Why Should You Move Your Roth Retirement Back To Precious Metals

Post on: 9 Апрель, 2015 No Comment

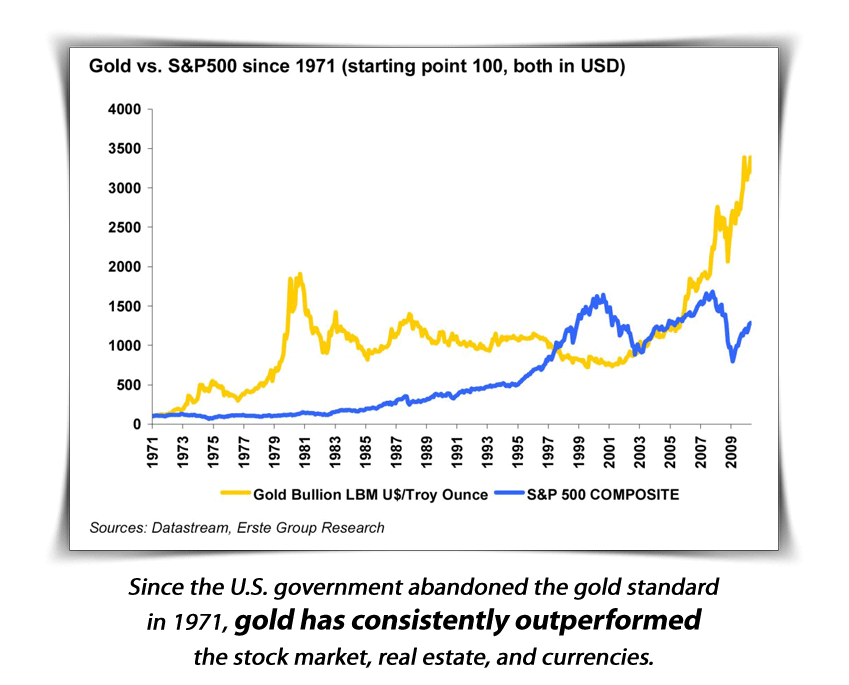

Nowadays, the best way to secure your future from the impending threat of an unstable economy is to invest in assets with low depreciation rates. Despite the recent rally in the world economy, many investors still remain nervous about its economic fundamentals. As a result, many still feel it is important to have precious metals for their future financial security.

There are many ways on how to put these ideas into fruition. Though not all can be considered reasonable and reliable due to several factors that may delay the process involved, there is one asset class that is deemed suitable for lifetime financial stability. Those assets are precious metals, and many people are looking to convert their retirement into gold and silver.

Quick Steps On How To Convert Your Roth Ira Into Physical Gold

Gold is a good investment that has never gone down to zero in its recorded history. As a matter of fact, several big countries such as Russia, China, and India are continuously hoarding huge amounts of gold and the turnover for this market increases greatly every year.

How does this affect you? Well, as investors and workers get more nervous about the coming collapse, many want to learn how to convert their ira into gold. Below is the simple step-by-step process that you will need in case you are considering going this route to secure your retirement:

1. You will need two fundamental requirements before you can start venturing in this industry. You must have an IRA account and/or 401K rollover funds.

2. If you dont have an IRA account, then this will be the ideal time to create one. However, if your current IRA does not hold any applicable commodities such as gold, then you should create a separate IRA personal account. This new IRA specialized account is affiliated with gold ira companies that specialize in reitrement-backed precious metals accounts.

3. Take note that the IRS regulatory rules state that there are only a few acceptable coins that you can purchase. These include the American Gold Eagle, Canadian Maple Leaf, or the Austrian Philharmonic. Ideally, your precious metals broker will help guide you in this confusing and often complicated process. They will however, explore all alternatives for you that will serve your best interests. Bullion bars tend to command higher premiums in the marketplace, so you wind up paying a little more per ounce.

4. If you have a special IRA that holds any form of commodities like gold, you are given the privilege to choose between these two options on how to convert ira to physical gold. These include taking direct possession of your metals or investing some of it into paper precious metals like the stocks GLD or AGQ. I do not not recommended that you go with paper gold because it can be heavily regulated and taxed by the government when it turns out that it isnt fully backed by the metals like it should be. This is a concern when the world economy falls apart.

5. If you want to change the asset portfolio of your retirement accounts into precious metals, then you will need to find the best gold ira custodian to do that for you. This post here has reviewed most of the major custodians, and there was a clear winner. But it is up to you to decide which company will help best suit your needs honestly.

6. Depending on the company you choose to work with, there will be large or small amounts of paperwork to fill out. The best ones usually handle most of the red-tape so that you dont have to.

7. After your previous custodian transfers your funds and assets to your new one, you can begin to fund your purchases for precious metals or take possession of them physically.

The Benefits of Converting Your IRA Into A Successful Gold Portfolio

Since the mainstream investment community thinks precious metals is a terrible investment, there isnt a whole lot of money going into this market just yet. When the U.S. dollar reaches a breaking point and the world economy begins to tank, gold and silver will begin to look quite lucrative to a lot of people.

If youre looking to protect your retirement, family, friends, wealth, assets, and sanity, then have your lifes work backed by precious metals today.