What are ETF s

Post on: 11 Август, 2015 No Comment

An Exchange Traded Fund represents a basket of stocks that is bought and sold on a stock exchange as if it were a single stock. An ETF is usually a 2 or 3 letter stock symbol that trades on the NYSE or AMEX and there are a handful of 4 letter stock symbols that trade on the NASDAQ. You can buy and sell any ETF just like a stock in a brokerage account.

History of ETF’s

The first ETF created was SPDR, or Spiders, which started trading on the market in 1993 and represents the S&P 500 index. Years later, QQQQ, also known as the Q’s, became available and represented the largest 100 non-financial companies listed on the Nasdaq exchange. The Q’s becomes very popular during the late 90’s when the prices of tech stocks skyrocketed. As of October 10, 2008 there were 790 ETF’s. This list of ETF’s continues to grow on a weekly basis and is becoming the future to mutual fund investing.

More Specific Investing

Most ETF’s represent a specific group (sector) such as home builders, basic materials, natural resources, metals & mining, financials, commodities such as gold and silver, energy, retail stores, tech (and sub-categories within technology), consumer durables, health care (and sub categories of health care) utilities, gas and oil, stocks from specific countries or regions (India, US, European, Russian, etc.), real estate stock sectors and many more.

You can also buy and sell an ETF that represents a purchase of stocks that are considered to be blue chip, small cap, value, growth, and bond funds. You can also buy an ETF that is a short fund which means your purchase will represent that you are short a specific sector (see selling short) if you believe a specific sector is going to drop in price. If you anticipate that the whole stock market is going to go down, you can purchase an ETF that would be short the indices like the Dow, S&P 500, NASDAQ Composite.

Examples of Buying ETF’s

For example, you could have made money when the stock market went down by purchasing an ETF. You could have purchased SH, a short ETF of the S&P 500, on January 2, 2008 for $60.75 per share and by October 10, 2008 (lowest price of the S&P 500) you could have sold SH for $99a share, a profit of $62.9% !

We all know what happened in the financial sector of stocks. You could have profited by the drop in the financial sector. An example is that you could have purchased SKF, a short ETF of the financial sector, for $101 per share on January 2, 2008 and by July 15, 2008, sold them for $211.75, a profit of 109% in 7 months !

ETF: More Flexible than Mutual Funds

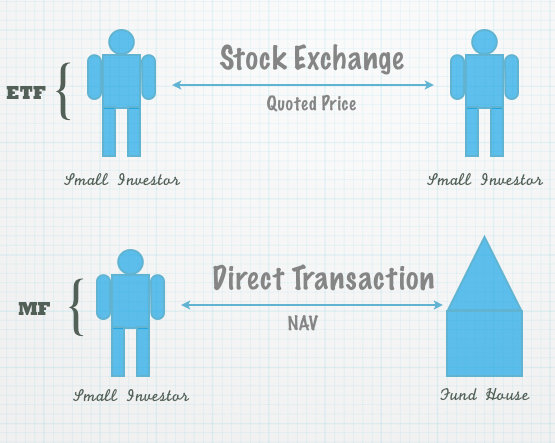

One of the benefits to trading an ETF is that you can buy a share of that basket of stocks at the current price as it is trading in the middle of the trading day just like a stock. This basket of stocks is similar to a traditional mutual fund where the manager selects a group of stocks that meet the criteria of that specific ETF and buys and sells stocks accordingly. Buying an ETF allows you to zero in on the exact timing for your purchase or sale of an ETF and get better prices during the trading day. The traditional Mutual Funds (with 5 letter stock symbols) are only priced once a day, at the end of trading which limits you as to the price you pay for the shares.

Another benefit to ETF’s is that you can also buy them using margin, similar to a stock in any regular brokerage account (not in an IRA, 401k, or any qualified account). You can also purchase ETF’s for an IRA, minor trust-custodial account and now many employer’s 401k plans are allowing ETFs to be purchased. In these accounts you cannot margin your purchase (see Margin).

Low Expense Ratios

Everybody loves to save money, particularly investors who take their savings and put them to work in their portfolios. In helping investors save money, ETFs really shine. They offer all of the benefits associated with index funds — such as low turnover and broad diversification (not to mention the often-cited statistic that 80% of the more expensive actively managed mutual funds fail to beat their benchmarks) — plus ETFs cost a lot less. There is also no penalty to sell at any time compared to traditional mutual funds which normally have limitations as to the holding period or frequency of transactions. With an ETF, you can buy and sell anytime (unlimited frequency) with only a small commission your brokerage firm may charge (Schwab $8.95, Ameritrade, $8, Scottrade $7, etc).

Summary

This trading strategy used to be defined as spread trading where you would take profits where small gaps expanded and contracted between the bid and the ask price for a stock. This strategy has now evolved to include technical indicators, support/resistance levels, and volume spikes to make round-trip trades lasting seconds to a few minutes. The basic idea of scalping is to take advantage of market inefficiencies using speed and high trading volume to create quick profits. Click here for more information on scalping.

- Better pricing due to purchases and sales during the trading day.

- More specific sectors to target.

- You can be short stocks by purchasing a specific ETF that shorts a sector or index (in any account, including an IRA or trust account).

- Lower cost than typical mutual fund with no penalties to sell.

- You can more easily custom design your portfolio by sector, long or short.

Our final recommendation to you is try to pick an ETF that is actively traded and has higher trading volume (see volume). This will result in a lower spread between the bid and ask (see spread).

Links to glossary in this text: selling short, margin, volume, spread, sectors, qualified account (add this term to glossary).