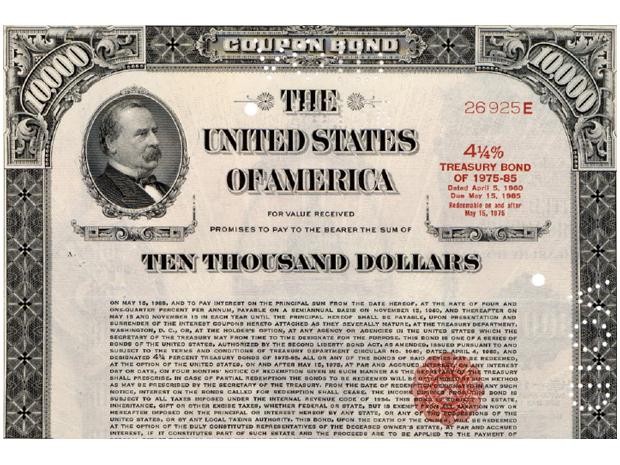

What is a Treasury Bill (with picture)

Post on: 16 Март, 2015 No Comment

These 10 animal facts will amaze you.

Adorable animal families that will make you aww.

These 10 facts about space will blow your mind.

A treasury bill, or t-bill. is a short term investment with maturity dates ranging from four to 52 weeks. These investments are often considered quite safe because they are backed by the United States government.

A treasury bill differs from other types of investments in that they do not pay interest in the traditional way. When an investor wishes to purchase a treasury bill, they buy buy it at a discount rate. The amount paid for the treasury bill varies, and is decided by a bidding process. Once the treasury bill is purchased, the owner does not receive any money until the t-bill matures at which time he or she will receive the face value of the t-bill. This difference, the discount rate and the face value rate, is said to be the interest of a t-bill. Another benefit of the t-bill, is that when you purchase one, you know exactly how much you will earn over the life of the investment.

For example, if the investor buys a treasury bill with a face value of $10,000 USD (US Dollars), for the price of $9,500 USD, he will receive $10,000 when the t-bill matures, earning $500 USD in the process. T-bills are available in a variety of denominations, from $10,000 to one million USD.

Treasury bills are purchased through either a competitive or noncompetitive bid. In the competitive bidding process, the investor decides what discount rate they will accept, though they are not guaranteed to receive this rate. In fact, they may end up with no t-bill at all, or with one in a different amount than they were initially interested in. Competitive bidding is handled through brokers, banks or other investment dealers. In noncompetitive bidding, the investor agrees to accept the discount rate that is determined at auction. The investor is guaranteed the t-bill in the amount they want, but may not receive as high of a discount as the competitive bidder. Noncompetitive bidders can purchase a treasury bill through banks, brokers and other dealers as well as directly from the US Treasury Department.

Regardless of whether you choose to purchase a treasury bill through the competitive or noncompetitive bidding process, do not expect to receive a piece of paper to prove ownership. T-bills are held electronically, and any remaining paper t-bills have reached maturity.