Why the Gold to Oil Ratio Matters

Post on: 7 Сентябрь, 2015 No Comment

Reading time: 4 7 minutes

Seasonally oil (USO ) is extremely weak from October through December. In 2008 oil started October at about $100 and ended December around $40 or around a monstrous 60% decline. Oil is strongest seasonally from July through September with the strongest individual months being January and August. Oils 200dma sits right around $100, appears to have hit around its bottom and the 200dma is exerting a gravitational like effect pulling oil prices up.

By contrast golds 200dma is at about $860 per ounce. Gold (GLD ) has recently passed through its strongest seasonal period from September to December. It maintains the uptrend from January to March, is asleep the rest of the year except for a strong rally in May. While seasonality is helpful it does not etch the future in bullion and this year has been different.

The recent financial turmoil has caused tremendous technical damage to gold almost as if it was done intentionally to stunt its bull market during all of the financial carnage. GATA asserts that when the news is really bad gold goes down. Well, the last half of 2008, when gold should have performed well seasonally, it swooned from over $1,000 per ounce to the $680s while Lehman Brothers evaporated, Fannie and Freddie were nationalized and bailouts were served every night on the news. Such suppression has only wound the spring that much tighter.

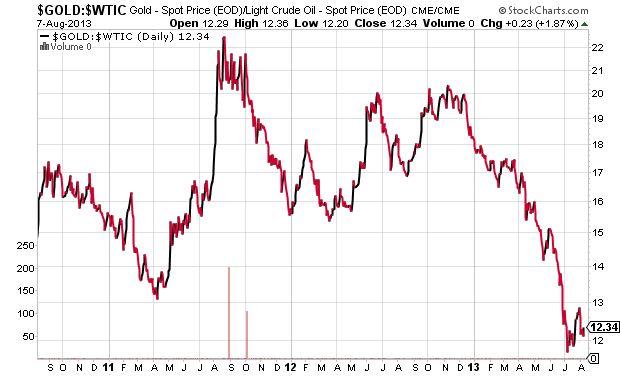

It is important to keep in mind that both of these commodities are still in strong secular bull markets. The FRN$ is in a strong secular bear market as is the DOW and real estate. The Gold/Oil ratio is now about 23 barrels of oil per ounce of gold. The 200dma is about 9.5 and the historic average is around 15.

The extremes happened in 1974, 1986 and 1988 as the ratio approached 30 and 1977, 2001, 2008 at about 8 and 2006 at around 6. For these relative prices to return to more normal ratios something is going to give. Oil is either going to go up, gold is going to go down or to move into some sneaky calculus the rate of oils rise will be faster than golds. The silver (SLV ) to oil ratio is not nearly as extreme as gold to oil but silver will most likely follow gold, either up or down, at a faster rate of change.

This is where geo-politics arrives. Are the oil producers willing to take so little value in exchange for their precious black gold? With Peak Oil (mp3) asserting itself the oil producers should hold the bargaining power. The latest IEA numbers indicate an extremely serious steeper than expected 9.1% decline rate. Yes, the Canadian Oil Trusts will rise in value as a safe, secure and stable source of oil. But perhaps the oil exporters should sit on their oil and let the importers roil and writhe in pain as E. M. Forsters 1909 essay The Machine Stops is played out. After all, a barrel in the future will be worth more than a barrel today. Obviously, the collapse will not be televised.

At all times and in all circumstances gold remains money. It is the most powerful currency in the world. Oil is the worlds primary energy source which is why the gold to oil ratio is important. Gold is the most effective tool humans have to perform mental calculations of value . By analogy it is the tool used to determine how many calories an apple provides and how many calories it takes to collect and process the apple so it can be eaten.

Producing gold is essentially converting energy into bullion. How many calories go into producing a one ounce gold coin? In some cases to produce a single ounce hundreds of tons of rock are moved. Ultimately, money is about energy. To make it personal how much value should you put on that nice steak dinner, bottle of water from Fiji or 3,000 mile Ceaser salad? Well, think through the supply chain and how much energy the good or service represents.

The world has a very serious problem. Because it has used a fiat currency with no definition or basis in reality for nearly 100 years and because oil production was constantly increasing during that time the effects of unwise capital investment were masked. Energy Return On Energy Invested (EROEI) calculations were not even performed. A fiat currency attempts to sustain the unsustainable while a commodity-based currency employs the strict laws of reality to ensure the unsustainable is not encouraged.

In other words, no one knew or calculated either how many calories the apple supplied or how many calories it took to procure and process the apple. The entire infrastructure of the entire world was built using mental calculations of value based on a derivative illusion. As natural and economic law assert reality and gold begins circulating as currency in ordinary daily transactions the distortions will be removed and the gross misallocations of capital will be revealed. I wonder what such a world will look like? Will The Machine Stop ?

Disclosures: Long physical gold and no position in GLD, SLV or USO.

Be the first to tip!