What Can a Commodity ETF Add to Your Portfolio Financial Web

Post on: 6 Июнь, 2015 No Comment

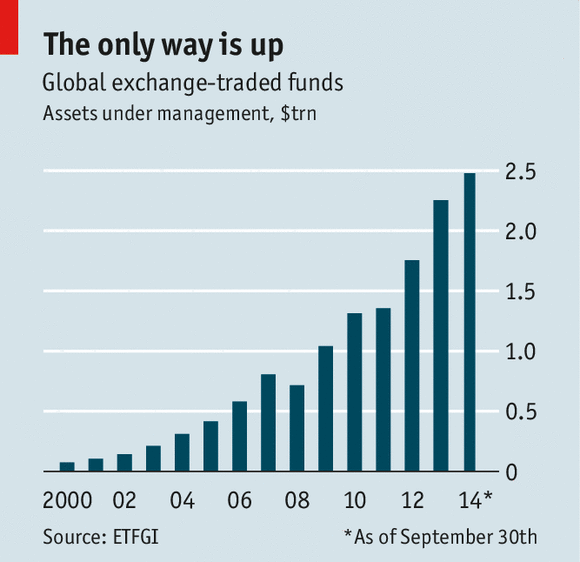

Exchange traded funds have been gaining popularity in recent years, with commodity ETF s and bond ETFs being the latest additions to the product portfolio.

Investing in commodity ETFs is similar to investing in managed portfolios. Since the ETF is a tradable securitized product, the ETF fund creates a new venue for a different class of investors. Here are some of the benefits of commodity ETFs.

Balanced Risk

The main reason to invest in the commodity ETF is to gain exposure to a different market that is negatively correlated to the stock and bond markets. It is advisable that up to 20 percent of an entire portfolio be invested in managed futures. That means you can invest up to $20 per $100 you have in secured investments. The diversification achieved by a single commodity ETF is greater when complementing a basket of stocks or a mutual fund. The asset class is different, and because commodities have such different cycles within that asset class, there are fundamental differences within commodity ETFs. Certain managed portfolios allow for diversification of management style as well.

Lower Cost

Commodity ETFs are a bargain compared to managed portfolios. These ETFs charge up to 5 percent a year—most likely 1 or 2 percent a year—for the management of the fund. By contrast, the managed portfolios can charge 20 percent or more a year depending on the performance of the fund. Exchange traded funds are a very low-cost and flexible alternative in commodities trading.

Lower Barrier to Entry

Exchange traded funds have normal leverage for small accounts that cannot handle major volatile swings in the commodity markets. What’s more, you still gain the exposure in the commodity itself. In addition, your principal is protected; unlike with futures, you can’t lose more than what you invest. They are similar to stocks. Finally, compared with commodities futures, you can start with a smaller sum of money to buy shares in the ETF.

For example, to buy gold futures, one would have to start up with at least $5,000 and most likely $10,000 to really get involved in trading. What’s worrisome is that this capital can be lost in a matter of no time. The ETF is much tamer. You can start up with as little as $1,000. Instead of just trading gold, for instance, you can actually invest for a longer time horizon in the commodity with ETFs because of the lower volatility and lower risk.

Lower Taxes

Finally, commodity ETFs offer investors lower tax liability because they function more like a stock. Commodies, conversely, require an investor to pay more taxes because most of the gains are considered short-term capital gains. In general, commodities futures investors pay a higher tax rate than stock investors. If the ETF is held for a year or more, the gains will be seen as long term. This long-term capital gains tax rate, which is currently (in June 2010) around 15 to 20 percent, offers a considerably lower tax bill in comparison to the income tax rate.

$7 Online Trading. Fast executions. Only at Scottrade