dollar could find itself in real trouble as the reserve currency. The dollar could fall so low that foreign nations decide to dump their dollars in favor of euros, yen or whatever. If that day comes, I (and many others) believe we will see an even greater financial crisis and another depression.

Very best regards,