What Is Diversification

Post on: 24 Апрель, 2015 No Comment

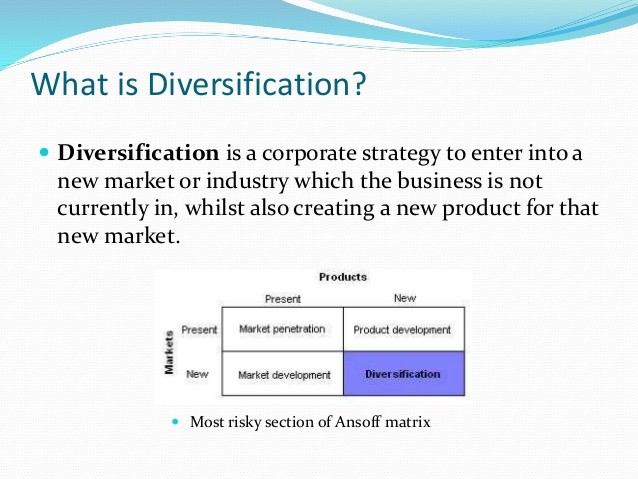

Youll hear Investment Advisors (including me) talk a lot about the benefits of Diversification. But what is Diversification?

Simply put, its not putting all your investment eggs in one basket. but spreading them out over a number of different baskets. That concept applies to both asset classes and investments within an asset class.

An Asset is anything that produces income or can be purchased and sold, such as stocks, bonds, or certificates of deposit (CDs). Asset classes are groupings of assets with similar characteristics and properties. Examples of asset classes are large-company stocks, long-term government bonds, and commodities, such as gold or oil.

Every asset class has distinct characteristics and may perform differently in response to market changes. Therefore, its important to consider which assets you should hold and the amount you should allocate to each asset. Asset Allocation is the process of developing a diversified investment portfolio by combining different assets in varying proportions.

Some factors that influence the asset allocation decision are your financial needs and goals, the length of your investment time horizon, and your attitude toward risk.

So thats one type of Diversification holding a variety of different asset classes.

But within each asset class, Diversification is also important.

Individual stocks and bonds are subject to whats called Company Risk. Thats the risk that a specific stock or bond may fall in price due to factors that have nothing to do with the overall market but are specific to that particular company.

Things can happen to one company that don’t happen to other companies in the same industry, or to the stock market as a whole. The company president can retire, or be lured away to another company. The company could get hit with a major lawsuit. A new product or service the company is developing might run into major delays. Any of these things can suddenly pull down the price of a company’s stock. Company Risk adds risk in excess of the overall market and is not always rewarded with higher returns. You assume greater Company Risk when you invest in a limited number of securities.

Including securities from different companies in a portfolio can reduce the level of Company Risk youre exposed to. This is true for stocks as well as other types of asset classes. An investor holding more than 100 stocks assumes very little Company Risk.

Generally, its impractical for most investors to buy hundreds of individual stocks or bonds. Thats where mutual funds and Exchange Traded Funds (ETFs) come in. Mutual funds and ETFs are able to reduce Company Risk because they have economies of scale. With millions of dollars in assets, mutual funds and ETFs can afford to buy hundreds of stocks or bonds. So if something bad happens to just one company, you dont take a big hit.

Note that even mutual funds and ETFs, however, cannot diversify away market risk. Market risk is the risk that the entire market will experience a decline in price. Even if you hold every stock in the market and have very little company-specific risk, you will still be exposed to market risk.

Diversification does not eliminate the risk of experiencing investment losses. Returns and principal invested in stocks are not guaranteed. Mutual funds and ETFs may have management fees and other additional costs. ETFs may also have trading costs.