What Rising Commodity Prices Mean for Investors (SGG UCO DAG FUE JJN RTSA BVL DYY UBM GRN)

Post on: 27 Апрель, 2015 No Comment

Have you ever wondered how billionaires continue to get RICHER, while the rest of the world is struggling?

I study billionaires for a living. To be more specific, I study how these investors generate such huge and consistent profits in the stock markets — year-in and year-out.

CLICK HERE to get your Free E-Book, “The Little Black Book Of Billionaires Secrets”

I could go on and on…

What’s behind these moves in commodity prices, and what does this mean for your investment portfolio?

In past Smart Investing Daily issues, we’ve made the connection between the U.S. dollar’s performance against other currencies and the rise and fall of commodity prices.

This link is simple: Every commodity priced in dollars is subject to price fluctuations based on the value of that dollar. That’s why some commodities make great hedges against a falling dollar.

What’s Behind Commodity Price Gains?

But is the U.S. dollar behind these major commodity price gains?

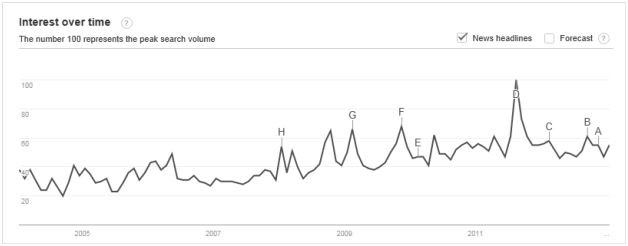

Yes, of course… But that’s only half the story. Here’s a six-month futures chart of the U.S. Dollar Index, which compares the greenback to a basket of major currencies:

You can see the index has fallen nearly 7% in the past six months. A move like this is pretty big in the currency world, and it certainly results in sizable swings in commodity prices.

But another reason commodity prices are rising could just be the fledgling recovery.

Consider this: In the past month, crude oil inventories have fallen by 20.3 million barrels. And while it is winter, and we expect declining stocks, this data is significant. Crude oil production in the U.S. is higher than it was a year ago, as are imports.

That means demand is on the rise.

Same with gold. When the official statistics come out, the World Gold Council expects jewelry demand for 2010 to outpace 2009, particularly due to a recovery in India and increased Chinese demand.

There’s also demand from central banks. Russia, for example, increased its gold holdings by 7% in the third quarter of 2010.

And gold is even making a comeback in industrial uses. In every region of the world, gold industrial demand has climbed in the first half of 2010 compared to 2009.

Climbing demand is found in agricultural commodities as well. The U.S. exported $108.7 billion worth of agricultural products in the fiscal year of 2010 up 13% from 2009. Everything from cotton to sugar to dairy products jumped in value… and many experienced sharply higher shipments. Soybean exports climbed 20% !

And imports climbed, too: 8% compared to 2009.

Rising Commodities Mean a Sign of Recovery

This is a good sign that the recovery is gaining ground. It also means that commodities could be more than just a hedge in your portfolio in 2011.

Here’s a captured image of the top 10 ETF gainers for the last day of 2010. ETFs Listed: iPath DJ-UBS Sugar TR Sub-Idx ETN (NYSE:SGG), ProShares Ultra DJ-UBS Crude Oil (NYSE:UCO), PowerShares DB Agriculture Dble Long ETN (NYSE:DAG), ELEMENTS MLCX Biofuels Index TR ETN (NYSE:FUE), iPath DJ-UBS Nickel TR Sub-Idx ETN (NYSE:JJN), iPath Short Extended Russell 20 (NYSE:RTSA), ELEMENTS BG Large Cap ETN (NYSE:BVL), PowerShares DB Commodity Dble Long ETN (NYSE:DYY), UBS E-TRACS CMCI Industrial Mtls TR ETN (NYSE:UBM), iPath Global Carbon ETN (NYSE:GRN).

Eight out of 10 of these ETFs are commodity-based. And look at some of the three-month gains…

- SGG up 45%

- DAG up over 32%

- UCO up over 23%

With these kinds of gains, what will 2011 bring?

My gut tells me that many commodities will see at least a small pullback in price. These gains are far too good for many investors to leave on the table, and we could see a lot of profit taking. I think this would be good for the commodity market as a whole, and it would consolidate some of the sharp price increases we’ve seen in the charts.

Any pullback would be an interesting opportunity for investors to start dabbling in commodities either through an ETF or through futures… or even options on those futures.

Aside from gold, which should be a staple in any investors portfolio if only for its hedging qualities, I’d take a look at agricultural commodities. Three of the eight commodity-based ETFs in the top-10 chart above are focused on agricultural commodities.

But take a moment to see what happens in the first week or two of trading in 2011. We’ll be back to higher volume trading, and we’ll be able to get a better sense of how the market will view the major gains some of these ETFs have made heading into the new year.

Smart Investing Daily will follow up on this idea in subsequent issues, but as always, feel free to send us your ideas and comments .

Written By Sara Nunnally For The Taipan Publishing Group

As Senior Research Director, global correspondent and co-editor of Smart Investing Daily . Sara has traveled all over the world in search of the best investment opportunities to recommend to her readers, be they in developed economies like France and Italy, in emerging markets like the Czech Republic and Poland, or in frontier terrain like Vietnam and Morocco. Her unique “holistic” approach of boots-on-the-ground research has given her an edge in today’s financial marketplace as she searches for the next investment opportunities in hot sectors like alternative energy, currency markets and commodities. Sara Nunnally’s diverse background includes studies in history, computer science, literature and financial research. She has appeared on news media such as Forbes on Fox. Fox News Live. Bloomberg and CNBC’s Squawk Box. as well as numerous radio shows around the country.

Article brought to you by Taipan Publishing Group, www.taipanpublishinggroup.com .