What s Subprime Mortgage Definition Economic Impact

Post on: 16 Март, 2015 No Comment

How It Affects the U.S. Economy

Definition: A subprime mortgage is a housing loan that’s granted to borrowers with impaired credit history. Often, they have no credit history whatsoever. Their credit scores don’t allow them to get a conventional mortgage .

According to the FDIC. these borrowers have been delinquent, bankrupt, have low credit scores and/or low income. Specifically, they’ve been delinquent on their payment (two or more 30-day delinquencies in the past year). The lender had to write-off or write-down the loan, or there’ been a judgment against them in the last two years. They’re subprime if they have gone bankrupt in the last five years. Subprime borrowers typically have low credit scores,such as a FICO of 660 or below. Their annual income is less than half of the total yearly principal + interest payments on the loan.

Such loans have a higher risk of default than loans to prime borrowers. Banks, therefore, charge higher fees to compensate them for the additional risk. They may have higher interest rates, greater closing costs, or require more of a downpayment.

A high-cost loan must be reported to the FDIC if its APR is more than 3 percentage points greater than the yield on a similar Treasury bond, or if the closing costs are more than 8 percent of the loan amount. (Source: FDIC, ComE-In Background )

Types of Subprime Loans

To attract subprime borrowers, banks offered all types of loans that were cheap in the beginning, but made profits later on. Most had low teaser rates for the first year or two. Many borrowers didn’t realize that rate rose dramatically after that. Others thought they could sell the house or refinance before then These so-called exotic loans weren’t outright deceptive, but did get uninformed or naive borrowers in trouble. Here’s examples of the most popular:

Interest-only loan is easier to afford because it doesn’t require that any of the principle be paid for the first several years of the loan. Most borrowers assume they will either refinance, or sell their house, before the principal needs to be repaid. That’s very dangerous, because that’s when the monthly payment increases. They usually can’t afford the higher payment. If the value of the home drops, then they can’t qualify for a refinance or sell the house. In that case, they are forced to default because they can’t make the higher payment.

Option ARM loans allowed borrowers to choose how much to pay each month. However, the small payment meant the rest was added to your principal. After 5 years, the option disappears and the loan was even greater than in the beginning.

Negative amortization loans were like interest-only loans, but worse. That’s because they never paid off the principal. In fact, the interest payments were so low that each month, the debt grew larger as it was added to the principle. In other words, the principle grew each month.

Ultra-long fixed rate loans that extended 40 or 50 years, instead of the conventional 30-year mortgage.

Balloon loans allowed low monthly payments, but required a big payment after 5-7 years to pay off the rest of the loan.

No-money-down loans that allowed the borrower to take out a loan for the down-payment. (Source: FACTBOX: Types of Subprime Loans. Reuters. May 14, 2007)

Economic Impact

Subprime mortgages were one of the causes of the subprime mortgage crisis. Hedge funds found they could make lots of money buying and selling mortgage-backed securities. These are derivatives that are based on the value of the underlying mortgages. They became popular when the traders started bundling the subprime mortgages with high-quality conventional mortgages.

The hedge-fund traders divided these bundles into different components, called tranches. They put all the low-interest payments from the first three years of the subprime mortgages in with the low-interest payments of conventional loans. The high-interest payments were bundled into tranches that appeared to be riskier, because they were high yield. To top it off, they sold insurance against any default, called credit default swaps .

The popularity of mortgage-backed securities meant hedge fund traders needed more and more actual mortgages to feed the demand. Banks created these exotic mortgages just to get more business booked, bundle the mortgages and sell them to the hedge fund traders.

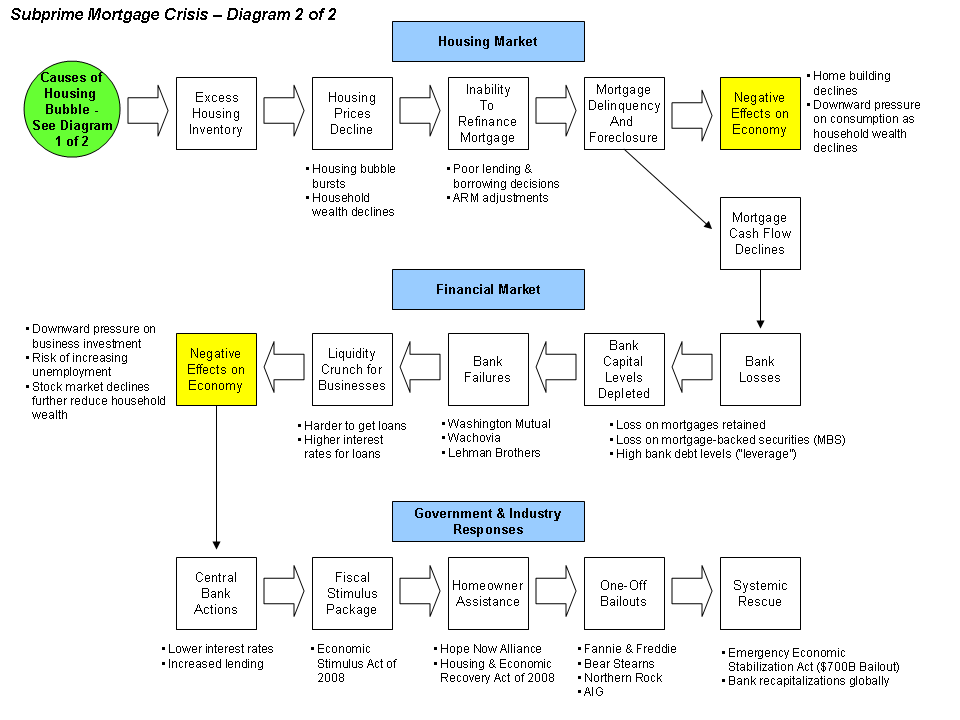

All went well until housing prices started to fall in 2006. This had rarely happened in U.S. history. However, it happened around the same time many borrowers found their interest rates were spiking in the third to fifth year of the exotic mortgage.

Since their house was now worth less than the mortgage, they couldn’t refinance or sell the home. When they started to default, the owners of the mortgage-backed securities realized their derivatives weren’t worth what they paid for. When they tried to collect their insurance, the issuer (AIG) almost went bankrupt. This led to the 2008 financial crisis. and the Great Recession. Article updated February 18, 2015