Weekly Fundamentals US oil Inventory Soared amid Production Gains and Refinery Turnarounds

Post on: 4 Май, 2015 No Comment

Latest Technicals

ONG Focus | Insights | Written by Oil N’ Gold | Sun Oct 27 13 05:17 ET

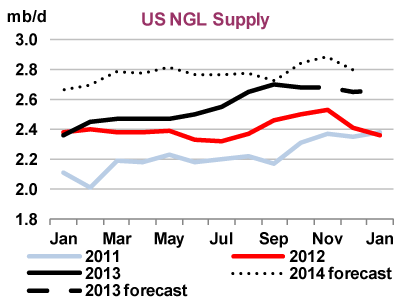

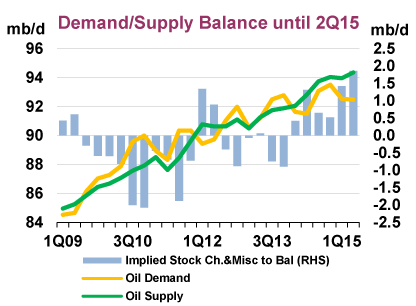

US crude inventory climbed higher for 5 consecutive weeks with stockpile gaining a total of 924.5M bpd over the past 2 weeks. The build-up in inventory was driven by both refinery turnaround and increasing crude production. As a result inland-coastal differentials widened. Meanwhile, Brent crude price also weakened modestly due to sluggish growth in emerging markets, which was partly offset by continued production disruptions in the North Sea and geopolitical unrest. The LLS-Brent spread widened to around -10/bbl after trading at a premium for most of the time in 2012 and at around -$2/bbl in last month September. Meanwhile, the WTI-Brent crude spread widened to as much as -12.2/bbl (close) last week. The widening in LLS-Brent signaled that less light oil should be imported to PADD3 (Gulf Coast where LLS is the benchmark crude).

Nymex natural gas price was pressured by weak US inventory data. As the government reopened, 2 consecutively weekly inventory reports were released with both showing higher than expected increase in stockpiles. The EIA reported that gas storage added 77 bcf for the week ending October 11, and then +87 bcf for the week ended October 18, compared with market expectations of +74 bcf and +82 bcf additions respectively. At the Drilling Productivity Report released on Ocotber 22, the EIA noted that drilling productivity has continued to rise in the US. Examining the 6 regions representing 90% of oil production growth and virtually all natural gas production growth in country during 2011-2012, the EIA has summarized that:

1. Increases in drilling efficiency and new well productivity, rather than an increase in the number of active rigs, have been the main drivers of recent growth in domestic oil and natural gas production

2. The Bakken and Eagle Ford regions together account for about 75% of current monthly oil production growth across the six regions tracked in the DPR. Over the past year, production in these two regions increased by nearly 700,000 barrels per day. The Permian region, which remains the biggest absolute oil producer, grew by about 93,000 barrels per day from last year’s production level

3. Although natural gas production increased in four of the six DPR regions over the past year, the Marcellus alone accounted for about 75% of natural gas production growth in the six regions.

Gold and silver prices strengthened last week as driven by weakness in the US dollar and disappointing US payroll data. Market open interest of Comex gold futures rose to 391.4K on October 23, the highest level since August. Despite the absence of the CFTC data, the rise in gold price and the increase in Comex open interest signaled firmer long positions of the metal.

Latest Analysis from this Author