Which Commodity ETFs Could Outpace QE3

Post on: 16 Июль, 2015 No Comment

Global easing programs from around the world have investors scrambling back and forth. Some are excited to see stock markets have such positive reactions, while others are ripping the Fed for what they feel will be our undoing. Either way you spin it, QE3 is here and it may be staying for quite a while. Ben Bernanke announced that this round of asset-purchasing will feature $40 billion in MBS per month until they see a material growth in the jobs sector and the economy. What they define as a significant growth isnt clear, so many are predicting for this spending spree to continue on for quite some time [for more economic news and analysis subscribe to our free newsletter ].

If QE3 were to stretch out for a year, the Fed would pump $480 billion into the economy while that number jumps to $960 billion and $1.4 trillion if it continues for two or three years. It may be that Bernanke is trying to inflate our way out of debt, as we currently sit on a massive $16 trillion pile. By most accounts, anything after QE1 has done little to nothing for the economy and only compounded our problems for future growth. One thing is certain, for as long as Bernanke continues to print money the threat of future inflation only grows.

While we are not going as far to say that hyperinflation is on the horizon, it seems inevitable that inflation will rear its ugly head. When that time comes, keeping up with rising prices is a must for any portfolio, as inflation can effectively minimize or erase annual returns as Bill Gross has been quick to point out. Below, we outline five ETFs to help you keep pace with QE3 and the inflation that it will stir up as time goes on.

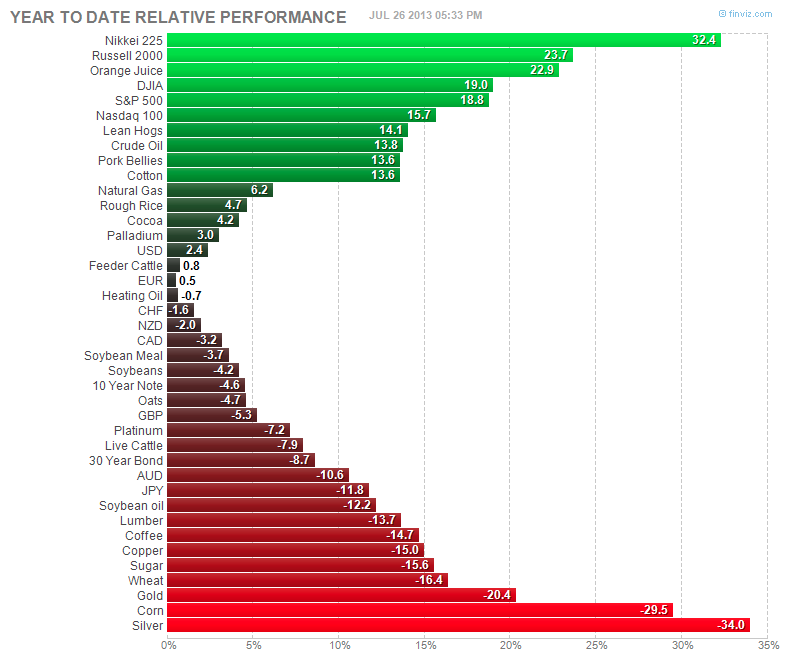

SPDR Gold Trust (GLD)

Everyones favorite gold fund is one of the best ways to keep pace with the asset-purchasing. As the dollar continues to devalue and investors leave the greenback for rosier gardens, gold will benefit. Not to mention that inflation is another key driver of prices for this precious metal, allowing it to gain on two fronts. Thus far in 2012 this fund has seen massive inflows of $3.8 billion to bring it up to approximately $75 billion in total assets. If GLD can keep up its pace it may very well give SPY a run for its money as far as AUM is concerned [see also Three Reasons Why Gold Is Overvalued ].

Ultra Silver (AGQ)

Silver is another commodity that will do well in the face of QE3 for mostly the same reasons that gold will. This white metal, however, is more volatile than its gold counterpart so the upside (and downside) potential is much higher. This ETF offers a 200% exposure to silver and has nearly $1 billion assets, a high figure for a leveraged product. For those looking to make a bet on silver, AGQ will by no means be smooth sailing, but it presents a strong option for those who are confident in the future of this metal.

United States Oil Fund (USO)

Many have predicted that crude oil will be one of the biggest beneficiaries of both QE3 and coming inflation. As QE3 helps to prop up stock markets it will also aid crude oil prices, which suffered a crushing sell-off last week after a major trade triggered a number of stop-losses. Some, like Peter Schiff, feel that the negative ramifications and eventual inflation from QE will allow crude to spike well beyond the triple digit barrier. This fund tracks front-month WTI futures and is the ETF benchmark for crude, as it trades more than 8.7 million times each day [see also 25 Ways To Invest In Crude Oil ].

Market Vectors-Agribusiness ETF (MOO)

One of the best ways to play inflation is by owning agricultural commodities, as food prices are often among the hardest hit. Though Jim Rogers has stated that the agriculture industry is in disarray. that does not mean that there are not significant profits to be made. As food prices jump with inflation, the companies that harvest and distribute these products have the potential to boost revenues. This ETF tracks companies who derive at least 50% of their profits from the agricultural business. It should be noted that about 62% of MOOs exposure falls out of the U.S. but with easing programs in place worldwide it still present itself as an intriguing buy.

S&P Global Timber & Forestry Index Fund (WOOD)

Believe it or not, timber assets have been among the best in the past century to keep up with and outperform inflation . Since the beginning of the 20th century timber has outpaced the S&P 500 and has risen by approximately 15% each year since 1987 (save one bad year during the U.S. housing crash). During the Great Depression, when stocks fell roughly 70%, timber investments soared by more than 200%. This fund measures the performance of companies engaged in the ownership, management, or upstream supply chain of forests and timberlands. WOOD has just over $170 million in assets and trades about 18,800 times each day.

Don’t forget to subscribe to our free daily commodity investing newsletter and follow us on Twitter @CommodityHQ .

Disclosure: No positions at time of writing.