What is Your Risk Tolerance_1

Post on: 17 Август, 2015 No Comment

What is Your Risk Tolerance?

If you’re new here, you may want to subscribe to my RSS feed. Thanks for visiting!

The risk tolerance of each individual is different.

It is based on ones experiences, desires, needs, objectives, and attitudes.

Understanding a persons unique risk tolerance is important. How investors view the risk and associated expected return of investments will guide their investment strategy.

Today we will look at few questions that shape an individuals perception of risk.

Consider how you perceive risk as we go through these questions?

Is risk the losing of invested capital?

For many, the thought of losing money is their greatest fear.

These investors typically consider the risk of losing money in absolute dollar terms as compared to the original cost of the asset. Some investors feel that money is only “lost” when the investment is actually sold. Others feel the pain even for losses that are not yet realized.

When we looked at risk and return, we saw that the greater the investment risk (i.e. standard deviation), the greater the volatility of the investment. That is, the greater the probability that the actual return would deviate from the expected return.

If you fear losing money, you might be more comfortable investing in extremely low risk assets.

Is risk the unfamiliar?

Individuals often fear the unknown.

For investors, this means that investments with which one has little or no knowledge of, or appear to be complex in nature, will be seen as riskier.

A good example is the writing of covered call options. Many investors have no experience dealing with options. The mechanics and even the terminology may be intimidating. If I suggested that they incorporate covered calls in their investment portfolio, most investors would be hesitant. Their uncertainty is internalized as increasing the investment risk.

But that is simply the perception. The reality is that covered call options can be an excellent tool within one’s portfolio. While not something I would recommend initially for investors, as investment knowledge and experience improves, one can see that certain options strategies are not risky nor overly complex to execute.

While it is fine to be cautious with unfamiliar investments, that does not necessarily mean they are more risky. Take a little time to learn about areas where you have no knowledge. You might find that the investment is not as risky, nor intimidating, as your initially thought.

Is risk being once bitten twice shy?

Individuals often view familiar investments that have previously lost that person money as unattractive or riskier than they really are.

For example, perhaps you purchased 10 ounces of gold in 1996 at $400 per ounce. The investment slowly fell over time and you sold in 1999 for $300 per ounce.

In 2010, many experts recommend gold as an investment. Based on your previous experience losing money on the investment, there is a strong probability that you will find this recommendation unattractive or high risk.

However, that unattractiveness or increased risk is merely a perception and not reality. Whether you gained or lost money on a specific investment in the past has no connection with how well you will do in the future.

Is risk not following the crowd?

Following the conventional wisdom and expert recommendations is usually comforting.

It is always good to find that others, especially experts, agree with your investing decisions. And if you lose on the investment, you can take some solace knowing that many others did so as well.

Taking contrary investment positions is more stressful to many individuals. Going against the tide may be seen as a risky proposition. After all, who are you to know more than everyone else?

For example, if the “talking heads” on the business channels are all recommending avoiding Canadian natural resource equities, it takes a bit of nerve to go out and buy shares in these companies.

Given the track record of many experts, I am not sure following their advice is often wise.

If you want further thoughts on this area, please review my discussion on investment bubbles here , here and here. Investment bubbles are often the end result of following the crowd.

Is risk historic based?

Finally, investors often focus on the past when assessing risk.

Individuals consider historic returns when extrapolating into the future. While history can be a predictor of the future, it is the expected risk that is more important.

Situations change, both good and bad, and that can impact the risk of an investment.

Consider a mutual fund whose mandate is shares in mining companies. Performance over the last 10 years averaged 15% and risk was 4%. Well ahead of other funds in the same category. Based on past results you decide to invest.

However, in the last six months the mutual fund has decided to sell its investments in traditional mining companies and focus on higher risk companies in Asia and South America. Specifically, countries with unstable companies and young free-market economies. Unhappy with the shift in strategy, the successful fund management team decides to quit the fund. To save money, the mutual fund decides to have the managers of their banking mutual fund take over management of the mining fund.

Although historic risk was 4%, these recent factors will significantly increase risk levels in the near future.

If you rely too much on the past, you might err in the future.

How did you respond to these questions?

The answers will help you arrive at your personal risk tolerance level. This will guide you as to investments you are comfortable to invest your capital in.

While risk tolerance levels are unique to each person, I would like to influence each of you to some extent.

I hope to show you that it is best to take a view of risk with as little emotional involvement as possible. I fully realize that this is a challenge for almost all individual. But if you can develop a disciplined approach to investing, you will be in better position to succeed over the long run.

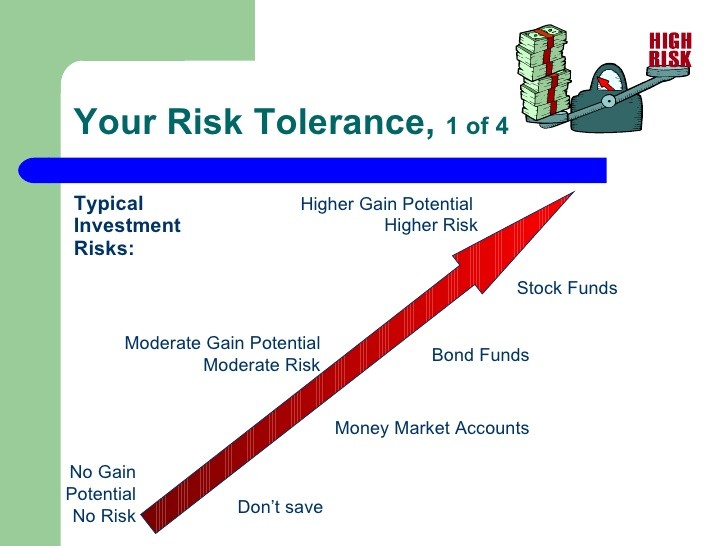

Next we will look at some typical investor profiles.