What Is Being Done to Control Inflation

Post on: 31 Март, 2015 No Comment

Current Fed Chair Janet Yellen will control inflation if it crops up. Photo: Bloomberg for Getty Images

Question: What Is Being Done to Control Inflation?

Answer: The primary job of the Federal Reserve is to control inflation while avoiding a recession. It does this with monetary policy. To control inflation, the Fed must use contractionary monetary policy to slow economic growth. If the GDP growth rate is more than the ideal of 2-3%. excess demand can generate inflation by driving up prices for too few goods.

The Fed can slow this growth by tightening the money supply. which is the total amount of credit allowed into the market. The Fed’s actions reduces the liquidity in the financial system, making it becomes more expensive to get loans. This slows economic growth and demand, which puts downward pressure on prices.

What Tools Does the Federal Reserve Use to Control Inflation?

The Federal Reserve has several tools it traditionally uses to implement contractionary monetary policy if it suspects inflation is getting out of hand. Its first line of defense is open market operations. The Fed buys or sells securities, usually Treasury notes, from its member banks. It buys securities when it wants them to have more money to lend. It sells these securities, which the banks are forced to buy, when it is concerned about inflation. This reduces their capital, they have less to lend, and can therefore charge higher interest rates. That slows economic growth and mops up inflation.

Second, the Fed can raise the Reserve requirement. This is the amount banks must keep on reserve at the end of each day. Raising this reserve keeps money out of circulation. Third, the Fed could raise the discount rate. This is the interest rate the Fed itself charges to allow banks to borrow funds from the Fed’s discount window.

The Fed rarely modifies these two tools. Instead, it usually changes the Fed funds rate. This is the interest rate banks charge for loans they make to each other to maintain the Reserve requirement. This is much easier for the Fed to modify, and it has the same effect as changing the Reserve requirement and discount rate.

Former Federal Reserve Chairman Ben Bernanke said the most important tool the Fed has to control inflation is to manage the public’s expectations. Once people anticipate inflation, they create a self-fulfilling prophecy. They plan for future prices increases by buying more now, thus driving up inflation even more. Bernanke said the mistake the Fed made in controlling inflation in the 1970s was its stop-go monetary policy. It raised rates to combat inflation, then lowered them to avoid recession. This volatility convinced businesses to keep their prices high. It wasn’t until Federal Reserve Chairman Paul Volcker raised rates, and kept them there despite the 1981 recession, that inflation was finally controlled.

The next Chairman, Alan Greenspan. followed Volcker’s example. During the 2001 recession. the Fed lowered interest rates to end recession. By mid-2004, it slowly but deliberately raised rates to avoid inflation. Greenspan heavily signaled the stock market and told investors exactly what he planned to do, thus avoiding another recession. This reassured market investors. who kept investing and spending despite higher interest rates. For more on how the Fed manages the expectations of inflation, see Past Fed Funds Rate .

How Well Is the Fed Controlling Inflation Now?

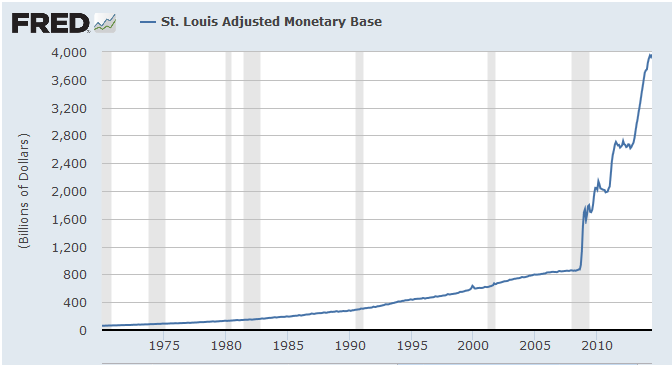

Since the 2008 financial crisis. the Fed has focused on preventing another recession. During the crisis, the Fed created many innovative programs that quickly pumped trillions of dollar of liquidity into the economy to keep banks solvent. Many were worried that this would create inflation once the global economy recovered.

However, the Fed developed an exit plan to wind down the innovative programs. In addition, it’s tapering off of Quantitative Easing by reducing purchases of Treasuries. That program created asset inflation in stocks in 2013, bonds in 2012 and gold in 2011. However, that inflation primarily affected investors, not consumers.

The Fed actually encourages a moderate inflation rate with inflation rate targeting. Right now that rate is 2%, for the core inflation rate. That’s the measurement of inflation excluding gas and food prices. which can be very volatile. A little bit of inflation can encourage growth. That’s because people expect prices to rise, so they buy more now to avoid future price increases. This generates the demand needed for a healthy economy.

Inflation rate targeting also means that the Fed won’t allow inflation to rise much above the 2% core inflation rate. If inflation rises too much above the target, the Fed will implement contractionary monetary policy to keep it from spiraling out of control. To find out how well the Fed is controlling inflation, see Current Inflation Rate. Article updated February 20, 2014