What Is the Cost of Living Adjustment (COLA)

Post on: 29 Апрель, 2015 No Comment

How COLA Protects You from Inflation

Definition: T he Cost of Living Adjustment, or COLA, is the adjustment made to keep your income current with the cost of living. It’s applied to wages, salaries and benefits. COLA is most widely used for retirees and recipients of Social Security benefits. COLA helps retirees, who are on a fixed income, to maintain a viable standard of living in the face of inflation.

On the whole, businesses don’t use it because they are more likely to hire, give raises, and fire based on merit. That’s because businesses compete with each other to remain profitable. If workers contribute to that profitability, they are given raises — regardless of whether the cost of living has increased or not. If they don’t contribute, they won’t get raises, and they might even get fired. However, businesses often award cost of living adjustments when valued employees are asked to move to a more expensive location.

Government workers and recipients of government benefits aren’t in such a competitive environment. Therefore, elected officials have made sure their incomes keep up with inflation.

How It’s Calculated

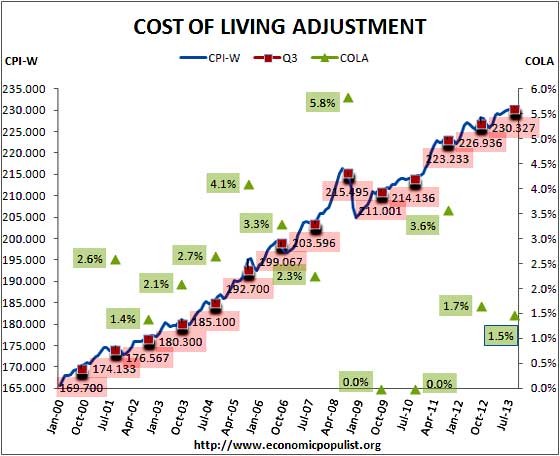

COLA is based on the Consumer Price Index (CPI). That’s the Federal Government’s official measurement of inflation. Specifically, it measures changes in the prices of 80,000 goods and services. COLA is triggered when prices go up. It’s rare to see COLA used to reduced wages or benefits if prices drop, a situation known as deflation. Find out more about how the Consumer Price Index is calculated .

COLA was introduced to Social Security in 1975 to help retirees with double-digit inflation. Why were prices rising so fast? Then-President Nixon had removed the U.S. dollar from the gold standard. That meant that the dollar was no longer redeemable by its value in gold. As a result, the value of the dollar plummeted. When the dollar is worth less, prices of imports are greater, triggering inflation.

Prior to 1975, Congress had to act to change the Social Security benefits. After COLA was introduced, benefit increases were automatically tied to rising prices. The adjustments occurred right in the nick of time. In 1975, COLA rose 8%, fell back to 6% for a few years, then skyrocketed to 9.9% in 1979, 14.3% in 1980 and 11.2% in 1981. By that time, then-Federal Reserve Chairman Paul Volcker had raised the Fed funds rate to 20%. This tamed inflation (and unfortunately caused a recession).

Since then, COLA has remained below 6%. That’s because double-digit inflation has largely been tamed. Thanks to Volcker, businesses know they can only raise prices so far before the Federal Reserve will step in and raise interest rates. In fact, COLA has been at 4% or less since 1992. The only exception was in 2008, when COLA rose to 5.8%. That was only because of spiking oil prices caused by commodities trading. (Source: Social Security, Cost of Living Adjustments )

Why Inflation Is No Longer a Threat

We have the Federal Reserve to thank for taming inflation. The Fed has a 2% target inflation rate. When the core CPI rises above that, the Fed can raise the Fed funds rate. or use other tools to enact contractionary monetary policy and slow the economy down. (The core CPI excludes volatile food, oil and gas prices .) By announcing its target, the Fed has removed the expectation of inflation. It’s this expectation that costs will rise higher that makes businesses raise prices even faster, hoping to maintain profit margins. Once the expectation is removed by Fed policy, then the threat of inflation is minimized.

There are three other reasons why inflation is no longer a threat. First, China and other exporters have a lower cost of living themselves. This allows them to pay their workers less, and keep the price of imports from their countries low. In addition, China pegs the value of its currency to the dollar. further insuring low prices.

Second, innovations in technology also keep prices down. For example, new features from smart phones, tablets and iPods keep lowering the prices of personal computers.

Third, the 2008 financial crisis walloped economic growth. thereby lowering demand. Instead of raising prices, businesses lowered them, cutting costs and creating high unemployment. Wages are much lower than before the Great Recession for many people, if they can get jobs at all.

Cost of Living Adjustment Calculator

The Social Security Administration tells you the latest COLA figures so you don’t need a calculator. See Latest COLA. Federal retirees can find out the latest adjustments at COLA Adjustments for Civil Service Retirement Benefits. Retirees from the Armed Services can find their adjustments at Cost of Living Adjustments. If you want to do your own calculations, use this CPI Inflation Calculator. You can also get a rough idea of the inflation rate for every decade since 1913 in What Is the Value of a Dollar Today?. Article updated September 17, 2014

More Articles About COLA and Inflation: