Why It Doesn’t Matter Where Gold’s Headed Opportunities Still Abound

Post on: 6 Сентябрь, 2015 No Comment

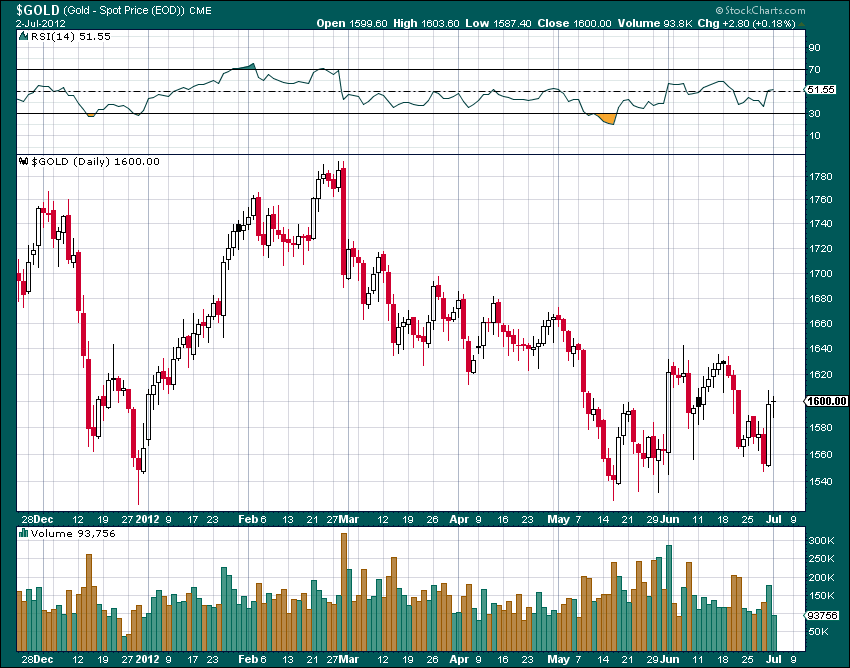

Between September 2012 and July 2013, gold wasn’t so much on a roller coaster ride as a steep descent, losing almost 35% of its value. During the first half of 2013, it fell almost 30%, hitting an intra-day low on June 28 of $1,179.40.

But it’s been a different story since then. Increased demand for physical gold and lower supply have helped the price of gold jump almost 15%, soaring past its 50-day moving average and hitting a two-ish-month high near $1,370 an ounce. Over that same time period, gold miners have gone up 35%.

Basic economics pointed to a rebound in the price of gold. During the second quarter of 2013, consumer demand for physical gold surged 53%, while total supply slipped six percent. Naturally, one would expect the price of gold to increase, but it didn’t; the price fell 35%.

According to the World Gold Council “Gold Demand Trends” report, gold’s second-quarter descent was due to speculators selling paper gold, rather than a decline in demand for actual physical gold. (Source: “Consumer demand for gold up 53% in Q2 2013 led by strong growth in China and India,” World Gold Council web site, August 15, 2013.)

With some analysts predicting the price of gold will head higher, many investors are asking how high. In the near term, some expect gold purchases by the manufacturing trade to increase ahead of the holiday season and harvest festivals.

Economist and gold bug Eric Sprott thinks the price of gold will double from its June 28 bottom, touching $ 2,400 an ounce by next summer. The gold bull market is also expected to help lift junior gold mining stocks into the triple digits, mirroring the 2008 recovery. (Source: Keith, D. “Q&A: Eric Sprott on gold and why it’s heading to $2,400 in a year,” The Globe and Mail. August 15, 2013.)

On the other hand, there are those who are not quite so bullish on gold. With the U.S. economy (apparently) heating up and China and the European Union stabilizing, the threats of inflation or hyperinflation are being, well, deflated—and along with it, the need to fortify your investment portfolio with gold, physical or otherwise.

Those investors bullish on gold might want to consider SPDR Gold Shares (NYSEArca/GLD), the largest physically backed gold exchange-traded fund (ETF) in the world. If you’re more bullish on gold miners, there is the Market Vectors Gold Miners ETF (NYSEArca/GDX).

If you think gold is overvalued and you like risk, you might want to consider shorting the precious metal through the VelocityShares 3x Inverse Gold ETN (NYSEArca/DGLD). If you want to short gold miners, you could start by looking at the Direxion Daily Gold Miners Bear 3X Shares (NYSEArca/DUST).

No matter what side of the gold fence you sit on or what your risk threshold is, opportunities abound.