Why Aren t Young People Buying Homes

Post on: 16 Март, 2015 No Comment

Submitted by Peter King on peter.king@mortgageloan.com writer

September 10, 2014

/why-arent-young-people-buying-homes-9777 Mortgage News 467 Mortgage News Mortgage Loan

Are younger adults turning away from the very idea of home ownership? Not necessarily, according to a recent study by the New York Federal Reserve.

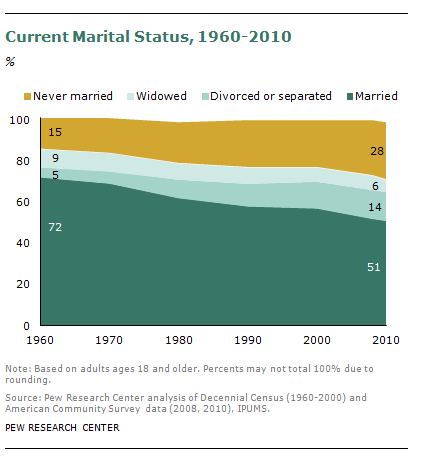

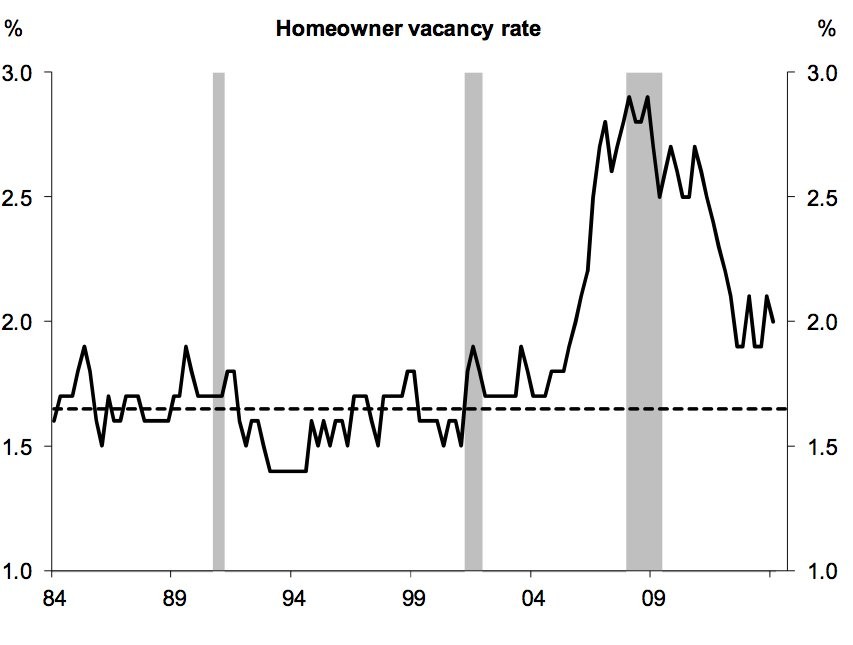

The current generation is producing relatively few first-time homeowners, leading to widespread speculation that the housing crash and Great Recession destroyed their faith in housing as a solid life investment, creating a generation of renters. Millennials are also often thought of as a more mobile generation, not wishing to be tied down to a single location as they go through multiple job changes in the course of a career.

However, the New York Fed study suggests a more pedestrian reason: they simply can’t afford it. Not only that, but also that they’re likely to become homeowners once the economy improves and mortgage credit becomes more available.

Personal finances, credit biggest obstacles

The survey. which looked at both renters and homeowners, found that personal finances and credit were by far the main reasons cited by renters who do not expect to buy a home in the near future. Debt /lack of savings was the #1 reason, closely followed by insufficient income, both cited by over half of renters who don’t expect to buy a home. Over four in ten named poor credit as a reason.

Conversely, less than one-quarter said they didn’t want to be tied down to a single area, or that they though renting was more affordable than buying. Slightly more said they didn’t want the responsibilities of home ownership and fewer than one in five said they didn’t want to tie up their money in a house.

As for the shock of the 2008 crash, fewer than 8 percent said they were reluctant to buy owing to a fear home prices might drop again. Meanwhile. about 60 percent said they thought buying a home in their zip code would be a good investment, compared to only 10 percent who thought it would not be, with the rest neutral.

Credit pessimism may persist

Not surprisingly, the study found that renters with higher incomes were much more likely to expect to buy a home in the next three years, with nearly 60 percent of those with household income in excess of $55,000 a year expecting to do so, suggesting young renters will still seek to become homeowners as their earnings improve.

At the same time, renters are also concerned about poor credit — more than one-third in the sample said they thought their credit score would be lower than 680, making it difficult or expensive to get a mortgage. That could change as credit standards ease or their personal credit scores improve, the report suggested that their current pessimism might persist and they may still regard themselves as unable to qualify even when that is no longer the case.