What Is CFD

Post on: 19 Апрель, 2015 No Comment

CFD

Contract for Difference (CFD) is an agreement between two parties, described as buyer and seller, to exchange the difference between the initial value of the underlying asset when the contract is opened and the value of the underlying asset when the contract is closed. For example, suppose the initial price of Apple’s share is $100 and a CFD for 1000 shares is exchanged. If the price then goes to $105, then the buyer gets $5,000 from the seller. If the price then falls to $95, the buyer pays the seller $5,000. No physical ownership, or purchase and sale of the underlying asset is involved in this contract. This enables investors to avoid any underlying asset ownership and associated transaction costs. These contracts can also be on the difference of two assets’ prices.

How CFDs work

CFDs replicate the profit and loss of actual asset purchase or sale. They provide a way to trade the underlying market and profit from the market exposure without actually buying the underlying asset.

Let us say you expect the rally in metals market to continue and want to buy 1000 stocks of Freeport-McMoRan Copper & Gold Inc. (FCX), the world’s largest publicly traded copper producer. You could buy these stocks through a stockbroker, paying a considerable portion (according to Regulation T of the Federal Reserve Board, the initial margin is currently 50% in US) of the full value of these stocks (1000 x the current market offer price of FCX) plus a commission to the stockbroker, and borrow the balance from the broker.

Instead, you could buy 1000 CFDs on FCX. To open this contract you would have to post a much lower margin deposit (2.5% with IFC Markets) to cover potential losses from market downturn.

CFD Trading

CFDs are versatile investment vehicles and contracts that do not have expiry dates, i.e. investors decide when they want to close and take their profits. Besides, several flexible features make them ideal instruments for online trading as follows.

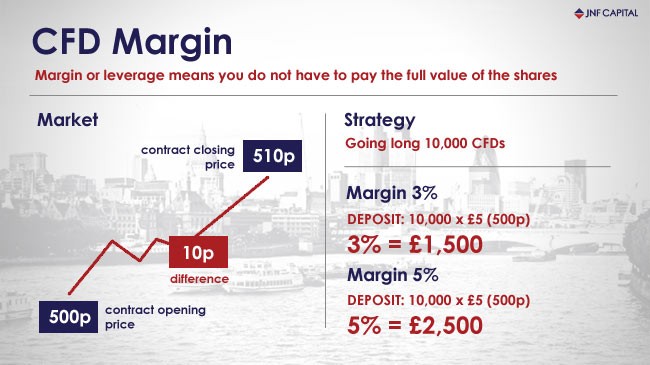

Leveraged trading

Margin trading allows to take a bigger position in the market with a given amount of investment capital. When a market moves as you expect your profits get magnified by the leverage provided through margin trading, since you had posted only a fraction of the total contract value but will capture the gain from a change in the total contract value. Of course, margin trading also can magnify losses if markets move against you, so risk management becomes especially important and care must be exercised when trading with leverage.

Day trading

As leveraged trading enables taking bigger positions with limited investment capital, CFDs make it possible to trade small daily market movements.

Trading equities, commodities, indices and foreign exchange

CFDs are universal trading instruments that allow to trade not only stocks but also the major indices, FX and commodity contracts.

Trading both the up and down market movement

A CFD is a flexible investment vehicle. When you believe the market will rise you can profit by buying CFDs which is known as going long. You can speculate on prices falling by selling CFDs, known as going short. If you go long on stock CFDs and have a long position open on the instrument at the beginning of the trading session on the adjustment payment day (coincides with the ex-dividend date), you will receive a dividend payment as if you owned the actual shares. However, the reverse applies if you have a short position or have sold CFDs — the dividend adjustment will be deducted from your account.

Hedging your investment portfolio

If you believe that stocks you own are going to fall in price but still want to hold them, you can hedge the portfolio by opening a short CFD position in the underlying stocks. Your profits from going short in CFDs will offset the capital loss from your stock portfolio, and you may incur lower transaction costs compared to hedging by selling the physical stocks in order to buy them back cheaper later.

Next steps

For a more detailed understanding of a CFD trade see our CFD trading examples in How To Trade CFDs section of our website.

To Practice CFD Trading for Free, Download our CFD Trading Platform NetTradeX