Weekly Forex Price Action Outlook

Post on: 16 Март, 2015 No Comment

EUROPEAN CARNAGE EDITION

EURUSD

As you might have guessed from the tagline today, Ill be focusing on Europe today. Starting with the Euro which has not fared well from 1-2 punch of the Cyprus Banks Restructuring ( i.e. Uninsured Deposit Confiscation, e.g. your €100K+ is no longer safe in European banks ) + the Dutch FinMin comment about how banks will now have to save themselves if they get in trouble ( e.g. bondholders, stockholders and uninsured deposits will fill the bill if banks get in trouble ), the pair has gotten absolutely monkey-hammered, losing over 200 pips from the post gap high/euphoria ( Cyprus is saved ) deal.

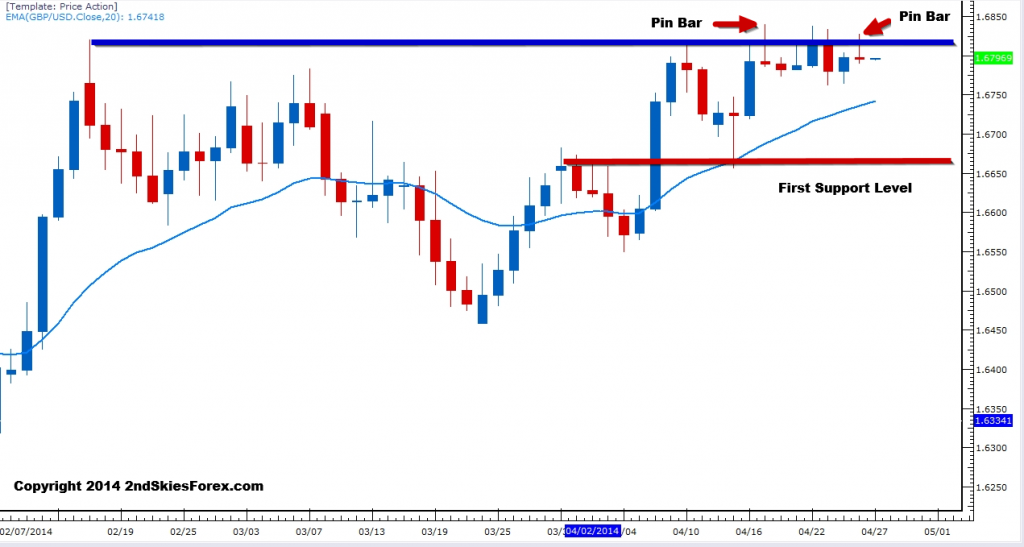

It should be noted in last weeks FX market commentary. how I talked about the key price action structure and channel the pair has been in for some time on the daily chart. The key resistance I talked about selling was 1.3050 which was the channel top.

Today price hit that level to the pip (going only .9 pips above), and then abruptly sold off over 200+ pips. You will notice how the price action formed a pin bar + engulfing bar at the level, further confirming the rejection at this level.

Several of my price action traders snagged this trade profiting nicely so hopefully you did the same.

With the pair now rejecting at the 20ema, channel top, and selling off so heavily post cyprus is fixed deal, expect any rallies to be sold. Ill look to sell any rotations into 1.2900 and 1.2950, targeting a deeper move lower towards 1.2700.

EuroStoxx 50

A lot of the European indexes got smashed today in the market, particularly the Italian, French and Spanish indexes, so wanted to show a chart of the EuroStoxx50 which is showing some structural weakness.

Looking at the chart below, we can see a break higher of the resistance level at A, which only produced a modest HH (higher high) at A. Then price action failed to hold above A, and broke down heavily below it and the prior swing low at B which was part of the last push up to A.

Then price opened this week and rejected at C which was also the same resistance at A, selling off almost 100pts so the pressure is on. Ill look to sell into rotations up towards 2675 and 2709 targeting the major support at 2600 and a possible larger move lower towards 2400 and 2150.

Being in a massive uptrend since Nov. 2012, the pair has been ranging for the last two months and struggling to maintain its bullish form. Today the pair formed a bearish engulfing bar off the daily 20ema, which is becoming more resistance than support as of late, and Im suspecting the bulls are getting tired during this redistribution phase. Below the intraday support and low of 120, is the 118.63 support, or the Feb. 25th SL (swing low) where Im guessing some bullish stops are parked.

If this breaks, we could see a deeper correction towards 115.50, which is the Jan. 2013 consolidation highs, but the pair is looking vulnerable to medium term EUR weakness, so watch for rotations higher into 121.54 and 122.75 and price action signals to sell here.

Switching attention away from a Euro based instrument for the moment, the USDJPY is also looking incredibly vulnerable and that its 4+ month uptrend may be in danger. Although today the pair formed a long tailed pin bar off the 93.50 support level, the pair has been showing a consistent pattern of LHs (lower highs) and LLs (lower lows) with more impulsive price action selling than buying.

This could be a redistribution of the order flow after such a long trend, but should the 93.50 support break, then we could see a deeper pullback towards 91.15, so watch for 95 as your upside cue. If this holds any rallies, look to sell, targeting 92.81 and 91.15. If this level breaks, then the bulls should challenge 96.00 again.

For those wanting to learn to trade price action. access to the traders forum, lifetime membership & more, visit my Price Action Course page here .