What Is an Investment Bank

Post on: 5 Май, 2015 No Comment

An Introduction to an Investment Bank and How It Differs from Your Local Bank

An investment bank is a special type of financial institution that helps companies raise capital by issuing stocks and bonds, among other tasks. Cultura Travel/Walter Zerla / The Image Bank / Getty Images

As the credit crisis unfolded, I’ve heard a lot of investors asking the question What is an investment bank and how does it differ from a regular, commercial bank? Unless you work in finance, you may not have come across the term investment bank before the global meltdown began.

To put it simply, an investment bank is nothing like the corner institution you’re used to dealing with to get a business loan or deposit your paycheck. Instead, an investment bank is a special type of financial institution that works primarily in higher finance by helping company access the capital markets (stock market and bond market, for instance) to raise money for expansion or other needs. If Coca-Cola Enterprises wanted to sell $10 billion worth of bonds to build new bottling plants in Asia, an investment bank would help them find buyers for the bonds and handle the paperwork, along with a team of lawyers and accountants.

In the next few minutes, you’re learn how investment banks make their money and why they helped cause one of the greatest financial meltdowns in history.

Activities of a Typical Investment Bank

A typical investment bank will engage in some or all of the following activities:

- Raise equity capital (e.g. helping launch an IPO or creating a special class of preferred stock that can be placed with sophisticated investors such as insurance companies or banks)

- Raise debt capital (e.g. issuing bonds to help raise money for a factory expansion)

- Insure bonds or launching new products (e.g. such as credit default swaps )

- Engage in proprietary trading where teams of in-house money managers invests or trades the company’s own money for its private account (e.g. the investment bank believes gold will rise so they speculate in gold futures. acquire call options on gold mining firms, or purchase gold bullion outright for storage in secure vaults).

Up until ten years ago, investment banks in the United States were not allowed to be part of a larger commercial bank because the activities, although extremely profitable if managed well, posed far more risk than the traditional lending of money done by commercial banks. This was not the case in the rest of the world. Countries such as Switzerland, in fact, often boasted asset management accounts that allowed investors to manage their entire financial life from a single account that combined banking, brokerage. cash management, and credit needs.

Most of the problems you’ve read about as part of the credit crisis and massive bank failures were caused by the internal investment banks speculating heavily with leverage on collateralized debt obligations (CDOs). These losses had to be covered by the parent bank holding companies. causing huge write-downs and the need for dilutive equity issuances, in some cases nearly wiping out regular stockholders. A perfect example is the venerable Union Bank of Switzerland, or UBS, which reported losses in excess of 21 billion CHF (Swiss Francs), most of which originated in the investment bank. The legendary institution was forced to issue shares as well as mandatory convertible securities, diluting the existing stockholders, to replace the more than 60% of shareholder equity that was obliterated during the meltdown.

The Buy Side vs. Sell Side of an Investment Bank

Investment banks are often divided into two camps: the buy side and the sell side. Many investment banks offer both buy side and sell side services. The sell side typically refers to selling shares of newly issued IPOs, placing new bond issues, engaging in market making services, or helping clients facilitate transactions. The buy side, in contrast, worked with pension funds. mutual funds. hedge funds. and the investing public to help them maximize their returns when trading or investing in securities such as stocks and bonds.

Front Office, Middle Office, and Bank Office

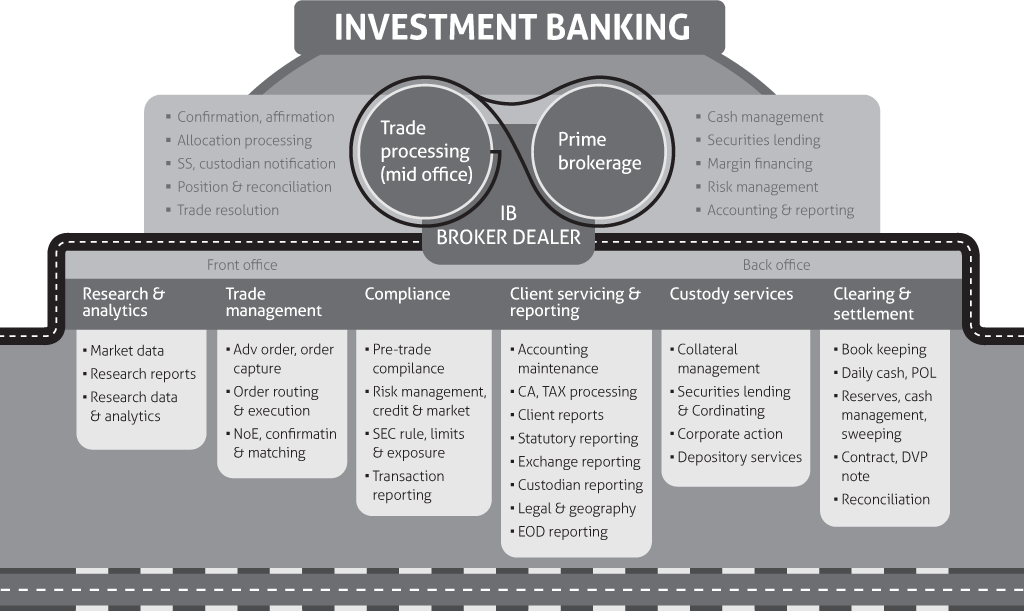

Many investment banks are divided into three categories that deal with front office, back office, or middle office services.

- Front Office Investment Bank Services. Front office services typically consist of investment banking such as helping companies in mergers and acquisitions, corporate finance (such as issuing billions of dollars in commercial paper to help fund day-to-day operations, professional investment management for institutions or high net worth individuals, merchant banking (which is just a fancy word for private equity where the bank puts money into companies that are not publicly traded in exchange for ownership), investment and capital market research reports prepared by professional analysts either for in-house use or for use for a group of highly selective clients, and strategy formulation including parameters such as asset allocation and risk limits.

- Middle Office Investment Bank Services. Middle office investment banking services include compliance with government regulations and restrictions for professional clients such as banks, insurance companies, finance divisions, etc. This is sometimes considered a back office function. It also includes capital flows. These are the people that watch money coming into and out of the firm to determine the amount of liquidity the company needs to keep on hand so that it doesn’t get into financial trouble. The team in charge of capital flows can use that information to restrict trades by reducing the buying / trading power available for other divisions.

- Back Office Investment Bank Services. The back office services include the nuts and bolts of the investment bank. It handles things such as trade confirmations. ensuring that the correct securities are bought, sold, and settled for the correct amounts, the software and technology platforms that allow traders to do their job are state-of-the-art and functional, the creation of new trading algorithms, and more. The back office jobs are often considered unglamorous and some investment banks outsource to specialty shops such as custodial companies. Nevertheless, they allow the whole thing to run. Without them, nothing else would be possible.

More Information About Trading Stocks

To learn more, read our guide to trading stocks. It will explain some of the basics of stock trading. pitfalls, and much more.