Why Life Insurance is a GREAT Investment (Free Money Finance)

Post on: 13 Май, 2015 No Comment

September 28, 2009

Why Life Insurance is a GREAT Investment

Ha! That title got you going, didnt it. -)

No, Im not losing my mind and abandoning index funds. Im simply reiterating what seems to be the new prevailing knowledge espoused by the mainstream media — that investing in insurance products is a great idea because its safe. For instance, consider this item from the 10 myths of investings new era piece on MSN:

Myth 6: Life insurance is not a good investment

This canard spread as 401ks and IRAs supplanted cash-value life insurance as Americans most popular ways to build savings while deferring taxes. True, the investment side of an insurance policy has higher built-in expenses than mutual funds do. But two factors point to a revival of insurance as an investment. One is guaranteed-interest credits on cash values, which means that if you pay the premiums, you cannot lose money unless the insurance company fails. The other is the boom in life settlements. If youre older than 65, you can often sell the insurance contract to a third party for several times its cash value — and pay taxes on the difference at low capital-gains rates.

Truth: A good investment is one in which you put money away now and have more later. Checked your 401k lately?

Think this is overreacting a bit? I do. Anyway, heres my take on the situation:

1. We had a once-in-a-generation (if not longer) economic meltdown and now the rules have changed, right? Wrong. We did have a meltdown, but that doesnt mean we all need to run from growth in search of safety.

2. I think the key learnings from the economic tumble are that: 1) we all need a diversified portfolio (and the closer we are to needing the money, the safer investment vehicle you need it to be invested in) and 2) we shouldnt build our financial futures on expectations (like borrowing way too much for a house because we know its going to go up in value.)

3. Re-read #2. Are these new learnings? Unfortunately, they are for much of America (and hence thats why our economys in the tank — too many avoided common financial principles in the past.) But for the rest of us with even a bit of financial sense, these really arent new points at all.

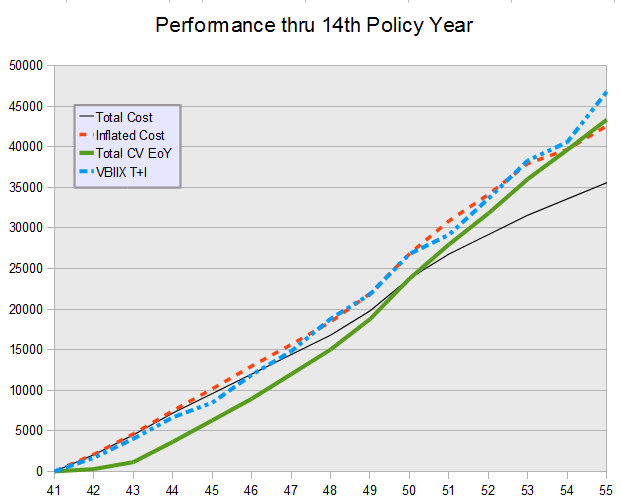

4. Insurance as an investment can be a valid financial move under the right circumstances (just like almost anything can be.) Is it a great option for most people? Not in my opinion. But my opinion is worth what you paid for it (zero) and your situation may be one where investing through insurance products makes sense. As always, run the numbers for yourself.

5. Remember the relationship between risk and return. The more risk you take, the higher the potential returns. The lower the risk, the lower the potential returns. A few comments on these principles:

Most people wont be able to retire on the very low (relatively speaking) returns offered by safe (or safer, if you prefer) investments. Youll be saving for 100 years if all your money is barely keeping up with inflation.

Youll need a blend of stocks, bonds, etc. to try and balance risk and return (youre trying to get a higher return without taking as much risk). This is what asset allocation is all about.

As such, no one investment (insurance, stocks, bonds, gold, and so on) is the ONLY option for you today. Like in days of old, you must be diversified (again, many people had to learn this the hard way).

Ok, Im sure I missed something, so feel free to fill in the blanks. But I at least wanted to note that many of the rules of investing weve always had are still valid today, after the crash — we just need to follow them.